India healthcare: New momentum, new directions

Private equity has become comfortable with niche segments and regional sub-markets in Indian healthcare services. Technology-based business models are next

Healthcare-focused Quadria Capital has been investing in India for about 10 years and has several hospital assets. But the ambition to expand a chain of hospitals in the country to massive scale didn't crystallize until last July.

That's when the private equity firm acquired ophthalmology specialist Maxivision Eye Hospital with plans to grow a chain of 42 locations to 150 within five years, mostly in lower-tier cities. Quadria invested USD 75m for a significant minority stake and has agreements in place to take control for an additional USD 80m upon certain growth milestones.

The deal touches on at least two key trends that have increasingly invigorated India's healthcare services space post-pandemic.

First single-speciality hospitals as well as niche B2B and patient-facing services have come to the fore. In many instances, regulatory risks have eased, especially in fertility, and receptive customer bases have been proven out.

Second, the economies of scale that go with a widespread geographic footprint have come into focus amidst seemingly secular industry trendlines. These include increases in regional spending power and mass-market access to insurance buoyed by policy support for developing non-metro areas.

In the case of Maxivision, the plan is to consolidate independent operators – which represent 90% of India's entire healthcare sector – in southern and eastern states. Going pan-India was ruled out as too diffuse. The hospital will engage an in-house M&A team. Economies of scale in medicine and equipment sourcing are hoped to lift EBITDA by 3%-4%.

"People have started realising, especially post-COVID, that scale is going to be very important, not just for getting more patients but for managing operational and supply chain efficiencies. That's why you're seeing a real estate grab," said Amit Varma, a co-founder and managing partner at Quadria.

"It makes [hospital operators] more attractive to the government's universal health insurance, which is growing 20% a year post-COVID. You see it at the bureaucratic level and, more importantly, at the state government level because they're answerable to their electorates."

Favourable policy

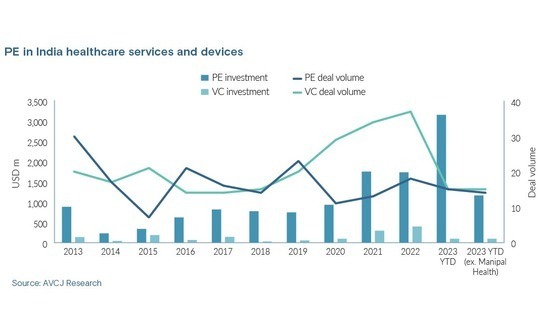

Many of the driving themes in this landscape have been converging for at least a decade but appear to have amplified with the pandemic. Private equity investment in Indian healthcare services – including medical devices but excluding pharma – cracked USD 1bn for the first time in 2020 and hasn't looked back yet.

Investment crossed USD 1.7bn in both 2021 and 2022 and has already passed USD 3.1bn in the first seven months of 2023. That includes the USD 1.9bn Temasek Holdings pumped into Manipal Health Enterprises last April in the sector's largest-ever transaction, but even without Manipal, 2023 is on track to be another record year.

The notion that investors are increasingly confident in pursuing healthcare services at scale, often in speciality niches and regional areas, is universally seen as an outcome of public policy and general macroeconomic uplift. Nailing down the statistical correlations is another matter.

However, the number of monthly beneficiaries peaked at about 22,200 in July 2019 and is now treading water around 3,000. Overall, life insurance has cracked 5% only once in India's history; it's currently languishing around 3%.

There is a promise of volume in PM Jay, albeit at a lower price point, but it's an open question as to when and how entrepreneurs and investors should start building towards that upside. Concerns about policy changes with a change of government are real but usually dismissed.

Rising GDP per capita is sometimes flagged as a key overlay in discretionary corners of healthcare services such as fertility clinics, preventative medicine, and lifestyle apps. But it could be a protracted process to evolve such a pricey, consumer-style phenomenon from the metros to the mass market.

