Articles by Larissa Ku

China investors see primary, secondary valuation mismatch - AVCJ Forum

Investors told the AVCJ China Forum they believe low valuations in the country’s secondary markets will begin to appear in the primary market. But they are positive on the long-term.

Fund focus: Vitalbridge plays it safe

The China-based venture capital firm declined to increase its Fund II hard cap as regulatory uncertainty mounted. It now has $275 million in dry powder earmarked for services digitalization

Deal focus: Whale takes a bite of big data

China-focused digital marketing start-up Whale has secured $50 million in Series B funding to hone a product offering that helps companies optimize customer engagement by analyzing traffic flows

China's Vitalbridge closes Fund II at $275m

Vitalbridge Capital, a China-based venture capital firm that spun out from Trustbridge Partners, has raised $275 million for its second US dollar-denominated fund.

China digital marketing platform gets $50m Series B

Whale, a China-focused digital marketing platform, has raised a Series B round of $50 million led by Temasek Holdings. Existing investors Nio Capital, Linear Capital, and Alpha Startups Fund re-upped.

Vision Fund: Big is beautiful?

Previously the sole elephant in Asia’s growth-stage technology space, SoftBank’s Vision Fund program is now one of a herd. Prevailing amid increased competition may prove its thesis once and for all

Deal focus: Digital brokerage Ajaib finds the right fit

Ajaib grew from nothing to become Indonesia’s fifth-largest stockbroker by volume in the space of six months. The newly appointed unicorn is now raising capital just as quickly

Fund focus: Yunqi reaffirms its enterprise focus

Yunqi Partners was the first Chinese GP dedicated to enterprise services and now claims to be the largest early-stage investor in the space. SaaS, in various forms, will account for the bulk of Fund III

China's Yunqi closes third US dollar fund at $300m

Yunqi Partners, an early-stage investment firm focused on enterprise software and services in China, has raised $300 million for its third US dollar-denominated fund.

China's Source Code raises $1.1b renminbi fund

Chinese venture capital firm Source Code Capital has raised RMB7 billion ($1.1 billion) for its fifth renminbi-denominated fund after approximately three months in the market.

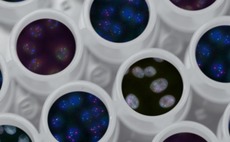

China biotech start-up LianBio files for US IPO

LianBio, a two-year-old Chinese biotech start-up incubated by life sciences investor Perceptive Advisors, has filed for a US IPO.

China Renaissance hits first close on flagship US dollar fund

Huaxing Growth Capital, a new economy-focused private equity division of China Renaissance, has reached the first close on its fourth US dollar-denominated fund of $550 million.

Indonesia fintech start-up Ajaib achieves unicorn status

Ajaib, an online stock-trading platform in Indonesia, has raised $153 million in a Series B funding round led by DST Global at a valuation of $1 billion.

Chinese EV maker WM Motor raises $300m

Chinese electric vehicle (EV) manufacturer WM Motor has raised $300 million in the extended Series D round led by Hong Kong telecommunication company PCCW and shipping company Shun Tak Holdings.

China SaaS: Path to profitability

COVID-19 has driven enterprise uptake of software-as-a-service solutions in China, but paying customers are still relatively few. Other markets offer some pointers on monetization

Indonesian e-commerce marketplace Ula raises $87m

Ula, a leading B2B e-commerce marketplace in Indonesia, has raised $87 million in a Series B round co-led by Prosus Ventures, Tencent Holdings and B Capital Group.

Tiger Global leads $50m round for China's DataCloak

China-based cyber security start-up DataCloak has raised $50 million in an extended Series B round led by Tiger Global Management. Existing investors Matrix Partners China, Jeneration Capital, GL Ventures and GSR Ventures re-upped.

China autonomous sanitation vehicle maker raises $250m

CowaRobot, a Chinese autonomous driving technology developer with an initial focus on sanitation vehicles, has raised $250 million in Series C funding.

China robotics player Mech-Mind raises $154m

Chinese industrial robotics supplier Mech-Mind has raised nearly RMB1 billion ($154 million) in a Series C funding round led by Meituan and IDG Capital.

Deal focus: Investors flock to SaaS specialist Ones

China’s Ones aspires to become Atlassian rather than Slack, catering to software developers working on complicated projects. Effective localization is partly responsible for a surge in VC investment

Evergrande EV unit cancels listing, suffers cash crunch

Evergrande New Energy Vehicle (NEV) Group, the Hong Kong-listed electric vehicle unit of troubled Chinese real estate developer Evergrande has canceled a planned secondary listing on Shanghai's Star Market and warned investors of a cash shortage.

China service robot player Pudu secures $77m

Pudu Robotics, a China-based manufacturer of service robots, has raised a $77 million Series C extension led by Meituan, Greater Bay Area Homeland Development Fund, Shenzhen Investment Holdings, and Sequoia Capital China.

China autonomous driving chip start-up hits $2b valuation

Black Sesame Technologies, a China-based chipmaker specializing in autonomous driving applications, has raised several hundred million dollars through two funding rounds at a valuation of $2 billion.

China AR glasses maker Nreal gets $100m Series C

Nreal, a Chinese manufacturer of advanced artificial reality (AR) glasses that resemble normal sunglasses, has raised a Series C of $100 million led by Nio Capital, Yunfeng Capital, and Hongtai Capital.