Infrastructure: Out of the comfort zone

Infrastructure managers in Australia are pushing into the PE space, competing with GPs for assets and buying businesses from them. It falls under the core-plus umbrella, but is the definition being stretched too far?

Pacific Equity Partners (PEP) is continuing its journey with Australia-based smart electricity meter business Intellihub. However, an asset that has been de-risked to the point of reclassification no longer belongs in the vehicle that originally housed it.

The GP acquired Intellihub in 2018 as the debut investment in its Secure Assets Fund, a vehicle designed for companies that generate infrastructure-like annuity income yet offer opportunities for PE-style operational improvement. At the end of last year, Brookfield Asset Management bought 50% at an enterprise valuation of AUD 3.2bn (USD 2.3bn). PEP plans to spin out the remaining 50% into a single-asset continuation fund.

"We are looking at giving investors a liquidity option, or an option for those that like the business and want to stay with it," said Andrew Charlier, a managing director at PEP. "Even though the expected returns will go down, the certainty around those returns has increased because it has been de-risked. A lot of value can be created by bringing businesses along that risk-return spectrum."

In the case of Intellihub, that de-risking was achieved through scale, longer contracts, and a more diverse revenue base. When PEP carved it out from Origin Energy and combined it with Landis+Gyr's smart meter business, there were 750,000 units and Origin was the primary customer. Now Intellihub has 2m meters and works with more than 30 counterparties in Australia and New Zealand.

This movement along the risk spectrum tracks an evolution from private equity to growth-oriented core-plus infrastructure to traditional core infrastructure. It is a well-trodden path in mature markets like Australia: PE investor takes asset with infrastructure-like characteristics, irons out operational, regulatory, and market complexities, and exits to an infrastructure investor at a healthy premium.

But the path is turning into a congested highway as infrastructure funds stretch the definition of core-plus to include businesses that arguably have more moving parts than fixed assets. While the phenomenon taps into super trends around demographics, energy transition, and technology, it is also a function of low interest rates and ample liquidity. As returns on more conservative assets are bid down, investors can only meet their return targets by moving up the risk curve.

"The envelope is being pushed more than it was in the past. With more dollars going into infrastructure, the competition for assets is intense," said Bruce Crane, a managing director for Asia Pacific infrastructure and natural resources at Ontario Teachers' Pension Plan (OTPP).

"If you are a seller with an asset on the cusp of infrastructure, all you need is one buyer to believe in the marketing and you get a great outcome. Time will tell whether these assets are core-plus infrastructure or private equity."

Liquidity in abundance

PEP is preparing to launch its second secure assets fund, targeting 50% more than the AUD 660m raised in the first vintage, according to a source close to the situation. The firm declined to comment on fundraising, but it was open regarding the origins of the strategy: frustration at losing out on infrastructure-like assets to rivals with a lower cost of capital.

One LP classified PEP's offering as private equity but knows of peers that placed it in the infrastructure bucket. "There were fewer infrastructure managers in that space when they raised the fund. In the last two years, we have seen more," the LP said. "They might have a 9% return target, but they can't get that on traditional infrastructure assets like utilities, so they go into digital."

Some of the infrastructure managers currently active in Australia, such as EQT and Stonepeak, run separate core and core-plus vehicles; others, like QIC and Brookfield, have funds that pursue a blend of core and core-plus assets. Ross Israel, global head of infrastructure at QIC, noted that the balance between the two has shifted as interests have fallen and returns have tightened in the core space. QIC has a 10-13% return target; pure core-plus funds usually aim for mid-teens.

The grey area between asset classes is being populated from the private equity side as well. Single-asset continuation funds are increasingly pitched as a means of retaining ownership of de-risked companies, while long-dated or perpetual capital pools are gaining traction. IFM Investors is said to be raising an Australia fund that will hold assets for 10-plus years.

Uncomfortable overlap?

Industry participants have different views on what sort of assets are appropriate for a core-plus portfolio, the key point of contention being whether managers are putting assets into funds that shouldn't be taking on that level of risk.

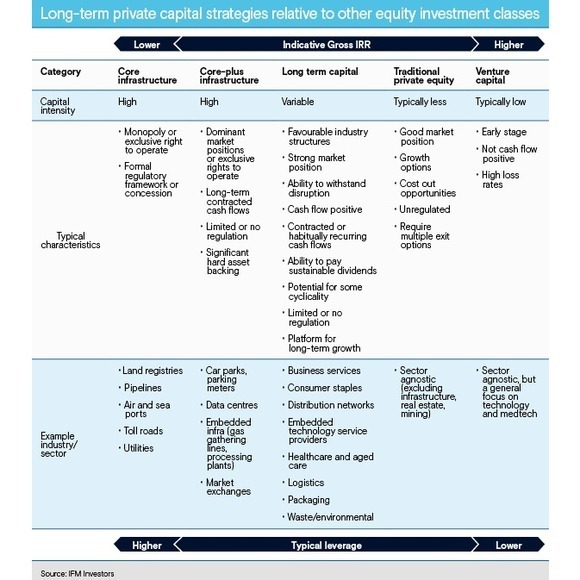

IFM outlined its parameters for core, core-plus, and long-term capital – which sits closest to traditional PE on the risk curve – in a recent white paper. Core infrastructure is characterised by monopolies or exclusive operating rights and concession agreements. With core-plus, regulation is limited but businesses still enjoy dominant market positions and long-term contracted cash flows.