"Everybody looks at India as a TAM [total addressable market] of 1.3bn people, but you cannot apply that filter to people being willing to pay for something like nutrition management. That's not our country," Rohit M.A., a managing partner at PeerCapital, said, noting that PM Jay doesn't cover preventive healthcare.

"I think a lot of people miss what is the SAM [serviceable addressable market] and the SOM [serviceable obtainable market] in the geographies that they're catering to."

Special cases

M.A., who is currently pursuing healthcare services at the nexus of developing technologies, is best known as the founder of Cloudnine Hospitals, one of India's earliest mother-and-child speciality providers. The hospital's story is illustrative of how the single-speciality space has exploded through perceived de-risking.

Cloudnine, founded in 2006, was never envisioned as a chain and took five years to establish its second location. M.A. notes it was almost impossible to have meaningful conversations with investors about expansion. Now the business has 30 locations across 14 cities.

Mother-and-child is a logical category for an early single-speciality success because it benefits from some of the diversification of the multi-speciality space. In terms of hospitals, this means operations are not limited to only a few procedures. The gamut of maternity and paediatric needs is serviced under one roof.

Other specialities seeing traction include oncology and dentistry. Varma expects big things in gastroenterology, where Quadria already has an investment, as well as nephrology and pulmonology. Standalone lung hospitals are unknown globally, but in light of its pollution, smoking trends, and genetic vulnerabilities, India is considered ripe to host the first one.

In the past 18 months, eyecare has proven the standout niche for private equity. In the lead-up to Maxviision, Kedaara Capital and General Atlantic invested about USD 188m in ASG Eye Hospital, setting up an exit for Investcorp. This followed TPG Growth and Temasek committing around USD 136m to Dr. Agarawl's Eye Hospital.

Many of the key advantages in eyecare dovetail with the impetus to scale. The clinics needn't be large and can take advantage of High Street addresses, facilities for overnight accommodation are not required, and equipment costs are minimal. Moreover, patient outcomes – including complication rates – are more predictable, which facilitates supply chain scaling.

"A lot of the investments in the 2016-2020 timeframe did well and created strong regional platforms. Based on the performance of that vintage, a lot more money is going back into hospital assets. It's also a reasonably defensive asset class across cycles," said Puncham Mukim, a managing director at Everstone Capital.

"The margin expansion we've seen in the industry and the net return on capital deployed has massively improved over the last four to five years. Add to that the fact that this is a capital-intensive play, a real estate-heavy play, and an infrastructure play. That will always drive demand for private equity."

Sahyadri and the scale-up

Everstone's standout investment in this space is Sahyadri Hospitals, a multi-speciality chain that few from 650 beds when acquired for about USD 126m in 2019 to 1,200 beds upon being sold last year to Ontario Teachers' Pension Plan (OTPP) in its first India buyout. OTPP plans to add more than 500 more beds in the next five years, expanding across western India.

The differentiator for Sahyadri was geography. Real estate in the Mumbai-Pune corridor has historically been too expensive for major hospital chains to establish a presence, leaving the area with one of the lowest bed densities nationally yet the highest retail insurance penetration.

Everstone hired a new CEO and filled several new senior management positions, in addition to bringing on new doctors. The number of clinicians doubled to about 2,000. New competencies were added in areas such as diagnostics and radiation oncology. By itself, the latter added about USD 6m to EBITDA.

Infrastructure buildouts, occasionally delayed by pandemic lockdowns, included a switch from thermal to discounted solar power via the construction of a remote panel farm connected to the regional grid. This was facilitated by Everstone's sister fund Eversource and saved about USD 1m in energy costs.

Meanwhile, the medicine buying programme was overhauled, saving around USD 3m. There were refurbishments across several locations, which went some way in attracting star doctors, notably in liver transplants. This allowed Sahyadri to come to parity with more professionalised hospitals in terms of pricing.

All in, EBITDA improved from USD 3m to USD 20m. Even with pandemic-related tailwinds stripped out of the equation, growth was 2.5x in the space of three years. Sahyadri became a household name regionally.

