Healthcare

CBC strikes China's first royalty-based biomedicine deal

R-Bridge Fund, a credit vehicle established by healthcare-focused private equity firm CBC Group, has completed what it claims is the first royalty-backed investment in China’s biomedicine space.

Liverpool Partners buys Australian fertility business

Australian healthcare player Healius has agreed to divest another asset to private equity, with the sale of its fertility business to Liverpool Partners for AUD 30.5m (USD 23m).

Deal focus: Medilink chases global ADC opportunity

The Medilink Therapeutics team spun out from Kelun-Biotech to develop antibody drug conjugates capable of competing with the world’s best. Its USD 70m Series B will support the pursuit of this goal

Genesis leads Series A extension for China's Nutshell Therapeutics

Nutshell Therapeutics, a China-based specialist in protein-focused drugs, has raised USD 40m in an extended Series A led by Genesis Capital.

Lyfe, Qiming lead Series B for China ADC player Medilink

Suzhou Medilink Therapeutics, a Chinese biotech company specializing in antibody-drug conjugates (ADCs) commonly used as targeted therapies for treating cancer, has raised a USD 70m Series B led by Lyfe Capital and Qiming Venture Partners.

J-Star exits Japan nursing care provider

J-Star has exited dementia-focused nursing care provider Platia to Bain Capital-owned counterpart Nichii Gakkan for an undisclosed sum.

China's Cloudview reaches $316m first close on renminbi fund

Cloudview Capital, a Chinese GP that previously operated as a joint venture with ICBC International, has completed a first close on its second renminbi-denominated Fund with CNY 2bn (USD 316m) in commitments.

Dymon pursues take-private of Singapore healthcare business

Dymon Asia Private Equity has made a take-private offer for Singapore-listed healthcare services provider Singapore O&G that values the company at approximately SGD 141m (USD 103.3m).

Deal focus: Nexus Point doubles down on dentistry

With a dentist clinic chain already in the portfolio, Nexus Point Capital has backed a B2B procurement platform that services clinics. It is a firm believer in the industry’s tailwinds

China cancer drug developer InxMed raises $50m

InxMed, a China-based biotech company focused on oncology treatments, has raised a USD 50m Series B round led by SDIC China Merchants Investment.

Korean GP Credian sponsors $200m US SPAC offering

Seoul-based private equity firm Credian Partners has teamed up with CrystalBioSciences, a captive VC unit of biopharmaceutical company CrystalGenomics, to raise USD 200m for a US-listed special purpose acquisition company (SPAC).

BGH seeks regulatory action amid battle for Australia's Virtus

BGH Capital has asked Australia’s Takeovers Panel to intervene a second time in its pursuit of Virtus Health after the fertility care business resolved to engage with CapVest Partners and not entertain BGH’s improved offer.

China 3D cell culture business secures Series B

CytoNiche, a Beijing-based provider of 3D micro-structure engineering technology used for stem cell research, has raised nearly CNY 300m (USD 47m) in a Series B led by Gaorong Capital and CICC Capital.

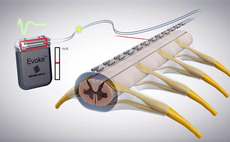

Australia's Saluda Medical raises $125m

US-based healthcare investor Redmile Group has led a USD 125m round for Australia’s Saluda Medical, a devices company focused on spinal cord stimulation.

Q&A: Sylvan Group's Gerald Leong

Gerald Leong, a 25-year veteran of Asian private equity, believes returns-focused impact investment is the future of the industry. His new firm, Singapore-based Sylvan Group, will attempt to prove it

Deal focus: Quadria goes shopping in Vietnam

Singapore’s healthcare-focused Quadria Capital has made its most overtly consumer retail-oriented investment with Vietnam’s Con Cung. But the endgame is considered squarely on-strategy

Baring Asia completes $386m recap of CitiusTech

Baring Private Equity Asia (BPEA) has completed a USD 385.9m dividend recap and refinancing of loans tied to its 2019 acquisition of India-based healthcare IT services business CitiusTech.

Investcorp seeks $400m for India private equity fund

Investcorp is targeting USD 400m for its third India private equity fund as part of efforts to quadruple its assets under management (AUM) in the country to USD 2bn within six years.

Korea's Biorchestra gets $45m Series C

Biorchestra, a Korea-based drug developer specialising in RNA therapeutics for neurodegenerative diseases, has closed a Series C funding round of KRW 54bn (USD 45m).

India's MediBuddy gets $125m Series C

Quadria Capital and Lightrock India have led a USD 125m Series C round for Indian healthcare platform MediBuddy.

Warburg Pincus commits $210m to India medical devices business

Warburg Pincus has acquired a minority interest in Micro Life Sciences, the parent company of India-headquartered medical devices manufacturer Meril, for approximately USD 210m.

CLSA launches $500m China growth fund

CLSA Capital Partners (CLSA CP) has launched a China growth fund focused on healthcare, smart manufacturing, renewable energy, tech-enabled media. The target is USD 500m.

AVCJ Awards 2021: Deal of the Year – Large Cap: China Biologic

For Centurium Capital, China Biologic was no ordinary take-private. It was the culmination of a multi-year effort to tighten the company’s shareholding structure and root out management inefficiencies

Singapore's Sylvan buys four local healthcare companies

Sylvan Group, a Singaporean private equity firm set up by Hyundai scion Kyungsun Chung, has acquired majority stakes in four local healthcare companies for USD 140.5m. These represent its first investments.