Asia co-investment: Gun-shy LPs?

Overallocation, risk aversion, and troubleshooting existing deals have prompted some LPs to pull back from co-investment in Asia. Others are willing to step in, but the market is selective

Potentia Capital can draw on AUD 220m (USD 148m) in co-investment to support its pursuit of Nitro Software, a listed Australian software developer. The private equity firm submitted its first bid last August, but discussions with LPs about bolstering the acquisition war chest began even earlier – partly because of a need to strengthen the bargaining position by accumulating Nitro stock.

HarbourVest Partners contributed AUD 185m to a warehouse facility while an additional AUD 36m came from a co-investment sidecar established by Aware Super, Potentia’s largest LP, and L Capital, a specialist co-investor. Potentia is committing capital to the deal from its first and second funds.

Picking up a 19.8% stake in Nitro before and after the initial offer was submitted proved prescient because it enabled Potentia to oppose a rival bid from a strategic investor favoured by the company’s board. A breakthrough came last week when an improved bid from Potentia bettered the strategic investor’s best and final offer, seemingly putting the private equity firm on course for victory.

“Few co-investors have the risk appetite to do blocking stakes and the ability to move quickly when you have two weeks in the data room to come up with a bid. They effectively co-underwrite it and we would syndicate to others once the deal is done,” said Michael McNamara, a partner at Potentia.

“The dynamics are very different for private deals where you have more control over the timeframe, but public markets can be irrationally exuberant one way or the other, which creates opportunities for larger deals. Having co-investors who can move quickly is a real strategic asset for us.”

The specialist B2B technology investor studied public markets in the first half of 2022 as valuations started to weaken. Two of four investments announced from the second half onwards have been blocking stakes in listed companies it wants to take private. HarbourVest is also supporting a proposed acquisition of Tyro Payments alongside two other Potentia LPs, MLC and Cbus.

This activity runs contrary to the prevailing state of wariness in Asian private equity. Macroeconomic uncertainty, higher financing costs, and an uncomfortably wide bid-ask spread remain among the chief impediments to deal flow – especially at the co-investment-friendly large end of the market. And even where co-investment is available, some LPs have become gun-shy.

In and out

The picture is by no means consistent. Experiences vary by manager and target geography, and by LP type. When pension funds or endowments pull back from co-investment because they are overallocated to private equity, can’t justify the risk, or are dealing with existing problem deals, sovereign wealth funds or fund-of-funds with dedicated co-investment resources may jump in.

“The deals getting done now are the ones where GPs have the highest conviction, where they feel they can deliver the returns they are underwriting,” said Amit Sachdeva, a managing director and head of Asia co-investments at AlpInvest Partners.

“This also means they are running harder and asking LPs to move faster. For some LPs, compressed timelines are a challenge, especially when it comes to co-investment, and that’s why they may be pulling back. For those equipped to execute on opportunities, we believe there’s plenty available.”

The likes of AlpInvest and Adams Street Partners claim to have robust investment pipelines globally and in Asia, which typically accounts for about 10% of global co-investment programmes. Deal flow in 2022 was on par or just ahead of the previous year – remarkable given that 2021 was a record year for private equity investment and activity visibly dropped off in the subsequent 12 months.

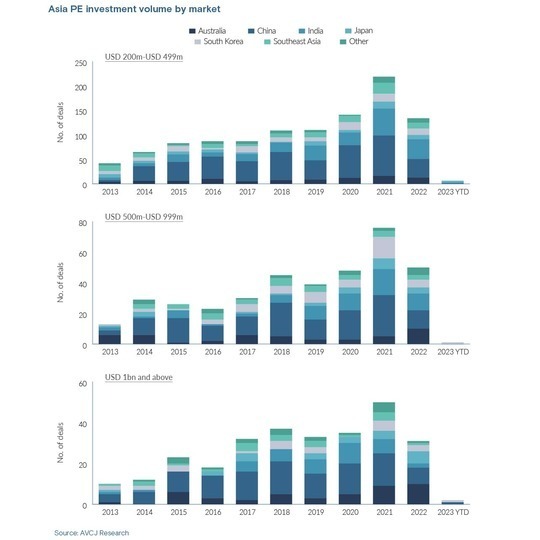

According to AVCJ Research, Asia saw 50 private equity deals of USD 1bn-plus in 2021. This fell to approximately 30 in 2022, which is broadly in line with the 2019 and 2020 totals. The same story played out in other mid to large-cap segments. Investments in the USD 500m-USD 999m and USD 200m-USD 499m ranges fell from 76 to 50 and from 219 to 134.

Industry participants noted a sharp slowdown in the second half of the year – 21 of the 30 deals of USD 1bn and above were announced before the end of July – and the pace has barely picked up in 2023. There have been fewer than a dozen transactions of more than USD 200m and only two have crossed the USD 1bn threshold.

