Region

Openspace makes first Thailand investment

Southeast Asia-focused Openspace Ventures has made its first investment in Thailand, co-leading a $10 million Series B round for financial technology player Finnomena alongside China’s Gobi Ventures.

Chinese drug developer wins General Atlantic backing

General Atlantic has led a $69 million Series D round of funding for Adagene, a Chinese drug developer with one cancer treatment currently in phase one clinical trials in China and the US.

Australia's Five V agrees Philippines outsourcing carve-out

Australian GP Five V Capital has agreed a A$100 million ($69 million) carve-out of Philippines business offshoring specialist MicroSourcing as a bolt-on for an existing portfolio company.

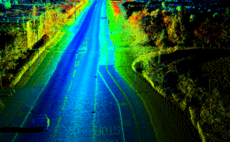

Lightspeed, Bosch lead $173m round for China's Hesai

Chinese smart sensor maker Hesai Technology has raised a $173 million Series C round led by Germany’s Bosch Group and existing investor Lightspeed China Partners.

TA promotes India-based Sharma to principal

Aditya Sharma, who makes investments in India for TA Associates, has been promoted from senior vice president to principal.

EQT backs Southeast Asia hospital operator

EQT Partners has confirmed an investment of undisclosed size in Health Management International (HMI), a hospital operator with a presence in Singapore, Malaysia, and Indonesia.

China's NextData gets $73m Series C

Tencent Holdings and XiangHe Capital have led a $73 million Series C round for China-based cybersecurity services provider NextData.

China's CF PharmTech raises $90m Series E

CF PharmTech, a Chinese devices maker focused on respiratory health, has raised $90 million in Series E funding led by local private equity investor New Alliance Capital.

Longreach buys another Japanese coffee shop chain

The Longreach Group has made its second foray into Japan’s coffee shop space with an agreement to acquire Chat Noir, operator of more than 190 stores nationwide, primarily under the Caffe Veloce brand.

Riverside exits Malaysian chemicals business

The Riverside Company has exited one of its few remaining Asia Pacific investments outside of Australia with the sale of Malaysia-based specialty chemicals distributor DCM Asia.

Everstone backs US, India-based generics developer

The Everstone Group has agreed to invest $50 million in Slayback Pharma, a developer of generic and specialty drugs with a presence in India and the US.

India's True North makes $75m biosimilars bet

True North has invested INR5.36 billion ($74.6 million) in the biosimilars business of India-listed pharmaceuticals giant Biocon.

VIG reaches $810m final close on fourth Korean fund

VIG Partners has closed its fourth Korea-focused fund at $810 million, with approximately half the commitments coming from international investors. This compares to 30% for Fund III, which closed at $600 million in 2017.

Chinese genetic testing player secures $115m round

Geneseeq, a Chinese genetic testing company that focuses on treatments for cancer, has raised RMB800 million ($115 million) in a funding round led by state-owned China Reform Holding Corporation.

Chinese biopharma player secures $100m Series B

Elpiscience, a Shanghai-based biopharmaceutical company has completed a $100 million Series B round of funding led by specialist healthcare GP Hyfinity Investments.

Talking points: 2019 in quotes

What industry participants had to say at AVCJ events on co-investment, technology opportunities in Vietnam, what LPs want to hear from GPs, Indian buyouts, long-dated funds, and late-stage deals in China deployment during times of uncertainty, responding...

SoftBank Vision Fund invests $275m in India's Lenskart

SoftBank Vision Fund has led a Series G round of more than $275 million for Lenskart, an Indian omnichannel eyewear retailer, facilitating exits for several early investors.

China's Hua Capital buys chip unit from US-listed Synaptics

Hua Capital, a Chinese investment firm that primarily focuses on the semiconductor industry, has agreed to acquire an Asia-based mobile LCD chip business from US-listed Synaptics for $120 million in cash.

India's Filter Capital names Sumit Sinha as co-founder

Filter Capital, an Indian private equity firm established last year by ex-Warburg Pincus executive Nitin Nayar, has appointed Sumit Sinha as a co-founder and managing partner.

CPPIB to invest $225m in Bain, Piramal India distress fund

Canada Pension Plan Investment Board (CPPIB) has committed $225 million to India Resurgence Fund (India RF), a distressed assets investment platform established by Bain Capital Credit and Piramal Enterprises.

PEP bids $517m for Australia's Village Roadshow

Pacific Equity Partners (PEP) has submitted a A$761.2 million ($517 million) bid for Village Roadshow, an Australian media company that operates cinemas and theme parks and has interests in film production and distribution.

Anacacia takes stake in Australia logistics business

Anacacia Capital has made an investment of unspecified size in Direct Couriers, a courier and logistics services provider that operates in Australia and New Zealand.

Carlyle backs Chinese apartment operator Anxin

The Carlyle Group has acquired a significant minority stake in Anxin Apartment, a Chinese serviced apartment operator that specializes in affordable housing for corporate clients.

Blackstone promotes India-based PE executive

The Blackstone Group has promoted Amit Jain to partner and senior managing director covering India, effective January 1.