North Asia

Deal focus: Putting Asia on the air mobility map

Japan’s SkyDrive leads Asia in the niche but potentially society-altering category of flying cars. A $37 million Series B round marks the latest step in a long safety build-out and public acceptance process

CPPIB backs GLP Japan logistics fund

Canada Pension Plan Investment Board (CPPIB) has committed JPY25 billion ($235 million) to a fund managed by PE-owned warehouse operator GLP that is said to be the largest open-ended logistics vehicle in Japan.

Deal focus: Japan sees more mid-cap carve-outs

Having completed its first-ever corporate carve-out in July, Japan's J-Star has now racked up its second with the acqusition of waste management business Sincere Corporation from NEC

Korean wave: Killer content

From Oscar-winning films to record-breaking pop bands, Korean content has started to replicate its success in Asia in the West. Venture capital investors are looking for ways to ride the K-wave

Affirma to exit Korea waste management business

Affirma Capital – formerly Standard Chartered Private Equity – has agreed to sell EMC Holdings, a South Korea-based waste and wastewater treatment business, to a unit of local conglomerate SK Corporation.

Deal focus: Hahn puts faith in aviation rebound

International travel remains largely off-limits, but Hahn & Company is optimistic on the long-term prospects for Korea's aviation industry and for Korean Air's in-flight catering and duty-free businesses

Japan flying car developer gets $37m Series B

Development Bank of Japan has joined a JPY3.9 billion ($37 million) Series B round for Tokyo-based flying car developer SkyDrive.

Korea's Viva Republica raises $173m

Viva Republica, the operator of Korean money transfer app Toss, has raised $173 million from a group of investors featuring Sequoia Capital China and Kleiner Perkins.

NSSK buys Japanese sports nutrition business

NSSK has acquired the sports nutrition division of Japan’s Dome Corporation, which is best known as the local distributor for US sportswear brand Under Armour.

Japan's J-Star acquires waste management business

Japanese private equity firm J-Star has acquired local waste management operator Sincere Corporation for an undisclosed sum.

Hahn & Co buys Korean Air's catering, duty free businesses

Hahn & Company is making its second acquisition from South Korea’s Hanjin Group – six years after carving out the Hanjin Shipping bulk carrier business – having agreed to buy the in-flight catering and duty-free operations of Korean Air for KRW990.6 billion...

Blackstone agrees $2.3b carve-out from Japan's Takeda

Japan’s Takeda Pharmaceutical has agreed to sell a portfolio of over-the-counter (OTC) medicines and health products to The Blackstone Group for JPY242 billion ($2.3 billion).

Carlyle exits Korean garment manufacturer

The Carlyle Group has agreed to sell its majority stake in Korean apparel manufacturer Yakjin Trading Corporation to domestic fashion giant JS Corporation for around KRW14.3 billion ($12 million).

Japan's iSpace raises $28m Series B

Japanese lunar exploration company iSpace has raised $28 million Series B round led by Incubate Fund.

Uncertainty deters distress investors - M&A Forum

Distress-focused investors warned that persistent economic uncertainty is making it difficult to act on opportunities even as companies run into trouble because of the coronavirus pandemic.

Baring Asia mulls challenging for Japan's Nichii Gakkan

Baring Private Equity Asia is poised to formally enter the bidding for Tokyo-listed aged care provider Nichii Gakkan, having approached certain shareholders regarding a JPY146 billion ($1.38 billion) deal.

Ant Capital targets $253m buyout of Japan's Softbrain

Ant Capital Partners has launched a tender offer for Softbrain, a Japanese sales and marketing software developer, that values the business at approximately JPY26.9 billion ($253.1 million).

Airbus Ventures sets up Japan office

Airbus Ventures, the US-based VC unit of European aeronautics giant Airbus, has set up an office in Japan and received investment from a number of Japanese investors for its third fund.

Japan's ACA exits aged care business

Tokyo-listed healthcare provider Solasto will acquire 100% of Japan Elderly Care Service for JPY2.3 billion ($22 million), providing an exit for local private equity firm ACA Investments.

Globis joins $32.6m round for Japan's Photosynth

Globis Capital Partners has joined a JPY3.5 billion ($32.6 million) Series C round for Photosynth, a Japanese internet-of-things (IoT) developer specializing in smart locks for office buildings.

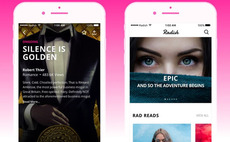

Korea, US-based serialized fiction app gets $63m

SoftBank Ventures Asia and Kakao have led a $63.2 million Series A round for Radish, a Korea and US-based producer and broadcaster of serialized fiction for mobile devices.

Sustainable food: Forces of nature

Environmental considerations are intrinsic to food innovation investment strategy, not a public relations bonus. Science, society, and myriad motivations color a range of perspectives

Hana invests $85m in Asia renewables platform

Hana Financial has invested KRW100 billion ($85 million) in a portfolio of Korean waste to energy (WTE) projects being developed by Equis Development.

Bain sweetens offer for Japan's Nichii Gakkan

Bain Capital has increased its offer price for Tokyo-listed aged care provider Nichii Gakkan – after a Hong Kong hedge fund criticized the board for not doing enough to protect the interests of minority shareholders – valuing the business at JPY122 billion...