Hong Kong: Action on innovation

Efforts to turn Hong Kong into a technology ecosystem are still at an early stage. Investors and start-up founders believe many of the ingredients are there, but the recipe can be flawed or ignored

Wristcheck is Hong Kong's first second-hand watch shop to occupy a high-end shopping mall. The start-up leased premises in The Landmark, close to Luis Vuitton and Tiffany & Co, in late 2021 when travel restrictions meant there were few other takers. Having an offline presence to supplement a growing online business facilitating trades between luxury watch owners was deemed essential.

And it was only ever going to be in Hong Kong. Frustrated at a lack of luxury watch-themed online content that appealed to his generation, Wristcheck founder Austen Chu began producing his own. He built up a strong following on Instagram and then conceived a trading platform that brings pricing transparency to an industry known for its opacity. He moved to the city in mid-2020 for this reason.

"Hong Kong is unequivocally the best place to be headquartered – not just for watches but for anything luxury because there is no tax," said Chu, who raised USD 8m in seed funding last year from Alibaba Entrepreneurs Fund (AEF) and the Malaysia-based Kwok family's K3 Ventures.

"For 20 years, Hong Kong has outsold the US in terms of imported luxury watches, despite trailing on every key metric, from population to number of tourists to number of Rolex stores. The last three years have been exceptional because there was a 99% drop in tourism, but Hong Kong was still the global number three after the US and China."

While Wristcheck has specific reasons for being here, the start-up also regards Hong Kong as an easily accessible platform for entering other markets, specifically Greater China and Southeast Asia. Other cross-border start-ups are thinking the same way, encouraged to varying degrees by an increasingly favourable policy environment that touches on incentives, funding, and capital markets.

The government's commitment to start-ups was emphasised last year through a blueprint for building an international technology hub and last month in a budget statement that promised more capital for key early-stage funding programmes. Yet acknowledged progress is hampered by accusations of excessive bureaucracy and a sense that Hong Kong isn't moving fast enough.

"There have been some important announcements and positive direction, but implementation should be swifter," said Alvin Kwock, co-founder and CEO of local insurance technology start-up OneDegree, which closed a Series B of more than USD 30m last year. "We entered a capital winter last year, and if new sources don't step up, there's a risk that even good companies won't survive."

Turning point

OneDegree is among the success stories to emerge from the Hong Kong ecosystem. The founders anticipated the issuance of digital insurance licenses in 2017 and had a strong set of products ready to launch. They then started offering technology transformation services to traditional insurers. OneDegree now employs about 170 people across multiple markets in the region.

The company initially struggled to secure funding but eventually won support from, among others, two of Hong Kong's early-stage stalwarts. OneDegree entered a Cyberport accelerator programme in 2018 and this led to a commitment from the HKD 400m (USD 51m) Cyberport Macro Fund, which participates in Series A rounds. The Gobi Partners-managed AEF invested the same year.

Cyberport Macro Fund was established in 2017 to complement existing incubation and accelerator programmes. HKSTP Venture Fund – under Hong Kong Science & Technology Park – emerged two years earlier as a seed-though-Series A specialist. The government recently boosted its corpus to HKD 1bn. AEF was also established in 2015 as a non-profit initiative of Alibaba Group with HKD 1bn.