"The performance of the asset created a lot of buzz, and national chains and financial sponsors started approaching us to invest in or buy the asset. It was not our time to sell, but the amount of interest was humongous," Mukim added. "So, we thought it was the right thing to do to hand it over to the next logical buyer, who could expand it into new territories with a bolt-on pipeline we had created."

360 One, formerly IIFL Asset Management, appears to be attempting to replicate much of this playbook with Kauvery Hospitals, a multi-speciality chain in the southern states of Karnataka and Tamil Nadu. It acquired a minority stake for USD 70m in March.

The primary angle with Kauvery is mass-market affordability and lower-tier cities. Services are 15%-20% less expensive than Apollo Hospitals, a leading chain. The company's hub is Chennai, but it has expanded into cities as small as Hosur, which has a population of 345,000.

360 One got comfort from Kauvery's history of PE ownership. It is joining a cap table that already features LGT Lightstone Aspada – which invested USD 20m in 2019 – and the family office of G.S.K. Velu, chairman of Trivitron Healthcare. Previous backers include India Venture Advisors, an affiliate of Piramal Group.

The plan is to double capacity to 3,000 beds by 2025 when the company will file for an IPO. The expansion will encompass a mix of new buildings and extensions to existing buildings. Nidhi Ghuman, a senior vice president at 360 One, noted that most of the locations, land parcels, and buildings for this effort had been secured pre-investment to avoid risks of cost overruns and delays.

"We also got a lot of comfort from the fact that the founders are doctors," Ghuman told AVCJ following the investment. "If you look at the hospital chains in the country, almost all the successful ones have been set up by doctors-turned-entrepreneurs. They have a far superior ability to navigate the human and clinical dimension of running a hospital business."

Into the hinterlands

Kauvery is part of a concerted effort by 360 One to ramp up its private equity activity in healthcare services. Its first two investments were in eyecare chain Infigo Life Sciences and dialysis clinic network NephroPlus in 2019 and 2021, respectively. Last year, it also anchored an approximately USD 157m IPO for Rainbow Children's Hospital.

It speaks volumes about the evolution of healthcare services in India that a mainstream private equity investor of this profile is plunging in so deeply.

In 2013, Rainbow was the kind of high-risk target most suitable for development finance institutions. That's when British International Investment (BII) invested an initial USD 17.3m; it subsequently pumped in an additional USD 15m as the hospital expanded from 300 to 1,000 beds. The company's only other investor as a private entity was the aggressive, now-defunct Abraaj Group.

Fast-forward post-IPO to 2022 and a mix of global mutual funds and sovereigns together paid USD 132.5m to buy out BII's 14.4% stake. BII still has USD 224m worth of investment in Indian healthcare, but it doesn't do hospitals of this ilk anymore.

"We're moving into rural India, and tier-two and tier-three cities, trying to support business models that mainly use technology because that's how you get to places to provide services that you couldn't provide at a reasonable price before," said Leandro Cuccioli, head of social infrastructure at BII.

"We're talking about 350m people who are still out there not getting good products and services for health. So, you'll see us do more rural distribution of supplies and primary care, the kinds of things mainstream private equity still doesn't do. We unlock it, and they come in as it grows."

It's an interesting indication that despite the calls for scale in underserved regions, the future of private equity in Indian healthcare services may have a relatively reduced component of real estate and infrastructure.

For its part, Quadria is betting heavily on at-home healthcare. It invested USD 40m in India's Health Care At Home (HCAH) in 2017, predicting the segment would expand from wound care, diabetes and medicine delivery to intensive care such as at-home chemotherapy. Technology will loom large.

"The era of getting patients to travel 500 miles to get basic healthcare is over. COVID taught us that healthcare is local, point-of-care testing is important, and you use whatever infrastructure you have to make sure it takes place," said Quadria's Varma. "The biggest challenge is in the democratisation of healthcare. More and more patients are demanding higher quality care at the lowest possible price."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.