Technology

US, India cybersecurity player gets $50m Series B

US and India-based cyber risk management software-as-a-service platform Safe Security has closed a USD 50m Series B round led by Sorenson Capital.

J-Star invests in Japan IT provider

Japanese private equity firm J-Star has invested an undisclosed sum in local IT staffing services provider Miraie in an apparent consolidation play.

Consumer specialist Tiantu closes $218m renminbi fund

Tiantu Capital, a China-based consumer-focused venture capital firm, has raised CNY1.5bn (USD 218m) for its latest renminbi-denominated fund.

US climate VC leads round for Australia lithium player

Lowercarbon Capital, a US-based VC firm specialising in climate, has led a AUD 23m (USD 15.5m) Series A round for Australian lithium production services company Novalith Technologies.

Jungle re-hires fundraiser Menka Sajnani as a partner

Menka Sajnani has re-joined Jungle Ventures as a partner responsible for investor relations, three years after departing the Southeast Asia and India-focused GP to head up Asia IR at B Capital Group.

1Q analysis: Barely disguised weakness

Government guidance funds in China and Toshiba Corporation in Japan papered over obvious cracks in Asia private equity fundraising and investment. Nothing could hide the pain around exits

Deal focus: The SoftBank effect, one step removed

The new owners of SoftBank Ventures Asia are cut from the same cloth – and even come from the same family – as the VC firm’s corporate parent. They aspire to reconfigure Asia’s tech ecosystem

Q&A: Vitalbridge Capital's Jinjian Zhang

Jinjian Zhang, founder of Chinese VC firm Vitalbridge Capital, on addressing domestic turbulence, getting investors to reengage on China, and where he sees opportunities in Southeast Asia

Australia's Glow hits first close on debut PE fund

Australian private equity firm Glow Capital Partners has reached a first close of AUD 55m (USD 37m) on its debut fund. The target is AUD 300m.

Nio Capital, Xiaomo back China 4D radar start-up Sinpro

Sinpro, a China-based developer of hardware sensor products, has raised a Series A amounting to several hundred million renminbi led by Nio Capital and Xiaomi.

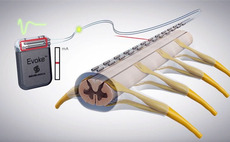

Wellington leads $150m round for Australia's Saluda Medical

Wellington Management has led a USD 150m round for Saluda Medical, an Australian devices company focused on spinal cord stimulation. TPG also came in as a new investor.

Australia's Milkrun winds down, founder defends business model

The founder of Australian grocery delivery business Milkrun, which announced that it would shutter last week amid challenging market conditions, has defended the start-up’s business model and claimed that its impact on the industry will be long-lasting....

China HR SaaS player Beisen completes $30m HK IPO

Beisen Holding, a China-based human resources software-as-a-service (SaaS) platform backed by the likes of SoftBank Vision Fund 2, Goldman Sachs, Matrix Partners China, and Sequoia Capital China, fell 12% on debut following a HKD 238.9m (USD 30m) Hong...

China automotive parts supplier Bibo raises $29m

Nio Capital and Hangzhou-based Orient Jiafu Asset Management have led a CNY 200m (USD 29m) Series A round for Bibo, a China-based automotive parts supplier.

Longreach acquires Japan IT company via bolt-on

The Longreach Group has acquired Japanese IT services provider Blueship as a bolt-on for Japan Systems, an existing portfolio company in the space.

Australia cybersecurity start-up raises $20m

Australian cybersecurity start-up Fivecast has closed a USD 20m Series A round led by Ten Eleven Ventures, a US-based specialist in cybersecurity.

Southern leads $31.5m round for fintech player Soft Space

Southern Capital has led a USD 31.5m funding round for Southeast Asia-focused payments technology provider Soft Space.

Lightspeed China hits first close on renminbi fund

Lightspeed China Partners has returned to the renminbi funds space for the first time in seven years, reaching a first close of CNY 800m (USD 116m) on its latest local currency vehicle.

Fund focus: Iron Pillar takes India SaaS to the world

Iron Pillar has secured USD 129m for what it claims is the first India venture-growth fund dedicated to supporting local companies with global software and cloud infrastructure solutions

China chip packaging player SJ Semiconductor raises $340m

Legend Capital, CITIC Securities-controlled Goldstone Investment, and Ince Capital have participated in an extended Series C round of USD 340m for SJ Semiconductor, a China-based chip packaging business.

Australia's QIC acquires 50% stake in smart meter business

Queensland Investment Corporation (QIC), an Australian sovereign wealth fund, has agreed to acquire a 50% stake in New Zealand-listed Vector Metering at an enterprise valuation of NZD 2.5bn (USD 1.6bn).

Prosus, Accel back India SaaS procurement platform

Prosus Ventures and Accel have led a USD 11m Series A round for Spendflo, an India-founded software-as-a-service (SaaS) procurement management platform now headquartered in the US.

BP, Morgan Stanley back India EV charging station provider

BP Ventures and Morgan Stanley Infrastructure have made a USD 22m equity investment in Magenta Mobility, an Indian electric vehicle (EV) charging station provider.

China decision-making software provider raises $73m

Chinese enterprise software company Cardinal Operations has raised CNY 500m (USD 73m) in two tranches of Series C funding, each led by a state-backed VC fund.