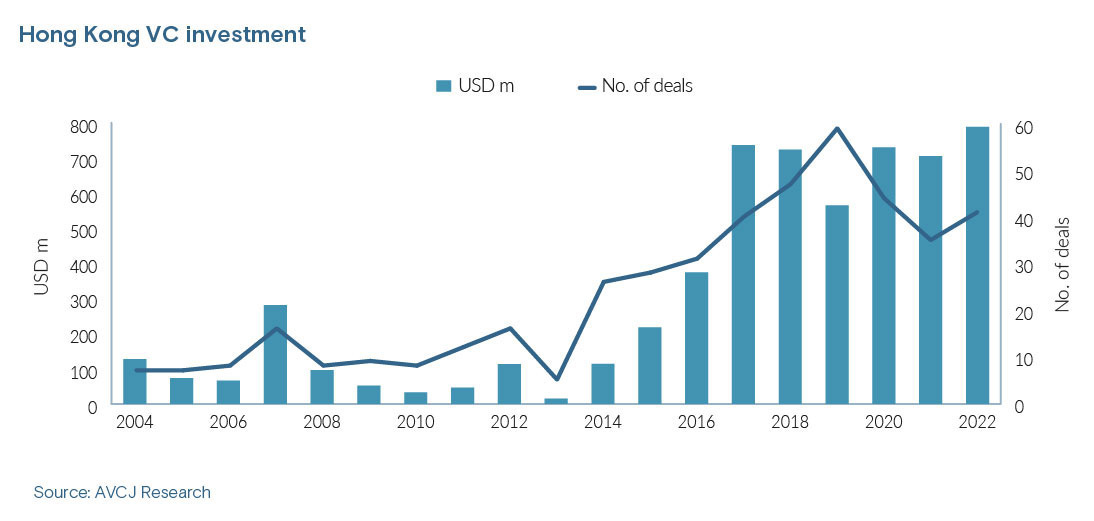

Multiple industry participants regard the launch of these funds as integral to the development of Hong Kong's technology ecosystem. Certainly, investment increased at this time. In the 10 years following Cyberport's founding in 2004, annual average deployment was about USD 90m, according to AVCJ Research. It passed USD 200m in 2015 and has averaged USD 700m since 2017.

"Cyberport has been described as a white elephant and a real estate programme, but what people don't see is the revenue split, which sees money from real estate go into early-stage incubation. The problem early on was that the entire ecosystem wasn't ready," said a source close to Cyberport.

"It wasn't until around 2015, when the VC trend began to emerge with companies like Gogox and WeLab that everything started to grow. Cyberport's incubator is now taking up 150 companies a year. And before the Macro Fund there was no equity investment, it was all grants."

The government encouraged local universities to cultivate start-ups as well. Benny Zee, a professor in the faculty of medicine at Chinese University of Hong Kong (CUHK) who leads the university's office of research and knowledge transfer services, identifies the Technology Start-up Support Scheme for Universities (TSSSU) in 2014 as a turning point.

"It wasn't about the money – the scheme wasn't that large, allocating about HKD 8m per institution, but it was a signal that they wanted universities to change. It took a few years for people to understand how this was done," said Zee, adding that the knowledge transfer office previously only really dealt with the issuance of patents.

CUHK became proactive, combining its research and knowledge transfer offices to establish a better connection between academia and commercialisation and working closely with Cyberport and HKSTP. CUHK and Hong Kong University of Science & Technology (HKUST) have both introduced equity investment funds on top of grant-based accelerator programmes.

City University of Hong Kong (CityU) upped its commercialisation efforts two years ago, pledging to support the formation of 300 start-ups – founded by anyone in Hong Kong using university facilities, not just students and faculty – over a three-year period. An eight-week training phase is followed by seed, angel, and expansion phases, with external funding partners introduced during this journey.

To date, more than 1,300 individuals have participated in the training, 510 teams have received seed funding, and 110 have made it to the angel phase. Candidates are currently being assessed for up to HKD 10m in expansion funding provided by CityU, China Resources Enterprise, and seven local VCs, said Laura Lo, the university's vice president for mainland affairs and entrepreneurship.

"A company founded in Hong Kong could spend two years here with CityU and the Science Park, expand into the Greater Bay Area (GBA) and develop its business, and then return to Hong Kong for an IPO," Lo added. "There is a path to achieving unicorn status within seven years."

Theory to practice

Steps have also been taken to boost growth-stage funding. The Hong Kong Growth Portfolio (HKGP) was established as a 10% allocation within the Future Fund – part of the Hong Kong Monetary Authority's Exchange Fund – for investments that support the local economy. The government subsequently announced a HKD 5bn strategic technology fund, also under Future Fund.

