Flexibility first: Investing in the future of work

Investment in work-tech has soared as start-ups devise solutions for workforces that are increasingly distributed in terms of location, structure, and practice. Data, and knowing what to do with it, is key

Apis Partners invested in Giift on the back of growth in a global loyalty program market that is becoming increasingly personalised. Rather than simply award points for every dollar spent through a credit card and allowing those points to be redeemed for a long list of products, companies are leveraging data to offer rewards and incentives tailored to the individual.

These more sophisticated programs potentially boost return on investment, but the likes of financial institutions lack the bandwidth to manage them in-house. Singapore-based Giift eases the burden, plugging them into a readymade, end-to-end cloud-based platform.

The recent acquisition of Xoxoday – executed jointly by Apis and Giift – is based on the logic that what works for customers also works for staff. Xoxoday, which originated in India, enables companies to send programmable digital rewards and incentives to their employees at scale, integrating seamlessly with applications such as Slack and SAP.

"The idea is that COVID has increased the level of remote working and flexible working, and so companies need to engage with employees in different ways and perhaps rethink how they compensate employees," said Udayan Goyal, a managing partner at Apis.

"And because Xoxoday is embedded in cloud-based work tools, there is instant pay-out and gratification. It helps businesses transition to digital working environments, and it provides insights into stakeholder behaviour and engagement and retention efforts."

It is one of a growing number of investments that qualify as "future of work" plays. The category captures an assortment of corporate needs: tools that allow teams to communicate and collaborate remotely; ways to accommodate demand for greater flexibility in working hours and structure; and apps that track performance and satisfaction as companies rely on culture to deliver cohesion.

From talent marketplaces to human capital management (HCM) software to nascent metaverse applications, the key components are leadership and data. Companies require senior management that can adapt to different working models – through an inclusive style of leadership underpinned by trust and confidence – and information flows that show if these models are functioning properly.

"It is all about data and resilience," said Nicole Scoble-Williams, a partner and Asia Pacific leader for future of work at Deloitte. "Living in a world of perpetual disruption, where one of your weapons is to be constantly sensing, you need constant access to data and trends so you can proactively pivot. There are so many listening tools that are enabling organisations to get real-time actionable insight."

Mapping the future

The recent context for the future of work is broadly visible. Existing digitalisation trends were accelerated by a sudden pandemic-driven switch to work from home, with apparently little or no loss in productivity. Many workers made some degree of remote working a permanent feature of their employment. Still more left their jobs, creating a host of openings and a recruitment problem.

According to Acadian Ventures, which invests solely in work-tech, the future will be characterised by widespread reskilling, increased competition for talent, the emergence of a younger generation of freelance and nomadic workers, more focus on work-life balance, and reimagined employee benefits.

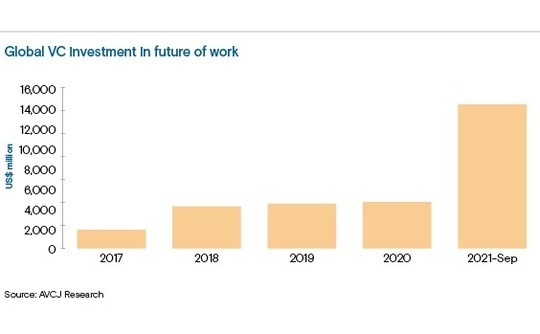

PE and VC investors are already betting heavily on these trends, with USD 17bn deployed in work-tech and HR-tech last year, compared to an annual average of USD 4.4bn for 2017-2020. Acadian was tracking 49 privately held unicorns as of September 2021 with a combined worth of USD 120bn.

The future of work will not play out uniformly across global markets. Even within Asia, the employee experience during COVID0-19 has varied markedly by geography. North America remains the focal point of activity, but Acadian sees increased international traction, including in Asia.

"When we launched three years ago, we wanted to invest internationally, and it was predominantly the US and Europe. However, the market has changed significantly in the last 12 months. The future of work is no longer dominated by the US. At the end of February, more than half the companies being funded were outside of the US," said Jason Corsello, founder and general partner of Acadian.

Speed of cross-border expansion is contingent on the size of the target domestic user base. Assorted work-tech start-ups have taken off in Australia and New Zealand partly because they could scale without pursuing global customers early on. Craig Blair, a managing partner at Airtree Ventures, claims that five of his firm's eight unicorns could be classified as future of work.

One is a decacorn: design and workplace collaboration platform Canva hit a USD 40bn valuation last September, up 12x from 2019, following a doubling in revenue over the prior 12 months. The others are training platforms Go1 and A Cloud Guru, HCM software provider Employment Hero, and Linktree, which creates social media profile landing pages.

