China SaaS: Path to profitability

COVID-19 has driven enterprise uptake of software-as-a-service solutions in China, but paying customers are still relatively few. Other markets offer some pointers on monetization

Investors are wary of China's technology sector. What began with Ant Group's aborted IPO last November has escalated into anti-monopoly investigations targeting top domestic internet companies, a fundamental redrawing of the commercial guidelines for private education, and a sweeping data privacy law that has complicated US IPOs by consumer-facing internet players.

Taken together, the tapestry of new regulation has undermined business models – to the point of making some unworkable – and created uncertainty over exit timelines. Public markets have been rattled. The CSI Overseas China Internet Index peaked at 14,735 points in February; it is now languishing below 6,500. The mood in private markets is much the same.

Amid this chaos, software-as-a-service (SaaS) start-ups have prospered. First, as B2B players, they have been largely unscathed by the B2C-focused regulatory action. Second, they are riding a wave of pandemic-driven digitalization as enterprises recognize the importance of virtual communication and cloud-based services. Capital has duly followed, especially at the growth stage.

"We are seeing increased participation from pre-IPO or hedge fund-like investors, such as DST Global, Coatue Management, Tiger Global Management, which used to concentrate more on the consumer internet side in China," says Yipin Ng, founding partner of Yunqi Partners. "But they are established SaaS investors because they understand the industry history in the US."

Changing dynamics

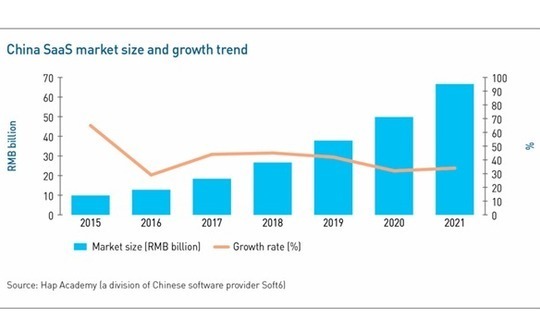

There are more than 4,500 SaaS companies in China, according to Hap Academy, a local research firm. Meanwhile, the country's SaaS enterprise user base swelled by 82% last year, reaching 9.15 million. The industry is expected to be worth RMB66.6 billion ($10.3 billion) by 2021, with annual growth of 34%.

Hap Academy puts PE and VC investment in SaaS at RMB30.7 billion for 2020, with nearly 200 companies receiving funding. It continues a longer trend of increased activity, yet the story isn't wholly positive. Even though SaaS players haven't suffered from the regulatory purge on an operational level, they aren't immune to a general cooling of investor sentiment sector-wide.

"Several of our SaaS portfolio companies have raised new funding rounds in recent months. It's not been uncommon for the lead investor to come back asking for a discount in terms of valuation despite the term sheet already being signed," one specialist SaaS investor tells AVCJ.

"And then all companies considering overseas IPOs now need regulatory approval under the new data privacy law. Although SaaS companies are B2B business and don't collect end-consumer data, they still need to make a statement and wait for approval."

For example, as part of the anti-monopoly probe, the government slapped a record $2.8 billion fine on Alibaba Group for its "pick one from two" practice, whereby small online merchants are forced to choose one platform as an exclusive distribution channel. The tactic is widespread in China's e-commerce industry, with Meituan is currently facing a potential $1 billion fine for the same offense.

"A small merchant can now sell on multiple online platforms, instead of just one," observes Daisy Cai, a general partner and head of China at B Capital Group. "However, it also brings extra complexity in that they need third parties to take care of customer acquisition and operations management on these various platforms."

B Capital's China portfolio includes Zaihui, a marketing SaaS platform that serves local restaurants. It was founded by an executive at Dianping, a restaurant reviews and marketing app that merged with Meituan. The company, which has secured more than $100 million in funding to date, has worked with over 8,000 catering brands.

The demise of "pick one from two" is expected to see a proliferation of new entrants on the platform side, with the likes of social networking and short video players Douyin, Kuaishou, and Little Red Book among the most prominent. Zaihui is positioning itself to help restaurants manage their presence across these platforms.

The India example

China is a reference point for markets like India and Southeast Asia when plotting the likely evolution of consumer internet business models. The situation is reversed regarding SaaS.

