Australasia

Brookfield buys Australia non-bank lender for $1.1b

Brookfield Asset Management has agreed to acquire Australian non-bank lender and asset manager La Trobe Financial for about USD 1.1bn, facilitating an exit for The Blackstone Group.

Index, Coatue lead $110m round for Australia's Linktree

Index Ventures and Coatue Management have led a USD 110m round for Linktree, an Australian social media platform that drives audience engagement, at a valuation of USD 1.3bn.

Livingbridge gets ESG-linked credit facility in Australia from Ares

Livingbridge has secured AUD 280m (USD 206m) in sustainability-linked credit facilities from Ares Management to support its acquisition of Australia-based waste management services provider Waste Services Group (WSG).

Flexibility first: Investing in the future of work

Investment in work-tech has soared as start-ups devise solutions for workforces that are increasingly distributed in terms of location, structure, and practice. Data, and knowing what to do with it, is key

Tiger Global leads Series A for New Zealand's ArchiPro

Tiger Global Management has led a NZD 35m (USD 24m) Series A round for New Zealand’s ArchiPro, a platform that connects homeowners with interior design and construction professionals.

AVCJ Awards 2021: Responsible Investment: The Arnott's Group

In taking ownership of an iconic Australian brand like Tim Tam, KKR was conscious of the need to be a market leader on sustainability. Progress is being made across sourcing, emissions, and packaging

Australia's AGL rejects Brookfield, Grok Ventures bid

Australia-based utility AGL Energy has rebuffed another acquisition attempt from Brookfield Asset Management and Grok Ventures, a private investment firm established by Mike Cannon-Brookes, co-founder of Atlassian.

BGH seeks regulatory action amid battle for Australia's Virtus

BGH Capital has asked Australia’s Takeovers Panel to intervene a second time in its pursuit of Virtus Health after the fertility care business resolved to engage with CapVest Partners and not entertain BGH’s improved offer.

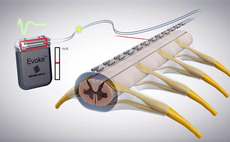

Australia's Saluda Medical raises $125m

US-based healthcare investor Redmile Group has led a USD 125m round for Australia’s Saluda Medical, a devices company focused on spinal cord stimulation.

Headline leads Series B for Australian payments start-up Zeller

Australian payments provider Zeller has closed an AUD 100m (USD 73m) Series B round led by Headline, a US venture capital firm, and supported by domestic superannuation fund Hostplus.

Australia's BGH closes Fund II on $2.6b

BGH Capital has closed its second fund on approximately AUD 3.6bn (USD 2.6bn) after fewer than six months in the market. It represents the largest-ever private equity vehicle raised for deployment in Australia and New Zealand.

Australia VC: An ideal match?

Having backed Australian VCs for Hostplus, Neil Stanford is now raising a fund-of-funds with a view to catalysing a state-wide start-up ecosystem. A preferred return structure is being used to lure LPs

Ex-Hostplus PE head launches state-level early-stage fund

V-Ignite, an investment firm established by the former PE and VC head at Australian superannuation fund Hostplus, is looking to raise AUD 120m (USD 86m) for a fund-of-funds that will support managers in the state of Victoria.

PEP targets $742m for second Australia secure assets fund

Australia’s Pacific Equity Partners (PEP) is preparing to launch its second secured assets with an AUD 1bn (USD 724m) target while planning to spin out one of the top-performing Fund I investments into a single-asset continuation vehicle.

Infrastructure: Out of the comfort zone

Infrastructure managers in Australia are pushing into the PE space, competing with GPs for assets and buying businesses from them. It falls under the core-plus umbrella, but is the definition being stretched too far?

AVCJ Awards 2021: Operational Value Add: Best & Less Group

Allegro Funds plucked Australian baby and kids retailer Best & Less from its underperforming parent and defied pandemic-related uncertainty to complete a turnaround that culminated in an IPO

IFM's decarbonisation credentials attract Australian LPs

Australia’s Clean Energy Finance Corporation (CEFC) has committed AUD 80m (USD 57.5m) to IFM Investors’ mid-market growth fund, which achieved a second close of AUD 380m at the end of 2021.

Silver Lake wins approval for New Zealand rugby deal

Silver Lake has won approval for a NZD 200m (USD 134m) investment in the commercial arm of New Zealand rugby, reflecting a recent upswing in global private equity involvement in sport in Asia.

New Zealand's Soul Machines raises $70m

SoftBank Vision Fund 2 has led a USD 70m round for New Zealand-based Soul Machines, which specialises in creating lifelike digital employees for customer engagement.

US GP invests $30m in Australia's Protecht

US venture capital and private equity firm Arrowroot Capital has invested AUD 42m (USD 30m) in Australian enterprise risk management software and services provider Protecht Group.

Australia impact GP hits $48m first close on debut fund

Australian impact investment firm For Purpose Investment Partners (FPIP) has reached a first close of AUD 67m (USD 48m) on its debut fund, which has an overall target of AUD 250m.

Blackstone agrees $6.3b buyout of Australian casino operator

Australian casino operator Crown Resorts has agreed to an acquisition by The Blackstone Group at an equity valuation of AUD 8.9bn (USD 6.34bn), ending a nearly one-year pursuit.

Australia's Quadrant recruits KKR managing director

Australian mid-market GP Quadrant Private Equity is adding a fourth managing partner with the recruitment of Gareth Woodbridge from KKR.

AVCJ Awards 2021: Firm of the Year – Mid Cap: Quadrant Private Equity

Quadrant Private Equity’s recent deals have focused on defensive, non-cyclical sectors, but the Australian GP continues to track a consumer story driven by technology and new modes of delivery