Long-term capital represents an incremental dilution in predictability: favourable industry structures, strong market positions, ability to withstand disruption, positive cash flows, contracted or habitually occurring revenue streams, the ability to pay sustainable dividends, some cyclical exposure, limited regulation, long-term growth prospects tied to product and geographic expansion.

The white paper links sectors to strategies based on those attributes. Land registries, pipelines, ports, toll roads, and utilities are core infrastructure; car parks, data centres, and market exchanges are core-plus. Long term capital encompasses business and technology services, consumer staples, distribution networks, healthcare and aged care, logistics, packaging, and waste.

Industry advisors expect core-plus infrastructure or long-term capital funds to be in the running for pallet leasing businesses Brambles and Loscam Australia and for Beijing Capital's New Zealand waste management unit. With core-plus said to be willing to pay 20x EBITDA for certain assets, several turns beyond most private equity bids, the hunt is on for more supply to sate this appetite.

"Bankers are looking for infra-like assets that sit within corporates," said Emin Altiparmak, a partner at law firm Allens. "Telstra restructured, separating its infra and retail assets, and that led to the towers deal. Other sectors such as oil and gas players are contemplating the same. Some of this activity might be through more synthetic structures, where separation of the actual infra-like assets is challenging including because of joint venture partner or other counterparty consents."

Altiparmak has found that some investors are comfortable bidding on businesses as core-plus despite a lack of significant hard assets if there is little prospect of competition or pricing is regulated. Others are happy with long-term stable or contracted returns and limited retail or merchant risk.

Disruptive forces

For those aiming to generate a premium return by pushing assets along the risk curve, there is plenty of case history. Data centres were originally more of a real estate play, but they progressed rapidly from private equity to core infrastructure as outsourcing models became increasingly complex, digitalisation took hold, and information shifted to the cloud.

Quadrant Private Equity invested in Canberra Data Centres (CDC) in 2014, when the business had only a couple of facilities and a concentrated customer base. Over the next two years, CDC became larger and more diversified, which led to an acquisition by HRL Morrison and Commonwealth Superannuation Corporation. Future Fund bought a stake last year, making its data centre debut.

"Data stored in the cloud and therefore data centres are now seen as a part of core digital infrastructure used by everyone all over the world," said Anthony Muh, Asia chairman at HRL Morrison. "The same is happening with social infrastructure as investors that already provide the hardware around schools and hospitals have evolved to own the next part of the value chain, services providers."

Last year, HRL Morrison facilitated another exit for Quadrant when it acquired Qscan, a radiology clinic chain. Muh described it as a relatively capital-intensive investment, given the need to support nationwide expansion, yet one that offers volume and economies of scale once operations can be standardised and replicated at scale.

The prospects for consolidation – and by extension, diversification of customer base – is part of the rationale behind QIC's foray into hospitals. It also detected a thematic trend around ageing and increased demand for healthcare services.

"Some businesses are core-plus today, but in time they will be regarded as core because sectors are being disrupted. It's happened with digital assets, like data centres and fibre, and the underspend on public health presents a similar opportunity. These hospital businesses can become a valid core component of an infra portfolio," said Israel.

He applies this reasoning to energy and the electrification of transport assets as well. Increased utilisation of remote power and energy storage solutions has served to decentralise asset bases, leading to different operating models. These require capital and scale to be de-risked. QIC expects much the same of electric vehicle (EV) charging infrastructure.

Devil in the detail

However, individual nuances around licensing and regulation – and even the types of services offered within a specific area and how they are paid for – are just as important to underwriting as broad sectoral themes. This is perhaps especially true of healthcare.

Nexus and Evolution sit together in QIC's infrastructure portfolio, but the LP cited earlier, on considering co-investments in both assets, categorised the former as private equity and the latter as core-plus infrastructure. The decision was based on an assessment of Nexus' competitive position: it was too easy for customers to find an alternative provider in a neighbouring suburb.

"Evolution has a dominant share in its main coverage areas, and it has less competition. It also has stronger relationships with public hospitals, whereas in Australia it's more ad hoc," the LP said.

When assessing businesses focused on elective surgery, investors stress the importance of catchment analysis in establishing the nature of local competition and the strength of supposed monopoly positions. With Nexus and Evolution, the underlying demand drivers were not at issue, rather it was a question of how the identity of the payer might impact income stability.