Hong Kong Investment Corporation (HKIC) has been established to manage the HKGP, the technology fund, and a HKD 5bn investment vehicle targeting the GBA. The board comprises current and former government officials, a couple of academics, and Victor Fung, who played a key role in the early development of private equity and venture capital in Asia.

Eight managers have received mandates under HKGP. The first batch featured BPEA EQT, CDH Investments, and Hillhouse Capital Group, according to three sources familiar with the situation, one of whom describes them as "big enough names so you won't get blamed if something goes wrong." The second includes a fund-of-funds, a VC firm, and some growth equity GPs.

However, there appear to be problems moving from conception to execution. It took nearly two years for the first batch of managers to receive any money and members of the second, which were formally approved at the end of 2021, are still waiting, two of the sources said.

"Implementation has been a nightmare because the infrastructure and the rails weren't set properly," one of the sources added. "The working team at HKMA was managing the selection of GPs, but the rest of the process hasn't been followed up. Some applications are stuck with the Department of Justice. Why do they need to sign off? It's a relic of the old bureaucratic system."

Comparisons are inevitably drawn with Singapore, which systematically introduced waves of matching funds – where the government matched private sector commitments – for incubation through growth stages and has more recently sought to fill the late-stage and pre-IPO gap. Hong Kong is to some extent pursuing a similar end-to-end model, but replication shouldn't stop there.

"In terms of high-level policy, more work must be done on integrating the different functions of government. We are moving in the right direction, but it will take a few years to see the results," said Chibo Tang, a manging partner at Gobi who is responsible for AEF. "Hong Kong also needs to copy what Singapore has done on marketing: identify local winners and champion them."

The implied criticism is that Hong Kong is being held back because initiatives are led by innately conservative career civil servants rather than by individuals with investment experience who might take a more VC-oriented approach. This view is echoed by Joseph Fung, a managing partner at Saltagen Ventures, a Hong Kong-Canadian deep-tech investment firm that operates across Asia.

"There is a difference between the funding itself and the qualitative element of the guidance provided by the government," Fung said. His firm was among the first to adopt Hong Kong's updated limited partnership structure and has participated in various government-led promotional activities.

"It comes back to governance and the lack of proper risk-taking. The Singapore government is aligned in wanting to support ecosystem players that develop technology conduits. They bring in senior advisors with relevant experience. Hong Kong lacks that. We have seen in places like South Korea and Japan what happens when policymakers are taken out of their comfort zone."

Speed matters?

This notion of laborious process extends throughout the ecosystem. When AVCJ contacted HKSTP about an interview, its representatives asked for sample questions, consulted internally, and then decided there wasn't sufficient time to respond. Meanwhile, the universities, for all their progress, have yet to fully resolve the issue of taking equity in start-ups emanating from on-campus research.

CUHK receives equity when its fund invests in a project, but otherwise there is no clear path. Zee described a tension between a public institution's goal to enable the widest possible positive social impact and its desire for financial returns, noting that the status quo falls well short of US-based peers that have organised systems and much larger budgets.

CityU has processes in place from the angel phase of its programme. Start-ups agree to issue equity to the university once a third-party investor commits capital and sets a valuation – and the university gets in at a discount. However, Lo believes the traditional mindset of ploughing money into research without giving thought to commercial application and monetisation is still prevalent.

Kai Chen, who established Clustar.ai based on research conducted at HKUST into high-performance networking to scale up computing for artificial intelligence-enabled big data processing, has yet to finalise an equity split with the university though this will happen at some point. He observed that the procedure is time-consuming, and some colleagues have taken several years to complete it.

In contrast, Sequoia Capital China reached out to Chen within days of him giving a lecture at Tsinghua University during a trip to Beijing in 2018. They met up on a Friday and Sequoia proposed an angel investment the following Monday. Clustar is now preparing for a Series B extension.

Both Chen and Jie Yuan, founder of Atom Semiconductor and an associate professor at HKUST, speak positively of the university's attitude towards technology transfer and the supporting networks offered by the likes of HKSTP. Atom entered the HKSTP incubation programme in 2021, a year after the company's founding, but has yet to tap the organisation's venture fund.

