Australasia

Fund focus: Patience pays for off for Movac

New Zealand VC firm Movac has exceeded expectations with its latest vintage, trading individuals and families for institutions, some of which are entering the asset class for the first time

New Zealand's Movac raises $125m for Fund VI

New Zealand-based Movac has closed its sixth technology fund on NZD 202m (USD 125m) despite what Mark Vivian, a general partner at the venture capital firm, described as “the most challenging fundraising conditions I've experienced since the GFC [global...

NZ Super CEO resigns

Matt Whineray, who has served as CEO of New Zealand Superannuation Fund (NZ Super) since mid-2018, will depart at the end of the year.

Australia's PE-backed Best & Less receives take-private offer

Best & Less, an Australian baby and kids retailer that went public less than two years ago under the guidance of then-majority owner Allegro Funds, has received a take-private offer from an investment vehicle controlled by retail industry veteran Brett...

Deal focus: Excavating the lithosphere

Australia’s Investible is helping lithium processor Novalith clean up one of the dirtiest links in the electric vehicle supply chain. The science appears sound, but can it stay clean as it scales?

LP interview: Stafford Capital Partners

Founded in Australia, Stafford Capital Partners evolved into a global asset manager focused on timberland and infrastructure secondaries and PE co-investment. ESG is a rising client priority

TPG abandons bid for Australian funeral services provider

TPG Capital has withdrawn its AUD 1.8bn (USD 1.2bn) unsolicited takeover bid for Invocare, a listed Australian provider of funeral services and operator of memorial parks and crematoria.

Australia's Quadrant launches minority equity strategy

Quadrant Private Equity is looking to raise AUD 300m (USD 201m) for a growth fund that will take minority equity stakes in companies across Australia and New Zealand.

Platinum buys Australian building products supplier

Platinum Equity has agreed to carve out the Australasia business of global building products manufacturer Jeld-Wen Holding for approximately AUD 688m (USD 461m).

Australia's Future Fund recruits ex-Carlyle dealmaker as PE head

Future Fund has recruited David Bluff, who stepped down last year as The Carlyle Group’s Australia and New Zealand buyout head, to lead its private equity investment programme.

US climate VC leads round for Australia lithium player

Lowercarbon Capital, a US-based VC firm specialising in climate, has led a AUD 23m (USD 15.5m) Series A round for Australian lithium production services company Novalith Technologies.

Australia's Glow hits first close on debut PE fund

Australian private equity firm Glow Capital Partners has reached a first close of AUD 55m (USD 37m) on its debut fund. The target is AUD 300m.

Australia's Square Peg adds partner

Australia-based Square Peg Capital has promoted James Tynan, a principal at the venture capital firm, to partner level. It brings the total number of partners to nine.

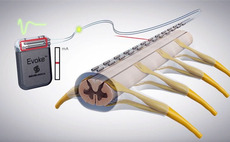

Wellington leads $150m round for Australia's Saluda Medical

Wellington Management has led a USD 150m round for Saluda Medical, an Australian devices company focused on spinal cord stimulation. TPG also came in as a new investor.

Australia's Milkrun winds down, founder defends business model

The founder of Australian grocery delivery business Milkrun, which announced that it would shutter last week amid challenging market conditions, has defended the start-up’s business model and claimed that its impact on the industry will be long-lasting....

Australia's Crescent closes Fund VII on $670m

Crescent Capital Partners has closed its seventh Australia and New Zealand mid-market fund with AUD 1bn (USD 670m) in commitments.

Australia cybersecurity start-up raises $20m

Australian cybersecurity start-up Fivecast has closed a USD 20m Series A round led by Ten Eleven Ventures, a US-based specialist in cybersecurity.

Australia's QIC acquires 50% stake in smart meter business

Queensland Investment Corporation (QIC), an Australian sovereign wealth fund, has agreed to acquire a 50% stake in New Zealand-listed Vector Metering at an enterprise valuation of NZD 2.5bn (USD 1.6bn).

Quadrant completes New Zealand cybersecurity roll-up

Quadrant Private Equity has invested in New Zealand-based cybersecurity providers Quantum Security Services, ZX Security, and Helix Security Services with a view to supporting expansion into new geographies and service offerings.

Bessemer leads Series C for New Zealand's Halter

Bessemer Venture Partners has led a NZD 85m (USD 53.3m) Series C round for New Zealand’s Halter, a start-up that makes solar-powered collars for managing cow herds with an app.

GP profile: Square Peg Capital

Square Peg Capital came of age at the same time as the Australian and Southeast Asian VC ecosystems, straddling the two with a toehold in Israel. The idea was to think big, not get big. It’s doing both

Affinity recruits Australia head, re-hires executive from Quadrant

Affinity Equity Partners has strengthened its coverage of Australia and New Zealand with the recruitment of Nick Speer from The Riverside Company as a partner and local team leader and the rehiring of Mark Chudek from Quadrant Private Equity.

Asia PE compensation set for downward adjustment in 2023

Compensation for private equity professionals at most levels of seniority in Asia Pacific continued its upward trend in 2022 despite a weaker economic outlook and a slowdown in deal flow, but executive search firm Heidrick & Struggles expects some kind...

Australia's Potentia wins majority shareholder approval for Nitro bid

Potentia Capital has secured support from more than half of Nitro Software’s shareholders for a take-private bid that values the listed Australian company at up to approximately AUD 552m (USD 370m).