Elsewhere, the dynamics are different. India HCM platform Darwinbox became a unicorn in January on the back of domestic and Southeast Asia expansion, while various Chinese software-as-a-service (SaaS) start-ups have risen to prominence locally. Among them are HR-focused Beisen and Moka and reimbursement specialists Ekuaibao, Huilianyi, and Fenbeitong.

Ones, which secured a USD 50m Series C round last year, aspires to become a Chinese version of Atlassian, an Australian collaboration tool popular among software developers. It built up a following by responding to local needs: being mobile-friendly, having a large support team to serve businesses that are new to SaaS, and delivering on-premises as well as cloud-based solutions.

Ones has seen the transition from pre-pandemic online or digitalisation work to remote and hybrid models, but founder Yingqi Wang stresses they are distinct concepts. The former is asynchronous – projects move to the cloud; employees continue to work on them – and the latter is absolutely not.

"With remote work, specific needs arise. There are many synchronisation requirements. People need companionship, to work at the same time, to see someone else's mouse moving," said Wang. "In general, I think remote work is a sub-concept of online work. Videoconferencing, for example, is a must-have for remote work but it isn't necessarily required for online work."

Going to market

The key consideration for start-ups is whether they have unique offerings that tap into sub-concepts and market nuances, thereby creating advantages that can be sustained even as companies switch from virtual to hybrid approaches and as incumbent platforms broaden their coverage.

For large companies, the starting point is often a talent marketplace. Some of these predate COVID-19. Schneider was driven by retention, having found that nearly half its staff thought they couldn't progress internally. Unilever, meanwhile, wanted to boost its agility by matching employees with the right projects, and Standard Chartered saw a marketplace as a means of unlocking internal talent.

The core philosophy is connecting people with opportunity. Employees are encouraged to create their own profiles – including skills, capabilities, passions – so that employers grasp what they have at their disposal. When relevant projects, learning activities, mentoring programs, or networking events come up – regardless of location or division – marketplaces identify and alert employees.

"We tell organisations that, if they could do only one thing this year, it should be investing in a talent marketplace," said Scoble-Williams of Deloitte. "They unlock people's potential and passion and show how those can be aligned with the business needs of the organisation. As the needs of the business evolve, the workforce is empowered and has access and visibility on opportunities."

In some cases, companies open their marketplaces to one another, enabling them to tap into an external talent pool if they are struggling to find a specialist skill internally. People can also log preferences around work times and structure in their profiles, giving marketplaces the scope to serve as management tools for gig economy-style employee communities.

"We are moving from a supply market to a talent market because a new generation of workers wants freedom, flexibility, and trust-based management. Companies that are more innovative in their approach will be talent magnets," said Regina Tsai, a partner at Boston Consulting Group (BCG).

"We've seen clients, when they start using remote working models, switch from process management-oriented to results-oriented KPIs [key performance indicators]. Provided you finish your work, no one really minds where and when you do it. A company might weaken its management system and strengthen its culture, and it uses culture to manage the new way of work."

SME or MNC?

As for the tools that enable this transformation, for the most part, large companies are expected to stick to the brand names they already know – Salesforce and Microsoft, or for some China players, Alibaba Group's DingTalk and ByteDance's Lark. They rely on legacy platforms to add functionality, organically or through M&A, Salesforce's 2021 purchase of Slack being an example of the latter.

There are independent leaders in different categories – Gloat and Fuel50 are flagged up in the talent marketplace space – that have multinational customers. They tend to be strong in certain verticals or geographies, and they usually gain initial traction with small and medium-sized enterprises (SMEs).

Dev Khare, a partner at Lightspeed India Partners, an investor in Darwinbox, has tracked a gradual consolidation in HCM, with sub-verticals such as talent management drawn into larger software suites. But the route from SME to MNC, perhaps culminating in an acquisition, is still valid.

"Very large enterprises typically get everything in one box, but as you move downwards to younger companies with fewer employees, they are mixing and matching best-of-breed solutions," said Khare. "They might use separate apps for employee engagement, payroll, and talent acquisition. All these apps have APIs [application programming interfaces], so they're easy to integrate."

Investors are looking avidly and widely for attractive niches, ever conscious that future of work is fast-evolving. In addition to business model twists in communication, productivity, and training, opportunities highlighted include virtual events platforms, remote interviewing services, and cross-border HCM providers that set up entire local operations for companies with distributed workforces.

Several other more fundamental trends stand out as investment opportunities. First, there is considerable interest in gig or freelance platforms, largely driven by the generational change in working preferences and the prioritisation of freedom over traditional structure.

"We are seeing a lot of organisations using contractors right now because they cannot find the staff they need," said Scoble-Williams of Deloitte. "They are starting to package work in ways that makes it suited to contractors. Investments that help facilitate these new models will be important."