Freshworks, India's second-oldest SaaS unicorns and arguably the first VC success story in the space, listed on NASDAQ last month with a market capitalization of $11.6 billion. The company last raised private funding in 2019 at a valuation of $3.5 billion. This has been surpassed twice in 2021, first by BrowserStack and then by Postman, with the latter achieving $5.6 billion on closing its Series D.

Based on current momentum, India's SaaS industry is on course to hit up to $70 billion in revenue by 2030, amounting to a 6% global market share, according to SaaSBoomi and McKinsey & Company.

However, Indian SaaS start-ups differ from their Chinese brethren in that most go global from day one, serving a primarily US customer base. They typical model is US front office-India back-office, with the bulk of the workforce located in India where talent is cheaper but also widely available. Speed is another consideration, with large India-based development teams reducing time-to-market.

China doesn't have India's long international business process outsourcing (BPO) heritage, which has fed into the SaaS boom – a rather tricky transition from taking orders to building products that customers are willing to buy. Moreover, China's SaaS industry operates in its native language and in accordance with local business norms. But there is still considerable optimism.

"China's SaaS industry is at an early stage and penetration of the domestic customer base is very low. There is enough local market potential for companies to achieve scale. I don't think we need to think about foreign climate too much at this stage, because our own market is just beginning to get tapped," says Duncan Zheng, head of China private equity at Investcorp.

Investors generally are also placing greater emphasis on SaaS opportunities in emerging markets. The US has reached a level of maturity where start-ups are typically "a small piece of the puzzle, serving a small piece of workflow such as capturing information from customers," notes Dev Khare, a partner at Lightspeed India Partners. In younger markets, the opportunity remains to build horizontal platforms that offer end-to-end solutions.

Emerging markets also appeal because customer volumes are large, and you don't have to travel to the US and Europe to see them. "There are so many SMEs in India, Indonesia, Malaysia, and Bangladesh. It wouldn't surprise me if a Shopify equivalent for SMEs came out of Asia," says Jai Das, co-founder of Sapphire Ventures, which invests in enterprise software globally.

Initial inroads

In keeping with the horizontal platform philosophy, customer support and systems implementation are seen as areas where local players can gain traction in China. Investcorp's exposure in this area includes Mind Cloud, which targets manufacturers in China and Southeast Asia. The founder is an ex-SAP executive who felt that SAP wasn't doing enough to integrate its services with local systems.

Localization also involves adding unique flavors to a product offering and to some extent striking compromises to fit in with specific cultures and preferences.

For example, Ones, a China-based collaboration platform used by software developers, found itself in direct competition with global leader Atlassian. It gained traction through flexibility, delivering on-premises solutions while Atlassian stuck to cloud-based services. This reflects a reluctance among Chinese companies to store sensitive data on external servers, especially those overseas.

In addition, Ones positioned itself to serve local businesses that are still finding their way into SaaS. The company has a large local support team and it cut back some more advanced features to create a relatively simple interface, notes Jake Xie, a partner at China Growth Capital, a backer of Ones.

Local knowledge is essential when plugging into existing infrastructure as well. "An e-commerce SaaS that's designed based on Amazon processes wouldn't work on WeChat or Taobao – you need to follow the processes of local platforms in selling goods," says Kelly Pu, a partner at Bain & Company. The same applies to tax reporting, with each Chinese province employing slightly different rules.

While China's SaaS industry is relatively immature by global standards, some of the technologies implemented by local providers are cutting-edge. These include artificial intelligence and big data where solutions have emerged to meet a complex set of needs. Bin Xiao, CEO of e-commerce SaaS player Huice, points to how his company serves merchants with multiple warehouses.

Huice developed an intelligent algorithm that helps merchants decide which warehouse to use when fulfilling an order, based on inventory levels, distance to the customer, and speed and cost of delivery. The system can be configured to prioritize different factors, accept manual intervention, assist in warehouse layout, and even identify fraudulent customers.

SaaS + marketplace

India's 60 million SMEs are an equally attractive target for SaaS start-ups. In China and India, the "SaaS plus marketplace" model has proved effective because it not only offers improved efficiency through software, but also promises to bring in new customers and revenue streams.

Lightspeed has invested in Zetwerk, a platform that connects 2,000 India-based manufactures with around 250 large-scale buyers in sectors like aerospace, automotive, and medical devices. The company is now in 15 markets globally, having established an international footprint last year in response to demand for increased supply chain diversification.

