Financials

Carlyle makes $536m realization from India's SBI Life

The Carlyle Group has sold more than two-thirds of its remaining stake in India-listed life insurance company SBI Life for approximately INR39.4 billion ($536 million) via a bulk transaction.

PE-backed Waterdrop falls on debut after $360m US IPO

Waterdrop, a China-based insurance, medical crowdfunding and mutual aid platform, fell 19% on its New York Stock Exchange debut following a $360 million IPO.

Female-focused Indonesia lending platform raises $28m

Amartha, a financial services provider for women-led micro and small to medium-sized enterprises (MSMEs) in Indonesia, has raised $28 million in VC funding.

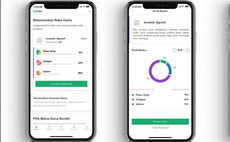

Sequoia India leads $65m round for Indonesia's Bibit

Sequoia Capital India has led a $65 million round for Indonesia robo-advisory app Bibit four months after leading a separate $30 million investment.

PEP, Carlyle end pursuit of Australia's Link

Pacific Equity Partners (PEP) and The Carlyle Group have abandoned their A$2.7 billion ($1.97 billion) bid for Australia-based financial data and fund administration services provider Link Administration Holdings.

Blackstone to cement control of India's Mphasis

The Blackstone Group is set to lift its controlling position in India-listed IT services provider Mphasis to 75% as part of a deal worth up to $2.8 billion.

Sequoia joins $25m Series D for Singapore's StashAway

Sequoia Capital India has joined a S$33.3 million ($25 million) Series D round for Singapore-based wealth management platform StashAway.

Tiger Global invests $25m in India crypto app

Tiger Global Management has invested $25 million in CoinSwitch Kuber, a cryptocurrency exchange for the Indian retail market that facilitates investments as small as INR100 ($1.33).

KKR joins $61m round for Japan's Netstars

KKR has contributed JPY4 billion ($37 million) to a JPY6.6 billion funding round for Netstars, a Japanese QR code payment gateway operator. SIG and Lun Partners, a Hong Kong-based global financial technology investor, also took part.

India's PE-backed Pine Labs acquires Malaysia's Fave

Pine Labs, an India payments start-up backed by MasterCard, PayPal, and Sequoia Capital India, has acquired Fave, a Malaysian counterpart also backed by Sequoia India, for $45 million.

Deal focus: Gobi sees 100x return on Airwallex

Gobi Partners became Airwallex's first institutional investor in 2016 due to a lack of support in the Australian company's home market. The GP made a partial exit in a recent Series D round at a valuation of $2.6 billion

True North makes partial exit from India's PolicyBazaar

Indian private equity firm True North has confirmed a partial exit from local insurance portal PolicyBazaar.

Qiming leads $30m Series B for China crypto start-up

Qiming Venture Partners has led a $30 million Series B round for China-based imToken, which claims to be Asia’s largest crypto wallet.

Japan payments start-up Paidy closes $120m Series D

Japanese payments start-up Paidy has raised $120 million in Series D funding from JS Capital Management, Soros Capital Management, Tybourne Capital Management, and Wellington Management.

KKR, Sequoia lead $234m round for Indian NBFC

KKR and Sequoia Capital India have led a $234 million investment in Indian non-banking financial company (NBFC) Five Star Business Finance at a valuation of $1.4 billion.

JC Flowers exits Asia trading platforms business

JC Flowers has agreed to sell Hong Kong-based Chi-X Asia Pacific, which operates equity trading platforms in Australia and Japan, to US-based Cboe Global Markets.

Australia's Airwallex sees valuation hit $2.6b

Airwallex, an international payments technology provider that launched out of Melbourne, has closed a third tranche of Series D funding, taking the overall round to $300 million and its valuation to $2.6 billion.

DCM set for partial exit from Japan's Freee

Tokyo-listed accounting software provider Freee is set to raise up to JPY42.5 billion ($391 million) through an offering of new shares and the sale of shares held by DCM Ventures.

Carlyle gets $543m through partial exit from India's SBI Card

The Carlyle Group has sold approximately one-quarter of its remaining 15.8% stake in SBI Cards & Payment Services – a year after the Indian company’s IPO – for INR39.4 billion ($543 million).

India's PolicyBazaar raises $75m for Middle East expansion

PolicyBazaar, India’s largest insurance comparison portal, has raised $75 million from US-based Falcon Edge Capital for a Middle East expansion.

Jungle leads $17m round for India edtech, fintech player

Singapore’s Jungle Ventures has led a $17 million Series B round for Leap Finance, a financial technology provider targeting the Indian education space.

Hillhouse, Tencent lead Series C for China's Fenbeitong

Hillhouse Capital and Tencent Holdings have led a $92.5 million Series C round for Fenbeitong, a China-based enterprise payment and expense management software provider.

MDV, Kenanga launch $73m Malaysia fintech fund

Malaysia Debt Ventures (MDV) and Kenanga Investment Bank have launched a VC fund focused on the local financial technology space with a target of MYR300 million ($73 million).

Jungle joins $46m Series D for India's Turtlemint

Indian online insurance broker Turtlemint has closed its Series D round at $46 million following a significant contribution from early-stage investor Jungle Ventures.