Deal focus: IFM secures debut long-term capital deal

Targeting PRP Diagnostic Imaging through its long-hold fund meant IFM Investors could offer the company stability and partnership. It expects to generate dividend yield and capital growth

PRP Diagnostic Imaging has known four owners in the past five years. The Australia-based company, established when a group of doctors spun out from I-Med in 2008, sold a 70% stake to China's Hengkang Medical Group in 2017. Two years later, Hengkang exited to an investor group led by ex-Macquarie Group CEO Nicholas More, and Crescent Capital Partners picked up the business in 2020.

IFM Investors, which become the fourth owner, promises greater stability – indeed this was a key selling point. The firm has acquired PRP has the first investment by its long-term private capital (LTPC) fund, a vehicle designed to hold assets for 10 years or more.

"We got early access to management and the doctor group because the doctors wanted a long-term partner," said Adrian Kerley, an executive director in IFM's private equity team. "We needed to think about succession and create a liquidity mechanism so that doctors can buy and sell shares every year. This took time to design hand in hand with the doctors."

The latest transaction is said to give PRP an enterprise valuation of approximately AUD 800m (USD 547m). This compares to AUD 330m when Hengkang invested, AUD 260m when it exited, and AUD 440m when Crescent came in. Unisuper is participating as a co-investor and will take a 30% interest alongside majority owner IFM, while a minority stake remains with doctors and management.

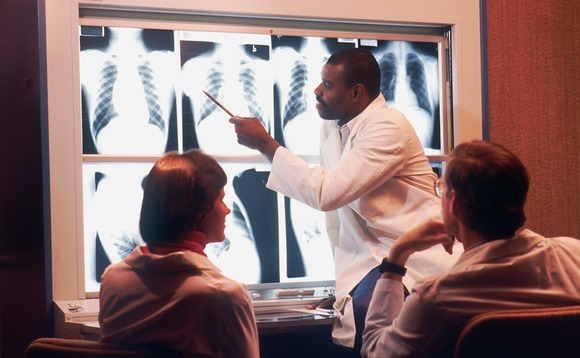

PRP operates 25 radiology clinics in Sydney and across New South Wales that offer services ranging from X-rays and ECG examinations to MRIs and CT scans. It claims approximately 50 doctors, most of whom are also shareholders. IFM and Unisuper will support growth through geographical expansion and investments in technology and systems that improve patient care.

"We're targeting economically durable assets that can handle cycles. We looked at a lot of radiology businesses and this one was outstanding. While revenue was flat during COVID, the business has grown every other year over the past decade. We should make dividend yield on invested capital potentially in the high single digits, and then there's capital growth on top," said Kerley.

"We can also bring expertise and capital to help the business grow. With radiology clinics, there is a greater need for equipment and for capital and therefore a role for a long-term institutional partner. In contrast, value creation in the GP [general practitioner] clinics business, for example, is driven by the GPs and how many people they can see every day. The capital requirements are lower."

PRP – originally Pittwater Radiology Partners – splintered off from I-Med amid general unhappiness with corporate ownership. The company had been acquired by CVC Capital Partners for AUD 2.6bn in 2006, one of a spate of highly leveraged buyouts that came to typify the pre-global financial crisis period, and soon began to struggle under the weight of the debt used to buy it.

The PRP team exited before a group of credit investors assumed control of the business through a debt-for-equity swap in 2011. Allegro Funds was brought in to lead a turnaround and stabilise the employee base. A second spinout was led by group of Western Australia-based doctors, which led to the formation of Perth Radiologic Clinic. Allegro bought a minority stake in the business in 2019.

The key to making investments in this space work is maintaining alignment between investors and doctors. Kerley identifies three main business models. First, corporate ownership where doctors receive fixed remuneration. Second, partnerships where doctors own all the equity. These are harder to scale and consequently cannot engage in cost-efficient capital investment.

This leaves the model pursued by PRP, where doctors are incentivised to perform through meaningful equity ownership and remuneration packages that rely heavily on revenue share. Kerley believes this is the only approach that delivers proper alignment, adding that "how revenue is shared by the doctors is part of PRP's IP [intellectual property]."

With its potential for long-term growth, strong market position, consistent cash flow, and management team integrated into the investment proposition, PRP meets IFM's stated criteria for LTPC fund. The vehicle reached a first close of AUD 450m earlier this year against a hard cap of around AUD 800m, with anchor commitments from Unisuper and Hostplus.

Up to AUD 3.5bn is expected to be put to work across 5-7 investments, the average equity cheque size of AUD 500m suggesting the fund is designed for LPs that want substantial amounts of co-investment. Moreover, it is likely to appeal to those that look beyond the traditional asset allocation model and are willing to trade lower risk and long-term yield for mid-teen returns.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.