"These small manufacturers in India don't have the capabilities to sell into the US and Europe, and even into other parts of India," says Khare of Lightspeed. "Zetwerk provides access to customers and software to manage factories and orders. This is a distinct flavor of SaaS that are focused on India."

In China, the likes of Baibu and Smart Fabric are taking a similar approach in fabrics, while Chubby Bear is doing the same for renovation materials. "Because it is B2B and businesses are regular buyers, transactions are recurring in nature and you can calculate ARR [average recurring revenue] and NDR [net dollar retention] like in SaaS," explains Yunqi's Ng.

Baibu is taking the strategy a step further by inserting itself directly into supply chains. The company has established a cloud factory that consolidates the capacity of multiple small textile manufacturers, taking orders from large brands and distributing them through its ecosystem. These manufacturers also receive digitalization tools.

OfBusiness, an India-based raw materials sourcing platform for SMEs that has expanded into supply chain finance, is also looking to become a manufacturer as well as a supplier. Vasant Sridhar, one of the co-founders, previously told AVCJ that the company is considering factory acquisitions as a means of exercising more control over supply chains as well as extracting better margins.

Using SaaS as the foundation for a range of other services – essentially leveraging existing customer relationships and market knowledge – is commonplace internationally. Investcorp is looking for ways to replicate the approach in China, according to Zhang.

The private equity firm backed Linkedcare, a SaaS provider to dental and medical aesthetic clinics. In addition to a software offering that encompasses customer relationship management and other functions, the company sources branded dental products for clinics. This is done through a dedicated online mall that feeds into the SaaS system to boost procurement efficiency.

The reference point for LinkedCare was Henry Schein, the world's largest distributor of dental equipment and a supplier of cloud-based software for dental offices. However, Investcorp believes the opportunity set is much larger in China and India than in mature markets.

Money matters

No matter how big the unmet need in emerging markets that SaaS products seek to address, in the end they must make money. While rising labor costs in China have pushed companies to accept SaaS, only 11% of users are paying customers, according to Hap Academy.

Achieving profitability might be more about the sector than the company: profitable sectors tend to nurture larger SaaS players. The emergence of Ming Yuan Cloud in real estate, Linkedcare in healthcare, and Kujiale in home renovation are good pointers. On the other hand, start-ups offering SaaS solutions to pet hospitals and pet stores struggle to generate revenue.

"Sometimes the problem goes back to the first SaaS company that covered the industry doing so on a free basis," says one global investor. "It's hard to change customer habits once they are ingrained."

One interesting takeaway from India is that technology companies and software developers were the first to be targeted as potential customers because they are considered early adopters of new technology and more willing buyers. Postman, which serves application programming interface (API) development teams, and Acceldata, as data observability specialist, both took this approach.

Given China is home to one of the world's three largest developer communities – alongside India and the US – it may end up taking a similar path.

Xie of China Growth Capital notes that a SaaS product valued by developers is more likely to attract paying customers than a mainstream offering. Moreover, it's easy to quantify cost savings. For example, Ones can be used to manage 100 programmers and deliver efficiency gains of 20-30% for less than the cost of employing one programmer on RMB300,000 per year.

A glimpse at the financials of China's listed SaaS providers confirms there is a profitability issue that has yet to be resolved. Youzan, an e-commerce SaaS player, saw its operating loss rise 87.3% year-on-year to RMB449 million in the first half of 2021. Weimob's operating loss was RMB195 million, an eightfold increase on the same period of last year.

Both companies are still in cash burn mode, with sales expenses close to exceeding gross profit. This is partly a function of low customer retention rates among SMEs – and, in turn, it might be driven by high failure rates among e-commerce merchants.

Shopify has a different strategy, attracting customers en masse by charging as little as $9 per month for its basic product. Customer acquisition costs are low because high recommendation rates from existing users bring in new ones. Shopify then seeks to move customers to higher pricing tiers – where fees are more than $20,000 per year – on the strength of its product.

"As a SaaS company, if you want to, you can grow at 10% without burning any money and you are suddenly a $100 million business," says Sapphire's Jai Das.

Perhaps this is the lesson that China's SaaS players should learn. The country's consumer-facing internet giants got to where they are today on the back of high-cash-burn customer acquisition initiatives and a belief that scale would ultimately deliver cost efficiency. SaaS doesn't have to work from the same playbook.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.