Weekly digest - May 03 2023

|

By the Numbers

AVCJ RESEARCH

THE SOUTH-SOUTHEAST ANGLE

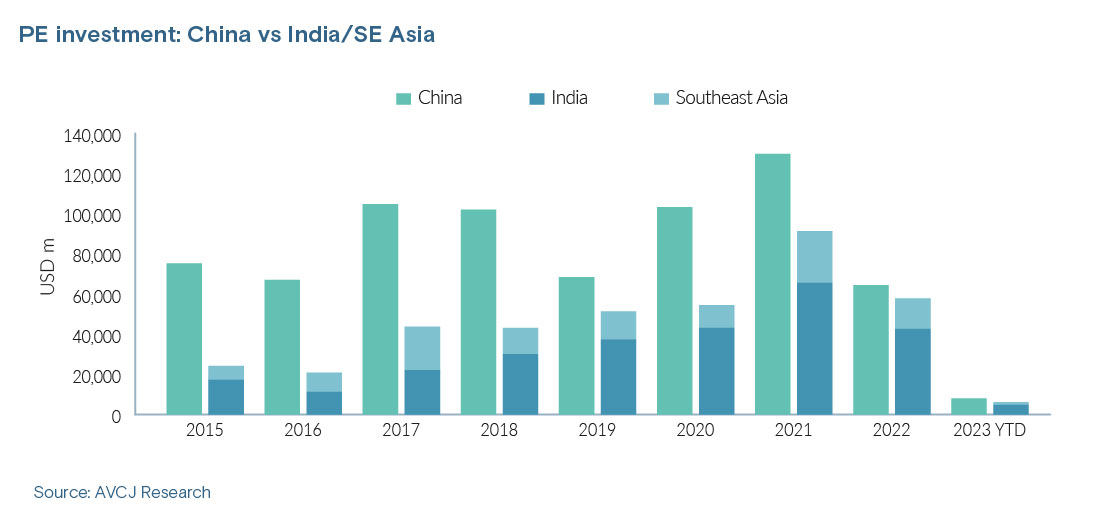

The notion of Southeast Asia and India combined is gaining traction as a select group of GPs and an increasing number of portfolio companies target both markets. In 2015, USD 24.2bn was invested across Southeast Asia and India, according to AVCJ Research. Last year, it was USD 57.8bn, just USD 6.6bn less than the China total.

Speakers at the AVCJ Southeast Asia Forum examined how the South-Southeast Asia opportunity has evolved in terms of the general maturation of the ecosystem. This – in addition to greater competition and in spite of the funding winter for companies – has put some onus on GPs to up their game. "Companies now are not as dependent on the financiers in the way they were previously. In this new interest rate regime, it's forced a lot of GPs to spend time around analytics, customer introductions, and governance help," said Rajeev Natarajan, head of Asia Pacific, at Iconiq Capital. Amit Varma, co-founder of healthcare-focused Quadria Capital, noted that the India is characterised by fierce competition for assets whereas in Southeast Asia it is a skills shortage. The point on skills was echoed by Sandeep Naik, head of India and Southeast Asia at General Atlantic, who added that one characteristic the markets have in common is an unprecedented build up of capital in recent years. "A lot of tourist capital entered and that has messed up the dynamics of the industry with unlimited capital available, no focus on cost, and zero discipline on profitability," said Naik. "That still needs to get washed away. It's hard work working with entrepreneurs to stay the course and truly build sustainable profitable companies."

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.