Articles by Tim Burroughs

BPEA EQT hits first close on mid-market fund, seals debut deal

BPEA EQT – which was formed through the merger of Baring Private Equity Asia and EQT – achieved a first close on its pan-regional mid-cap fund at the end of last year and the vehicle recently completed its debut investment in a Malaysia-headquartered...

China industrial supplies platform ZKH pursues US IPO

ZKH Group, a China-based industrial supplies platform backed by the likes of Eastern Bell Capital, Genesis Capital, Tencent Holdings, and Tiger Global Management, has filed to list in the US.

Silicon Valley Bank's China JV reassures stakeholders

SPD Silicon Valley Bank, the China-based joint venture of SVB Financial Group, has offered assurances about the robustness of its operations following the closure of SVB Financial-owned US lender Silicon Valley Bank (SVB), while listed Chinese clients...

Australian GPs look to retain spirit of entrepreneurship - AVCJ Forum

The combination of personalities and skillsets that characterised the first generation of Australian private equity is unlikely to be repeated, but GPs are still looking for ways to capture elements of entrepreneurialism even as the industry becomes more...

BlackRock hires Campbell Lutyens' Asia head

BlackRock has recruited George Maltezos, formerly head of Asia Pacific at placement agent Campbell Lutyens, to lead alternatives distribution in the region.

Adams Street establishes Australia presence

Adams Street Partners has opened an office in Sydney, which will be led by Shaun Thomas, an investor relations principal who joined the firm last November.

Singapore's SeaTown backs buy-and-build healthcare platform

A fund managed by SeaTown Holdings International, an affiliate of Singapore’s Temasek Holdings, has invested SGD 150m (USD 111m) in Foundation Healthcare Holdings (FHH), a newly created private healthcare platform.

Australian LPs get tough on unlisted valuations - AVCJ Forum

Australian LPs are facing more scrutiny as to how they value unlisted assets, prompting several superannuation funds to establish independent valuation teams that operate separately from private equity investment professionals.

Permira closes $17.6b global buyout fund

Permira has closed its latest flagship global buyout fund with EUR 16.7bn (USD 17.6bn) in commitments, a 50% increase on the previous vintage.

Hong Kong: Action on innovation

Efforts to turn Hong Kong into a technology ecosystem are still at an early stage. Investors and start-up founders believe many of the ingredients are there, but the recipe can be flawed or ignored

TPG targets $1.2b Australia funeral services take-private

TPG Capital has submitted a buyout offer for Invocare, a listed Australian provider of funeral services and operator of memorial parks and crematoria, that values the company at approximately AUD 1.8bn (USD 1.2bn).

AVCJ Awards 2022: Special Achievement – Kok Peng Teh

Kok Peng Teh spent most of his career at GIC, helping build out what has become one of the world’s largest private equity programmes and nurturing the careers of numerous industry participants

KKR exits Malaysia's Weststar Aviation after 10-year hold

KKR has exited Weststar Aviation Services (WAS), which primarily provides helicopter transportation services to the offshore oil and gas industry, after a holding period of nearly 10 years.

EQT buys Korean security services provider

EQT has agreed to acquire a majority stake in Korea-based security monitoring business SK Shieldus from an affiliate of SK Group and Macquarie Asset Management, through an investment under its core-plus infrastructure strategy.

BGH, Sixth Street's PushPay buyout bid set to fall short

New Zealand and Australia-listed payments business PushPay has announced that its NZD 1.54bn (USD 933m) acquisition by BGH Capital and Sixth Street Partners will not proceed based on proxy votes already received.

Hong Kong PE stalwart John Levack dies aged 64

John Levack, who spent over two decades with Electra Partners Asia and was a long-serving board member at the Hong Kong Venture Capital & Private Equity Association (HKVCA), has died aged 64.

Q&A: Aware Super's Damien Webb

Damien Webb, deputy CIO and head of international at Australia’s Aware Super, on opening offices overseas, internalising asset management, and opportunities at the nexus of PE and infrastructure

Northstar leads pre-Series C for Singapore's Una Brands

Northstar Group had led a USD 30m pre-Series C round for Una Brands, a Singapore-based brand agglomeration platform that operates across Asia.

Goodwin adds investment funds partner in Singapore

Goodwin Proctor has recruited Matthew Nortcliff as a partner in its investment funds practice in Singapore, adding headcount to an office that opened towards the end of last year.

India's Nexus Venture closes Fund VII on $700m

Nexus Venture Partners has reached a final close on its seventh India venture capital fund with USD 700m in commitments, taking the firm’s total assets under management past the USD 2bn mark.

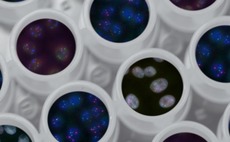

China's Oricell secures $45m Series B extension

Qatar Investment Authority (QIA) and RTW Investments, a US-based healthcare investor, have led a Series B extension of USD 45m for Oricell Therapeutics, a China-based drug developer working on CAR-T cell therapies.

Asia co-investment: Gun-shy LPs?

Overallocation, risk aversion, and troubleshooting existing deals have prompted some LPs to pull back from co-investment in Asia. Others are willing to step in, but the market is selective

Q&A: Blackbird Ventures' Rick Baker

Rick Baker, co-founder of Australia’s Blackbird Ventures, on pricing adjustments in the tech space, fundraising and secondaries, valuing unicorns, and the rise of ChatGPT

Cenova leads $40m Series B for China's Eluminex

China-based healthcare investor Cenova Capital has led a USD 40m Series B round for Eluminex Biosciences, which is developing drugs and regenerative tissue used to treat eye disease and other vision-threatening medical conditions.