Sequoia Capital

Indonesia's Gojek, Tokopedia merge as GoTo

Gojek and Tokopedia, two of Indonesia’s best-funded technology start-ups, have completed a merger, forming what they claim is the largest mobile on-demand services and payments platform in Southeast Asia.

China snack maker Weilong raises $549m, pursues HK IPO

China’s leading spicy snack food company Weilong has raised a $549 million pre-IPO round at a valuation of $9.4 billion and filed for a Hong Kong IPO.

China HR SaaS player Beisen raises $260m

Beisen, China’s largest integrated human resources software-as-a-service (SaaS) platform, has raised $260 million in Series F funding. It is said to be the largest-ever round in this segment of enterprise services.

Philippines digital bank Tonik raises $17m

Tonik, which claims to be the first digital bank in the Philippines, has raised $17 million in pre-Series B funding led by Singapore’s iGlobe Partners.

Hong Kong crypto start-up gets $40m Series A

Sequoia Capital China, Tiger Global Management, and Boyu Capital have joined a $40 million Series A round for Hong Kong cryptocurrency services provider Babel Finance.

China medical tech supplier AMS raises $100m

China and US-based Access Medical Systems (AMS) has raised a $100 million round co-led by Sequoia Capital China and GL Ventures.

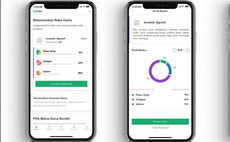

Deal focus: Bibit lays claim to be Indonesia's Robinhood

A couple of quickfire funding rounds for Bibit reflects global investor appetite for robo-advisory businesses and the Indonesian company’s rare double-headed product offering

5Y, Sequoia back China app-building platform

Huoban.com, a Chinese zero-code application building platform has raised $17 million in Series B funding led by 5Y Capital and Sequoia Capital China. Challenjers Capital also took part in the round.

DCP, Sequoia lead Series B for China's Valgen Medtech

DCP Capital has continued its run of investments in China’s medical devices industry by participating in a Series B funding round for Hangzhou Valgen Medtech.

Sequoia India leads $65m round for Indonesia's Bibit

Sequoia Capital India has led a $65 million round for Indonesia robo-advisory app Bibit four months after leading a separate $30 million investment.

India food delivery player Zomato files for domestic IPO

Zomato, an India-based food services platform that raised more than $1.25 billion in private funding from the likes of Ant Group, Tiger Global Management, and Sequoia Capital India, is looking to raise up to INR82.5 billion ($1.11 billion) through a domestic...

Sequoia joins $25m Series D for Singapore's StashAway

Sequoia Capital India has joined a S$33.3 million ($25 million) Series D round for Singapore-based wealth management platform StashAway.

Loyal Valley leads Series B extension for China's Edigene

Loyal Valley Capital has led a RMB400 million ($62 million) Series B extension for EdiGene, a China-based biotech company that uses genome editing technologies to accelerate drug discovery.

Chinese funds back local AI-RPA player Laiye

Laiye Technology, a Chinese artificial intelligence (AI) start-up that specializes in robotic process automation (RPA) has raised $50 million in an extended Series C round led by Ping An Global Voyager Fund and Shanghai Artificial Intelligence Industry...

Indonesia's Shipper gets $63m Series B

Indonesian logistics start-up Shipper has raised a $63 million Series B round led by DST Global and Sequoia Capital India.

China home fitness brand Fiture raises $300m

Fiture, a Chinese developer of artificial intelligence-enabled home fitness devices, has raised $300 million in Series B funding led by All-Stars Investment, Legend Capital, DST Global, and Coatue Management.

India's PE-backed Pine Labs acquires Malaysia's Fave

Pine Labs, an India payments start-up backed by MasterCard, PayPal, and Sequoia Capital India, has acquired Fave, a Malaysian counterpart also backed by Sequoia India, for $45 million.

PE-backed Brii Bioscience pursues Hong Kong listing

Brii Biosciences, a three-year-old Chinese biotech start-up that has raised approximately $415 million in private funding from the likes of Sequoia Capital China, Boyu Capital, and Yunfeng Capital, has filed for a Hong Kong IPO.

FountainVest, ClearVue back China self-driving truck player

FountainVest Partners and ClearVue Partners have led a $220 million funding round for Plus, a China-based autonomous driving technology developer that specializes in trucks.

China consumer brands Genki Forest, Tasogare secure funding

Two emerging Chinese beverage brands - Genki Forest and Tasogare, which focus on sparkling water and coffee, respectively - have completed new funding rounds.

Matrix leads Series E tranche for China corporate training platform

Matrix Partners China has led a second tranche of Series E funding - worth $90 million - for Yunxuetang, a Chinese online corporate training services provider.

Sequoia India raises $195m for latest seed fund

Sequoia Capital India has closed a second seed fund under its Surge accelerator program at $195 million. Like its predecessor, it will target start-ups in India and Southeast Asia.

KKR, Sequoia lead $234m round for Indian NBFC

KKR and Sequoia Capital India have led a $234 million investment in Indian non-banking financial company (NBFC) Five Star Business Finance at a valuation of $1.4 billion.