Talent marketplaces that plug into corporates can perform this function, but there are also independent platforms looking to aggregate specialist talent and provide fully outsourced solutions. For example, Lightspeed India's portfolio features Pepper Content, which has accumulated 50,000 freelance writers, videographers, and designers to provider native content to corporates.

The venture capital firm categorises the strategy as "SaaS plus labour marketplaces." It believes the basic economic model – clients pay an annual subscription plus a volume-based fee to the platform, with most of the latter going to the content producers – and Pepper Content's technology could be applied to any industry where there is a large talent pool.

Airtree is an investor in Australia's Expert360, which offers a similar service in consulting, while AlphaX Ventures backed PMCaff, which has cultivated a community of product managers in China.

Engagement issues

Employee engagement, and beyond that, the delivery of incentives, benefits, and compensation are also coming into focus in Asia. Jungle Ventures recently invested in a conversational chatbot designed to keep track of worker wellbeing and sentiment, and then deliver analytics-based insights to employers. Previously, this would have been a clunky six-month process overseen by a consultant.

These insights form part of the information flow companies need to assess the effectiveness of their decentralised operating models, specifically in terms of employee retention. Benefits and compensation come into this because demand for greater flexibility in working hours, location, and practices implies that money is one of several considerations influencing employment choices.

A highly evolved scenario would see new full-time hires design their own package within certain predefined boundaries, dialling cash compensation up or down based on the components of health insurance plans and demand for longer vacations or four-day weeks. Most companies are not far along the evolutionary curve, but investments like Xoxoday underline the direction of movement.

"Whereas previously benefits would normally be fixed, now people increasingly are allocated a budget and choose what they want, maybe putting less into insurance and more into the housing allowance. They might also be able to accumulate points and redeem gifts," said BCG's Tsai.

"Sometimes, compensation is more flexible as well. People can opt for more options or more cash, a higher variable part or a higher fixed part."

Greater customisation of compensation is expected to be accompanied by deeper penetration of the financial side of HCM. Across the region, B2B marketplaces have expanded from brokering transactions to financing them, reasoning that their accumulated knowledge and data facilitates a level of underwriting beyond that of many traditional banks.

In the same way, an HR SaaS player that manages payroll arguably knows enough about an individual employee's earnings history to assess basic creditworthiness. "If you have a lens on what people are getting paid and the regulatory aspect, financial services are a natural next point," said Airtree's Blair. "We've seen it with Zenefits in the US, which hasn't gone well, but there is an opportunity."

India and Southeast Asia are already seeing a rise in earned wage access (EWA) start-ups that enable workers to receive a portion of their earned salary on-demand before the scheduled payday. Yash Sankrityayan, a managing partner at Jungle, added that payroll software platforms are looking to team up with consumer platforms, while EWA players are pushing into the HCM software space.

Refyne, an EWA start-up that raised a USD 82m Series B round in February, conducted an Asia-wide study with EY that connected the dots between EWA and retention. They found that over 80% of employees face liquidity crunches between pay cycles, 60% see EWA availability as a decisive factor in accepting a new job, and companies offering EWA experience less employee attrition.

EWA also serves as a driver of financial inclusion, especially among blue-collar workers that have seen minimal use of technology in HR. "The future of work for them is using their smart phones to interact with employers for payroll, EWA, timesheeting," added Lightspeed's Khare. "It's not necessarily remote work, more getting access to technology to do their work more efficiently."

Valuation vortex?

Several investors suggest that the convergence of HR and financial data is a Web3 play, but it represents uncharted territory. The same can be said of metaverse - seen as a logical extension of the virtual reality platforms some companies have established internally but still in its nascent stages. There is uncertainty as to how an ostensibly consumer concept can address enterprise needs.

Corsello of Acadian noted that he struggles to be bullish on metaverse given the barriers to its everyday usability. Meanwhile, the work-tech space is confronting several more pressing issues, not least valuations that may have spiralled beyond even the most aggressive underwriting cases.

Acadian's future of work index based on 38 listed stocks that soared in 2020 on the back of strong pandemic tailwinds for productivity tools like Zoom and Atlassian. Its 2021 performance was mixed as employees returned to the office and some of the hype receded. This has yet to filter through to private markets, but it may only be a matter of time.

"The fast-growing companies must grow into those valuations, or they face the prospect of down rounds. Businesses will be managed more tightly because cycles are lengthening, which means the focus is on getting to cash flow breakeven as well as on top-line growth. Some are already shrinking their workforces to get more efficient on their burn," Corsello said.

"Last year, one company raised a Series A at USD 70m in January and a Series B at USD 500m in April. There won't be many more of those."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.