Hahn & Company agreed a KRW 1.6trn (USD 1.3bn) acquisition of SKC’s industrial materials unit last June and the deal closed in December. Ten co-investors took part. CEO Scott Hahn believes asset quality – it is Korea’s largest producer of polyester film – and the proprietary nature of the deal were key factors. It is also typical of what his firm does: Hahn & Co. has carved out five assets from SK Group.

“Appetite for co-investment depends on the quality of the business and the valuation, much more so now than a year or two ago,” said Hahn. “There was some strategy drift during the bull markets of 2021, so LPs are now always asking whether a deal is consistent with a GP’s strategy.”

Assessing the global market, Dave Brett, a partner and head of co-investments at Adams Street, describes it as a mixed bag: some deals are oversubscribed, others are not. One established trend that has accelerated – driven by uncertainties around debt and LP participation – is managers looking to bring in co-underwriters that get involved early on and share the costs of the transaction.

British Columbia Investment Management (BCI) completed six co-investments in the first half of 2022, smaller commitments of USD 50m-USD 100m where it took syndicated pieces of deals post-close. These were followed by three larger co-underwritten transactions in the second half – all in North America – which took overall deployment for the year to USD 3bn.

“We did those deals because no one else was really showing up. When there is too much noise or volatility in markets, co-underwriters are more likely to retreat to syndicated deals and I know of investors who participate in syndicates cutting back from USD 25m-USD 50m to USD 10m-USD 15m or stopping altogether,” said Jim Pittman, global head of private equity at BCI.

“It comes down to resource, appetite, and risk measurement. If you don’t have the resource, most likely you can’t do the risk assessment, so it’s a case of whether you like the GP and the sector.”

Big vs mid

Situations become more challenging when there is a need for relatively widespread syndication and co-underwriters alone cannot fill the gap. Jean Eric Salata, head of BPEA EQT, noted that availability of equity can be just as problematic as availability of debt when taking on a USD 10bn buyout.

“It’s not just the terms of the debt, but also the equity syndication because a lot of investors have pulled back from direct co-investments,” Salata said, adding that upsizing BPEA EQT’s latest Asia fund to USD 11.2bn, from USD 6.5bn in the previous vintage, represents a competitive advantage because there is more capacity to underwrite large equity cheques.

For most middle-market managers looking for co-investment cheques that rarely surpass USD 100m, there is no shortage of demand – although many LPs are wary of China and to a lesser extent India and Southeast Asia. BCI’s Pittman rejects all three markets at present, preferring to focus on Korea and Japan. Fund-of-funds with co-investment pools will consider China, but they are highly selective.

India’s ChrysCapital Partners has completed two buyouts in the past 12 months that drew heavily on co-investment: it acquired IDFC’s asset management business for INR 45bn (USD 593m) and software engineering specialist Xoriant for USD 350m. Kunal Shroff, a managing partner at the firm, said the biggest challenge is satisfying every LP’s appetite for deal flow while deploying a larger fund.

Anthony Kerwick, a managing director at Australia’s Adamantem Capital, saw more caution in the market from the second half of last year, especially from LPs concerned about the denominator effect. But Adamantem’s investors are still keen. “If I plotted the proportion of LPs interested in co-investment over the course of my career it would be a line that went up to the right,” said Kerwick.

Korea-based IMM Private Equity is relatively unusual among the country-focused managers that make up the bulk of Asia’s middle market in achieving a near 1:1 ratio for fund deployments versus co-investments over the past three years. Recent activity includes investing KRW 200bn to a KRW 450bn round for managed cloud service provider Megazone Cloud. Co-investors put in KRW 50bn.

Joseph Lee, CIO at IMM, notes that LP demand has never wavered. One possible explanation is that syndication is rare. The private equity firm works with a core group of about 10 LPs that essentially participate as co-underwriters, ensuring a degree of stability from an early stage in each process.

“Having done co-investments in five of our last eight deals, we have several very active co-investment partners, international and Korean, who have been ‘running the engine’ with us in reviewing deals,” said Lee. “We discuss our pipeline with them almost every quarter. This communication and cooperation is a competitive advantage in the current environment.”

Nevertheless, investors claim they are being approached with increasing frequency by private equity firms of all sizes looking for co-investment in Asia, even though they have never worked with them before. The implication is that some might be struggling to mobilise existing LPs into co-investments.

Potentum Partners, an institutional advisor established by a team from Australia’s Future Fund that works with LPs on tailored PE programmes, including co-investment, has openly expressed interest in a certain type of asset. They were recently approached by a Southeast Asia-based team under a global manager that had a relevant opportunity. Potentum knew of them but had never met them.

AlpInvest is also receiving more approaches from non-relationship GPs, although 90% of the firm’s co-investments are with pre-vetted managers. “They might be in the market with a new fund and using co-investment as a carrot to get fund commitments or perhaps because existing LPs are not stepping up. Others might be using it as a long-term relationship-building exercise,” said Sachdeva.

