General Atlantic

Deal focus: Affirma generates 8x return with India's TBO

Affirma Capital makes good on a partial exit from Indian travel agent software provider TBO.com as General Atlantic comes in to help rekindle plans for a domestic IPO

General Atlantic backs India travel platform, Affirma exits

General Atlantic has acquired a minority stake in TBO.com, an India-based business-to-agent travel portal that serves a global customer base, for an undisclosed sum. The deal facilitates a partial exit for Affirma Capital.

India healthcare: New momentum, new directions

Private equity has become comfortable with niche segments and regional sub-markets in Indian healthcare services. Technology-based business models are next

General Atlantic raises exposure to India's PhonePe

General Atlantic has invested USD 100m in India’s PhonePe only four months after providing the payments platform with a USD 350m round at a pre-money valuation of USD 12bn.

South by Southeast: Asia's next growth engine?

Grouping together markets based on growth and scale is a problematic with South Asia and Southeast Asia as it was with the BRIC economies. But to some extent, investors are buying into the story

India-ASEAN GPs rethink Asia growth – AVCJ Forum

Developing Asia is set for a new chapter of greater opportunities and challenges in the wake of the pandemic-related investment boom, the AVCJ Southeast Asia Forum heard.

India's PhonePe raises $350m at $12b valuation

General Atlantic has invested USD 350m – at a pre-money valuation of USD 12bn – in PhonePe, a digital payments platform that spun out from Indian e-commerce marketplace Flipkart.

General Atlantic invests $130m in Indonesia's Cimory

General Atlantic has paid USD 130m for a 5.64% stake in Indonesian dairy and consumer goods producer Cimory, which completed a domestic IPO towards the end of 2021.

PayU terminates $4.7b acquisition of India's BillDesk

The USD 4.7bn acquisition of Indian payments app BillDesk by industry peer PayU – which was poised to facilitate exits for the likes of TA Associates, General Atlantic, and Temasek Holdings – has collapsed.

India's ASG Eye Hospitals gets $188m from Kedaara, GA

Indian optometry chain ASG Eye Hospital has raised a INR 15bn (USD 188m) round led by Kedaara Capital and General Atlantic, setting up an exit for Investcorp.

General Atlantic leads $300m Series D for Biofourmis

Biofourmis, a Singapore founded and now US-based operator of a health analytics platform, has achieved unicorn status with the closing of a USD 300m Series D round led by General Atlantic.

Bain buys minority stake in India's IIFL Wealth

Bain Capital has paid INR 33.8bn (USD 484m) for a 24.98% stake in India’s IIFL Wealth Management, taking out positions held by General Atlantic and Fairfax India Holdings.

Singapore's Fireblocks closes Series E, hits $8b valuation

Fireblocks, a US and Singapore-based blockchain services provider that aims to “help every business become a crypto business,” has raised a USD 550m Series E round at a valuation of USD 8bn.

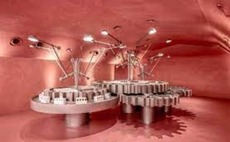

China beauty retailer Harmay raises $200m

Harmay, a China-based omnichannel beauty products retailer, has raised USD 200m across Series C and D rounds.

Biotech player CANbridge drops on debut after $87m HK IPO

CANbridge Pharmaceuticals, a Beijing-based drug developer that focuses on treatments for cancer and rare diseases, lost 27% in value on its Hong Kong trading debut following a HK$685.1 million ($87.8 million) IPO.

India's NoBroker joins unicorn club

General Atlantic, Tiger Global Management, and Moore Strategic Ventures have participated in a $210 million Series E round for Indian real estate marketplace NoBroker at a valuation of $1 billion.

India's Acko achieves unicorn status with $255m round

General Atlantic and Multiples Alternate Asset Management have led a $255 million round for Acko, which claims to be India’s only digital-native insurer, at a valuation of $1.1 billion.

General Atlantic leads Series C for Philippines-based Kumu

General Atlantic has led a Series C round of undisclosed size for Philippines-based social media start-up Kumu, bringing total funding to date to $100 million.

China's Ximalaya abandons US IPO

Ximalaya, a Chinese online audio platform backed by the likes of Tencent Holdings, General Atlantic, and Goldman Sachs, has canceled its planned IPO.

Naspers-owned PayU to buy India's BillDesk for $4.7b

PayU, a payments provider owned by South African conglomerate Naspers, has agreed to acquire 100% of Indian payments app BillDesk for $4.7 billion, setting up several private equity exits.

Deal focus: GA backs VNLife's two-pronged fintech play

VNLife is not alone in trying to build value-added services onto a payment platform in Vietnam, but it is unusual in being able to rely on a profitable B2B digital banking business while figuring out monetization

GA, Dragoneer lead $250m Series B for Vietnam's VNLife

General Atlantic and Dragoneer Investment Group have led a $250 million Series B round for Vietnamese financial technology provider VNLife.