Articles by Larissa Ku

Boyu, Confitop lead pre-IPO round for China pet food player

Shandong Seek Pet Products, a China-based pet food manufacturer, has raised nearly CNY 500m (USD 75m) in pre-IPO funding led by Boyu Capital and Confitop Capital.

Deal focus: Bud puts content creators first

GGV Capital first backed Bud before the founders had a market-ready product. Now the company has closed a Series B round and is looking to take its user-generated content tools into more markets

China chip developer Hongjun raises $120m

Chinese chip developer Hongjun Microelectronics has raised CNY 800m (USD 120m) in angel and pre-Series A rounds led by Walden International, GL Ventures, and CDH Venture and Growth Capital.

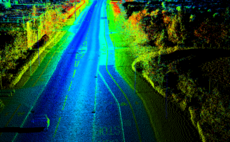

Deal focus: WeRide confirms its ascendency

Chinese autonomous driving pioneer WeRide has climbed from near bankruptcy to a USD 4.4bn valuation within three years. A collaboration with Bosch could form a blueprint for other alliances

China energy storage start-up gets $48m pre-Series A

Zhongchu Guoneng Technology (ZGT), a China-based energy storage company, has raised CNY 320m (USD 48m) in pre-Series A funding led by Tsinghua Holdings Capital.

Bosch invests in China's WeRide

China-based autonomous driving technology developer WeRide has received a strategic investment from German engineering multinational Bosch.

Franklin Templeton strengthens Asia PE coverage of agri-food

Franklin Templeton has appointed Patrick Vizzone as a managing director and head of agri-food for its Asia Pacific alternatives group. He will lead PE and VC investments in the space globally.

China guidance funds pump $132m into Gowin Semiconductor

Chinese semiconductor manufacturer Gowin has raised an extended Series B round of CNY 880m (USD 132m) led by Guangzhou Bay Area Semiconductor Industry Group, which has now become the company's largest shareholder.

China's Primavera seeks $1.5b for carbon neutrality fund

China-focused Primavera Capital Group is looking to raise approximately CNY 10bn (USD 1.5bn) for a carbon neutrality fund, emphasising the increased popularity of sustainability strategies among local private equity investors.

Fund focus: XVC stresses its idiosyncrasies

The China VC firm cuts against the grain, eschewing investment committee meetings and embracing consumer deals while others shun them. It works from a fundraising perspective

Fund focus: BlueRun defies China fundraising woes

Having secured USD 819m, across US dollar and renminbi vehicles, the early-stage investor wants to prove that China can deliver globally competitive technology

Singapore metaverse platform Bud raises $36.8m

Singapore-based metaverse user generated content (UGC) platform Bud has raised a Series B round of USD 36.8m led by Sequoia Capital India.

China rocket developer Orienspace raises $60m

Chinese rocket developer Orienspace has raised a CNY400m (USD 60m) Series A round led by HikeCapital.

Ince leads $30m round for China's PhiGent Robotics

Beijing-based autonomous driving solutions provider PhiGent Robotics has raised a USD30m Series A round led by Ince Capital. Previous investors such as Atypical Ventures, 5Y Capital, and GSR Ventures re-upped.

China's BlueRun $819m across US dollar, renminbi funds

China-based BlueRun Ventures has closed its third US dollar-denominated China fund and third renminbi vehicle with aggregate commitments of CNY 5.5bn (USD 819m).

China industrial internet platform Xuelangyun raises $44m

Xuelangyun, a China-based industrial data service provider, has raised a Series B of CNY 300m (USD 44m) led by China Structural Reform Fund. Poly Capital and an intellectual property fund under Wuxi Guolian Development also participated.

China outbound: Organic options

Tough domestic competition is encouraging Chinese tech start-ups to expand overseas – often organically, earlier in their lifecycles than before, and despite regulatory concerns

India e-commerce enabler Gokwik raises $35m

Gokwik, an Indian e-commerce enablement platform, has raised USD 35m in a Series B round led by Think Investments and RTP Global.

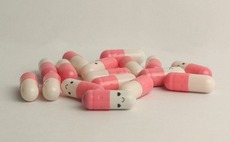

China biotech player Reistone raises $100m

Reistone, a novel drug developer incubated by Jiangsu Hengrui Pharmaceuticals, has raised a Series A of nearly USD 100m led by Huagai Capital.

China Renaissance raises $446m for renminbi fund

Huaxing Growth Capital, the private equity division of China Renaissance, has achieved a CNY 3bn (USD 446m) first close on its fourth flagship renminbi-denominated fund.

China's Sensors Data raises $200m

Chinese marketing technology provider Sensors Data has raised a USD 200m Series D round led by Tiger Global Management and The Carlyle Group.

Deal focus: Sensors Data finds meaning in compromise

Requests for customised rather than standardised products challenged Sensors Data’s notion of what software-as-a-service should be. The company overcame its anxiety and continues the growth journey.

IDG backs China surgical robot start-up

IDG Capital has joined a Series A round of several hundred million renminbi for China’s Sustao, which is developing a platform for fully automating surgical robots.

Maverick leads $75m round for Hong Kong SaaS player Coherent

Hong Kong-based no-code software-as-a-service (SaaS) provider Coherent has raised a USD 75m Series B round led by Maverick Capital.