"It's good that the government is supporting local start-ups, but the approvals processes for larger schemes are so long and we don't have the bandwidth to apply. We've spoken to the Science Park VC fund before and I didn't understand the decision-making process. With private sector funds, it is much more efficient," says Yuan, who has raised capital from AES and Qiming Venture Partners.

It could be argued that companies capable of raising capital independently are not the kind of start-ups government schemes are intended to serve. Yet Gobi's Tang and the Cyberport source point to a relative scarcity of independent VCs operating in Hong Kong and a noticeable thinning out between Series B and D before the capital supply swings back during the pre-IPO stages.

Even at the early stages, Saltagen's Fung questions the quality of capital on offer. He has seen start-ups with valuable core technology pushed downstream into hyper-competitive, capital-intensive product distribution by family offices that are not familiar with other business models.

People and plans

Diversifying funding channels is one of eight goals set out in Hong Kong's technology ecosystem blueprint. One of the others is deepening the technology talent pool. Availability of human capital is flagged up by most industry participants who describe Hong Kong's workforce as high-quality but lacking in quantity in almost every area outside of financial services.

OneDegree, for example, had no trouble finding insurance professionals locally, but Kwok travelled to the Bay Area in search of top-class engineers. The start-up's team ended up being highly international from the outset, suggesting that talent will come to Hong Kong for the right opportunities. However, it is argued that more could be done to attract such individuals.

"In the past, surprisingly, the government has provided fast-track visas to supposedly talented individuals, such as second-rate actresses and over-rated, uber-hyped musicians," said Fritz Demopoulos, founder of Chinese online travel agency Qunar and now founder of Hong Kong-based investment firm Queen's Road Capital, suggests that more could be done to attract such individuals.

"Why can't they also give the fast-track for arguably much more productive members of society, such as people with PhDs in artificial intelligence, experts in quantum computing, and medical professionals?"

Talent is essential if Hong Kong is to play to its strengths as a technology hub: leveraging its enduring appeal as an international business centre – quality of life and strong corporate infrastructure are among the factors highlighted – and harnessing its strategic positioning as cross-border jurisdiction with capital markets that are increasingly accessible to start-ups.

Investors are already adjusting their resources and remits. HKSTP is said to be setting up a branch office in Shenzhen while the second iteration of the AEF has added GBA to its name and secured LP commitments from a wider variety of Hong Kong corporates, institutions, and family offices interested in the GBA opportunity. Alibaba's non-profit arm remains the anchor LP.

"We now have the mandate to invest in the GBA, not just Hong Kong," said Gobi's Tang. "The government is working closely with authorities in Shenzhen and Guangzhou and the universities here are getting more active, opening remote campuses in the GBA. There could be interesting pockets of international talent and academics that come out of that."

The start-ups he is backing aren't limiting themselves to China. Increasingly, founders have a global perspective from day one. Wristcheck is a case in point, but so is Mapxus, a provider of indoor digital mapping services to the likes of shopping mall and station operators. The technology was proven in Hong Kong's high-density urban landscape and is now moving into Japan and Southeast Asia.

Proximity to multiple potential end-user markets is a key draw. "Some faculty members get positions in the US and Canada, but they come here because they feel they are closer to target markets in China and Asia, and so they might have a better chance of commercialising their technology," said Yuan of Atom Semiconductor.

The consensus view appears to be that Hong Kong has many of the right ingredients but lacks an integrated technology plan and administrators capable of executing it. Even then, the role of government is a topic of much debate: an excessively interventionist or prescriptive approach might cause a near-term spike in start-up activity that doesn't crystallise into a sustainable ecosystem.

Demopoulos of Queens Road Capital believes it is too early to pass judgment on Hong Kong's efforts and suggests revisiting the discussion in five years. "The best technology ecosystems are organically created from the bottom up, not directed from the top down. I think the government is cognisant of this dynamic," he added.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.