Weekly digest - November 01 2023

|

By the Numbers

AVCJ RESEARCH

HOPE SPRINGS

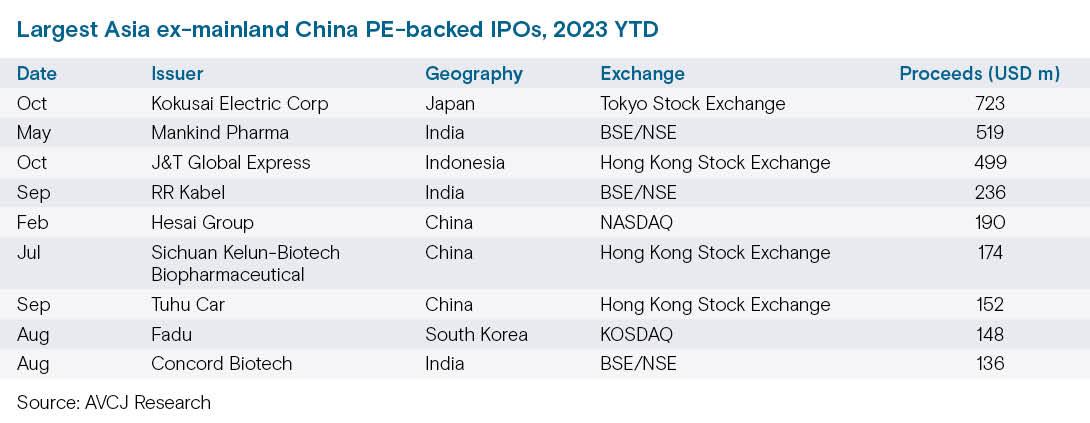

Mainland China – notably the Star Market and Chinext – remains the dominant force in Asia private equity-backed IPOs, accounting for nearly two-thirds of the offerings and close to 90% of the aggregate proceeds for 2023 to date. Of the year's 50 largest IPOs involving companies with financial sponsors in the cap table, 45 took place on mainland exchanges, according to AVCJ Research.

Yet the other five are worth noting. Hesai Group was the largest of the Chinese companies that listed on NASDAQ earlier in the year, when there were hopes of revival in the China-to-US channel. It remains to be seen if those hopes will be realised. Mankind Pharma, a drugmaker that counts ChrysCapital Partners and Capital International among its investors, raised USD 519m in May. The largest PE-backed IPO in about a year, it is credited with helping revitalise the domestic market. A trickle of other offerings has followed, including TPG's RR Kabel, another of the other five. The remaining two have both gone public in the past week. J&T Global Express, an express delivery business launched in Indonesia by a Chinese entrepreneur, raised USD 499m. This facilitated liquidity events for the likes of Boyu Capital, Hillhouse Investment, Hidden Hill Capital, Sequoia Capital, and Temasek Holdings. But pride of place goes to Kokusai Electric, a KKR-owned semiconductor industry supplier. Its USD 720m IPO is Japan's largest in five years. It represents a sizeable windfall for KKR, which bought Hitachi Kokusai Electric for USD 2.9bn in 2017 through a tender offer and split the business in two, taking full control of the thin films division – now called Kokusai Electric – and sharing the rest with its co-investors. KKR sold its interest in the other assets to one of those co-investors, made a partial exit from Kokusai Electric by selling a minority stake to Qatar Holding in June, and then took all the proceeds from the IPO, which valued the company at USD 3.6bn.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.