Debt dynamics

Difficulty rallying LP support for a co-investment is not considered a deal-killer. The bigger obstacles typically involve valuation multiples (sellers are still anchoring to 2021 valuations) and financing (the secured overnight financing rate, or SOFR, was 0% in early 2022, which meant senior debt for Asia buyouts was available at less than 5%; now SOFR is 4.5%-5% and debt costs 8.5%-9%).

In markets like Australia that have shifted towards covenant-light or covenant-loose in recent years, the terms attached to those covenants have tightened. However, Peter Graf, a managing director at Ares SSG, a direct lender in Australia and New Zealand, the most profound behavioural change has been a refocusing from net leverage to interest coverage ratios.

“With base rates going up and margins getting wider, only a certain amount of cash flow generated by a business can be used to service the debt. This means the debt comes down based on the math. As you think about underwriting the equity thesis, it becomes a question of finding the right balance of adding additional equity alongside a more expensive interest cost line,” he said.

Rising base rates feed into a higher cost of mezzanine capital as well. There is evidence of some structural creativity in Australia – hybrid equity-debt instruments that offer additional upside on exit – but this doesn’t necessarily extend across the region. Manas Chandrashekar, a partner at Kirkland & Ellis, notes that sponsors often look at the pricing and resolve to wait until the cost of capital falls.

For most of the deals that have secured financing in the Australian market, financial sponsors increased the equity contribution on day one, according to Krish Vaswani, a member of Partners Group’s private debt team in the country. This reassured lenders, but it meant lower leverage levels.

“If it’s a platform buy-and-build play and the equity return is derived from the M&A story on top of organic growth, you could use the M&A to solve for your required equity returns. Alternatively, you could refinance when market conditions improve,” he said.

A further adjustment in valuation multiples would help address the problem by reducing the debt and equity requirements. Otherwise, some GPs envisage relying on co-investment to fill the gap. IMM’s Lee is among those endorsing this approach in response to rising financing costs.

Even LPs that remain active co-investors have become more careful in their sector exposure. Momentum plays like growth-stage technology are out of favour as the focus intensifies on more resilient industries where there is less concern around input costs, pricing power, and customer retention. For Adams Street, this began in 2018-2019 as entry valuations began to surge upwards.

“We knew interest rates eventually had to rise, we knew there would eventually be a recession, and these two events would probably be related. The question became: ‘Are we comfortable enough with our base case to hold this asset during a recession?’” said Brett.

“We’ve done much less retail and consumer for those reasons. We are doing more predictable businesses – technology, healthcare, recurring business services.”

Being vigilant

Heightened risk awareness extends into manager assessment as well. Co-investment has taken off in Asia because more LPs want it as a means of doubling down on standout deals while reducing their overall fee burden. GPs recognise this and so investor relations teams are conditioned to present opportunities with a view to cementing relationships and securing future commitments to funds.

Co-investment is also responsible for liberating managers from the constraints of fund size. Many are developing deeper domain expertise that leads them to opportunities where they have the relevant expertise but the equity requirement is beyond the capacity of their funds. Co-investment allows them to flex up and pursue bigger paydays on bigger deals.

ChrysCapital, for example, didn’t offer any meaningful co-investment until 2018. It featured in one deal apiece from the firm’s seventh and eighth funds. Within six months of activating Fund IX, USD 850m in equity had been pumped into the IDFC asset management business and Xoriant. Only USD 300m of that came from the fund, which has a corpus of USD 1.4bn.

“LPs want more co-investment, especially in sectors where we have proven ourselves. We appreciate co-investors as they allow us to punch above our weight in our sectors of specialisation,” said Shroff.

The concern for LPs is that managers are simply biting off more than they can chew, which leads to scrutiny of whether the GP is a good fit for the asset, based on track record and internal capabilities. A rapid scale-up in deal size from USD 100m to USD 1bn would likely be viewed negatively.

“That is difficult for us to digest,” said Sachdeva of AlpInvest. “However, if they have shown progression over time and have ramped up in deal size, we believe there is more proof of their ability to manage those opportunities.”

These considerations become more pressing during downturns when lapses in discipline from previous upcycles are sometimes exposed. Co-investment teams might be unable to pursue new deals because they have become acutely risk-averse or they are fighting fires in the existing portfolio.

Steve Byrom, a founding partner at Potentum, observes that misalignment with GPs on co-investments is always a danger in the current environment. He also notes that buyouts and growth capital are very pro-cyclical investment categories and co-investment is most widely available at the top of the market.

“A lot of people got their fingers burned in 2006-2007,” Byrom said. “When we started reviewing co-investments globally [at Future Fund] in 2010, we looked at the track records and some of them were dire. GPs had just offloaded risk to LPs and LPs had lapped it up. Part of the reason there’s a pullback today could be that some of these programmes are underwater.”

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.