Japan's T Capital buys Fujitsu semiconductor memory assets

Japanese mid-market buyout firm T Capital Partners has agreed to carve out Fujitsu’s semiconductor memory chip business for an undisclosed sum.

Fujitsu Semiconductor said in a statement that it would retain a 30% interest in Fujitsu Semiconductor Memory Solution (FSM) "for the time being."

T Capital is investing through its sixth fund – and first since completing its spin-out from Tokio Marine – which closed on JPY 81bn (USD 773m) in early 2021. The vehicle is 55% larger than its 2017-vintage predecessor. Historically, the GP has targeted companies with USD 10m in EBITDA. However, at the time of the final close, it was seeing more opportunities in the USD 30m-USD 40m EBITDA range.

Succession planning solutions for ageing founders continue to account for the bulk of T Capital's deal flow – eight of the last 10 investments fit this profile. But FSM represents a second carve-out in 12 months following the acquisition of MicroBiopharm Japan, a contract development manufacturing organisation (CDMO), from Mitsui & Co.

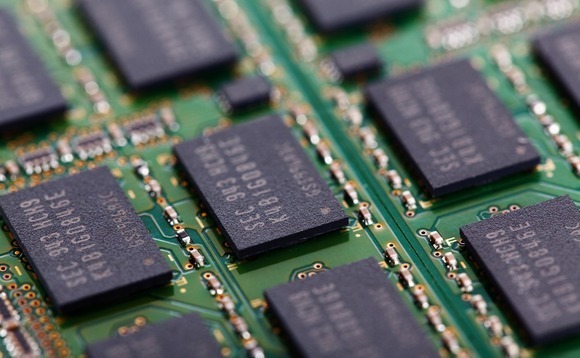

FSM manufactures FeRAM (ferroelectric random access memory) and ReRAM (resistive random access memory), which offer much of the same functionality as flash memory. FeRAM is said to combine the benefits of read-only memory and RAM, while offering fast write speeds, low power consumption, and high read-write cycle endurance.

FSM has been producing FeRAM since 1999 and Fujitsu Semiconductor concluded that independence would enable the company to accelerate the development of next-generation memory solutions. Supply pressures in the global semiconductor industry were also a factor, with raw material prices soaring post-COVID-19 while socio-political uncertainties have intensified competition amongst vendors.

Fujitsu generated JPY 3.59trn in revenue and JPY 266.3bn in operating profit for the 12 months ended March 2021. Semiconductors fall under the device solutions division, which contributed JPY 293.8bn in revenue and JPY 29.8bn in operating profit.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.