Expansion

NPX invests $43m in Korean digital content provider

The private equity arm of US and Korea-based NPX Capital has invested USD 43m in Korean digital cartoon studio Copin Communications.

Hong Kong's Animoca Brands raises $359m at $5b valuation

US-based Liberty City Ventures has led a USD 359m round for Hong Kong blockchain media company Animoca Brands at a pre-money valuation of USD 5bn, more than double its valuation in October.

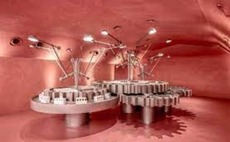

China beauty retailer Harmay raises $200m

Harmay, a China-based omnichannel beauty products retailer, has raised USD 200m across Series C and D rounds.

TPG-owned clinical trials player raises new equity, debt

Novotech, an Asia-based clinical trials specialist controlled by TPG Capital, has secured USD 760m in new equity and debt financing at a post-deal valuation of approximately USD 3bn.

India digital wealth manager secures $75m Series D

Indian personal finance app INDmoney has raised USD 75m in Series D funding from Steadview Capital, Tiger Global Management, and Dragoneer Investment Group.

Asia PE investment hits new high in 2021

A rebound in China-based activity took Asia private equity investment to a record USD 105.3bn in the fourth quarter, ensuring that 2021 represents a new high watermark for the industry.

China's Dishangtie Car Rental raises $200m

Dishangtie Car Rental, a Shenzhen-based electric vehicle (EV) rental service, has raised a USD 200m Series D round across two tranches featuring CICC Capital.

Impact investors commit $60m to India agtech platform

Quona Capital, Lightrock India, and Asia Impact SA have co-led a USD 60m Series C round for Indian agriculture technology platform Arya.

Q&A: Gulf Capital's Richard Dallas & Shantanu Mukerji

Richard Dallas, a senior managing director at Gulf Capital, and newly appointed Asia head Shantanu Mukerji on using Singapore as a regional hub, cross-border expansion, and why a dedicated regional fund is unlikely

4Q analysis: Record quarter, record year

China rebounds as Asia private equity investment ends 2021 with a bang; bright spots in improving fundraising environment; sponsor-to-sponsor exits thrive while PE-backed IPOs stumble

China GPs emphasize consumer sector opportunities

Policy volatility in China has prompted many investors to eschew consumer-facing business models in favour of B2B plays like deep-tech, but sector specialists still see opportunity, the Hong Kong Venture Capital & Private Equity Association’s (HKVCA)...

Quadria backs Vietnam mother-and-baby chain

Singapore-based healthcare specialist Quadria Capital has invested USD 90m in Con Cung, Vietnam’s largest mother-and-baby retailer.

China 5G chip designer Eigencomm raises $157m

SoftBank Vision Fund II has led a CNY 1bn (USD 157m) Series C for Shanghai-based chipmaker Eigencomm, with participation from new investors Cathay Capital, CoStone Capital, Chobe Capital, and GF Qianhe, a unit of GF Securities.

WestBridge, GSV lead $100m Series E for India's Lead School

WestBridge Capital and GSV Ventures have led a USD 100m Series E round for Indian education technology platform Lead School at a valuation of USD 1.1bn.

Apis invests $50m in Singapore loyalty program start-up

Apis Partners has invested USD 50m in Singapore-based loyalty program management and development services provider Giift.

China plant-based protein player Starfield raises $100m

Primavera Capital Group has led a USD 100m Series B for Starfield, a Chinese producer of plant-based meats.

MDI leads $108m round for Indonesia's KoinWorks

MDI Ventures, the VC arm of Telkom Indonesia, has led a USD 108m Series C round for Indonesia P2P lending platform KoinWorks.

China sustainability start-up Bluepha raises $235m

Bluepha, a China-based synthetic biology company working on a range of biodegradable plastics, has raised a three-tranche Series B of CNY 1.5bn (USD 235m).

Indonesia's eFishery raises $90m Series C

Temasek Holdings, SoftBank Vision Fund 2, and Sequoia Capital India have co-led a USD 90m Series C round for Indonesian aquaculture technology start-up eFishery.

Goldman, Sofina lead Series C for China CDMO Zhenge

Goldman Sachs Asset Management and Sofina have led a USD 100m Series C round for Zhenge Biotech, a Shanghai-based contract development and manufacturing organisation (CDMO).

India delivery business Dunzo raises $240m

Reliance Retail Ventures has contributed USD 200m to a USD 240m round for Indian last-mile delivery start-up Dunzo, taking a 25.8% stake.

Carsome hits $1.7b valuation on closing $290m Series E

Carsome, a Malaysia-headquartered used car trading platform with operations across Southeast Asia, has raised USD 290m in Series E funding led by Qatar Investment Authority (QIA), 65 Equity Partners, and Seatown Private Capital Master Fund.

Sun Hung Kai leads Series B for Singapore digital asset bank

Sygnum, a Singapore and Switzerland-based digital asset bank, has raised a Series B of USD 90m - at a post-money valuation of USD 800m - led by Hong Kong-based investor Sun Hung Kai & Co.

China gene therapy start-up Cure Genetics raises $60m

Advantech Capital has led a USD 60m Series B for Suzhou-based biotech player Cure Genetics. Other investors include Oriza Holdings, Blue Ocean Private Equity, and Qiming Venture Partners.