In New Zealand, there is more emphasis on public health insurance and hospitals enter contracts directly with district health boards, whereas private insurance dominates Australia. Meanwhile, a growing number of patients are willing to pay out of pocket for procedures by specific doctors instead of being outsourced to other providers through the public or private systems.

It is suggested similar dynamics influenced the divestment of Healthscope's pathology assets. New Zealand Superannuation Fund and OTPP acquired the New Zealand business in 2020. Crescent Capital Partners and TPG Capital respectively carved out the Australia and Southeast Asia operations in 2015 and 2018. The Australia unit listed last year; Southeast Asia is expected to follow suit.

"They were able to distinguish between the various parts of the business and get different valuations," one industry advisor explains.

Contract tenor is another key factor when underwriting assets. A 20-year take-or-pay agreement under which the buyer pays a set amount regardless of how much volume is utilised might ensure core status. Extending contracts from 3-5 years to 10 years-plus helped push Intellihub in that direction. At the same time, stretching the definition of core-plus brings in shipping, where contracts can be 1-3 years and volume specific but not price specific or the other way around.

"The type of contract can change the definition from core-plus to core or private equity to core-plus," said OTPP's Crane. "It's the difference between knowing you will get paid a certain amount for the next 20 years no matter what happens and having to manage customers because the market fundamentals will shift and underlying contracts will reprice every three years."

Two shipping assets have made the transition from private equity to infrastructure in recent years. QIC acquired Sea Swift, which serves fishing communities and natural resources outposts off Australia's northern coast, from CHAMP Ventures in 2019. Last year, CPE sold StraitNZ, an operator of freight and passenger services between New Zealand's two main islands, to Morgan Stanley Infrastructure Partners.

Israel noted that creating a sustainable business that can expand into different service areas, thereby offsetting issues around competition, volumes, and pricing, is among the biggest portfolio challenges QIC currently faces. "Institutionalising the model is a bigger and deeper exercise than Nexus," he added. "There is real risk in core-plus, no question."

Operational angst

Getting to grips with complexity is a feature of the broader core-plus universe – and where investors are moving from facility provision to service provision, people management is a common pain point.

"A toll road has very few moving pieces in operational terms," said Mark McNamara, a partner at law firm King & Wood Mallesons. "Conversely, a cancer care business is operationally much more complicated and requires a significant amount of stakeholder management given so much of the value is tied to the medical specialists."

Private equity investors have backed a string of doctor-shareholder businesses in Australia, with mixed results. I-Med Radiology Network was the highest-profile failure in the post-global financial crisis years. A large group of doctors, disillusioned with the company's management and precarious finances, splintered off in 2009 to form a competing business. More were agitating to do the same when creditors brought in turnaround experts to mount a successful three-year recovery effort.

The solution is corporatisation and alignment: create a single ownership layer and a growth-oriented business plan; award economic interests to doctors in a way that facilitates succession planning and binds younger members to the business long term; and demonstrate the benefits of a scaled operation in terms of training, branding, and capital investment, as well as cost savings.

The continued lever-pulling of this active management approach is removed from core infrastructure, where the emphasis tends to be on transaction structuring and pricing. As investors step outside their comfort zone into a flexibly defined core-plus arena that asks difficult operational and governance questions, it is unclear whether they are bringing the necessary skillsets.

"If investors don't have experienced operational experts to manage businesses, it's hard to add value," said Muh of HRL Morrison. "Core assets are often bought by consortiums, so no single investor has absolute control and management is done by professionals. Experienced board members are necessary to challenge management. Core-plus is often about managing complexity and growth, so you need industry operators who can roll up their sleeves and engage."

Still in abundance

Mangled execution means the journey from core-plus to core is at best protracted and at worst uncompleted, potentially resulting in exit multiples that don't justify entry premiums. Misreading macro trends – investing in roadhouses only as in-home EV charging takes off or backing cleantech solutions that fail to catch on – would create stranded assets and deliver similar outcomes.

It is generally accepted that some investors who neglect to price risk appropriately will get their fingers burned. But neither this nor an upward adjustment in interest rates is tipped to dampen enthusiasm for infrastructure and the search for returns further along the curve.

"I don't think people will necessarily get less aggressive," said OTPP's Crane with respect to the impact of an interest rate hike. "Returns might adjust but you'll still have a lot of competition for a limited number of assets, where the price floor depends on those individual assets and the extent to which they have inflationary pass-throughs."

If anything, the surge of capital into private markets is likely to sustain the current dynamic and encourage fundraising, led by the global multi-strategy firms but filtering down to country level. Charlier of PEP contends this will see the grey area between private equity and infrastructure become more defined as managers from both sides adopt increasingly idiosyncratic mandates.

"There will always be people stretching outside of their manor, but I think there will be more specialisation around those risk profiles," he said.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.