GP profile: Square Peg Capital

Square Peg Capital came of age at the same time as the Australian and Southeast Asian VC ecosystems, straddling the two with a toehold in Israel. The idea was to think big, not get big. It’s doing both

With some mathematical figuring, by way of Pythagoras’ theorem, one can conclude that a square peg in a round hole is a more awkward fit than a round peg in a square hole, at least in terms of empty hole space. And so Australia’s Square Peg Capital appears to have christened itself in 2012 by engaging in one-upmanship with none other than the inventor of the mass-market touchscreen smart phone.

The venture capital firm was named for Apple’s “Think Different” television commercials, which ran from the late 1990s to early 2000s. A voiceover from actor Richard Dreyfus champions the round pegs in the square holes because “the people who are crazy enough to think they can change the world are the ones who do.” Unsurprisingly, the ads say nothing about money and asset management.

“The mindset was always driven by being an investing organisation as opposed to a funds management organisation. We’ve never had fund management as a first-order objective,” said Square Peg co-founder Tony Holt. “It’s always been about what is required to make the investments we want to make to solve the problems that we can solve.”

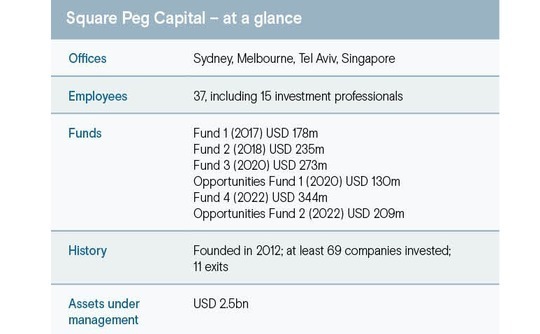

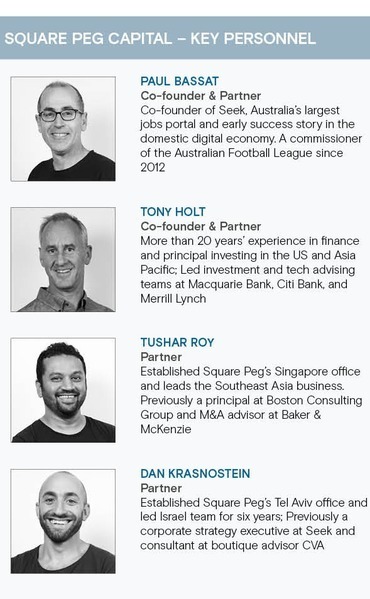

Holt, who previously led investment and technology advisory teams at Macquarie Bank, Citi, and Merrill Lynch, established the firm with childhood friend Paul Bassat, co-founder of Australian jobs portal Seek, as well as Barry Brott and Justin Liberman. The latter two were investors at Liberman’s family office Jagen, one of Seek’s early backers.

Together they invested about USD 120m during Square Peg’s deal-by-deal period. Third-party capital was involved from the outset, channelled in via special purpose vehicles. Most investors went on to take LP positions in the flagship blind pool funds. Collectively, these early investments are said to be generated distributions to paid-in (DPI) of 3.5x to date.

Dan Krasnostein, a former Seek executive, was the first hire in late 2012, and he helped set up the first overseas office in Tel Aviv in late 2014. Standout investments in Israel during this period included Fiverr, a marketplace for freelance creatives that provided a material exit upon its US IPO in 2019.

By 2015, the firm’s third year, there were already three offices, a thriving overseas beachhead, and further expansion across the region was underway. That year, Square Peg brought in Tushar Roy, formerly of Boston Consulting Group, as a partner in charge of Southeast Asia.

“These are not people who do things in a relaxed way,” Roy said, referring to Square Peg’s founding team. “These are extremely high-functioning individuals and extremely successful in their careers. So Square Peg quickly morphed from being, ‘Let’s just invest our own money,’ to being, ‘Let’s build one of the best VCs in the world and catalyse ecosystems.’”

Benefits of scope

Square Peg broke new ground in 2015 by launching its first fund with an anchor commitment of AUD 50m (then USD 50m) from Australian superannuation fund Hostplus. This marked the super fund industry’s return to venture capital after getting singed in the dotcom busts of the early 2000s. Since then, AustralianSuper has also come in as an LP.

Fund II closed on USD 235m in 2018, followed by USD 273m for Fund III in 2020 and USD 344m for Fund IV in 2022. Two opportunity funds, targeting later-stage deals, closed in tandem with Funds III and IV on USD 130m and USD 209m, respectively. Assets under management stand at about USD 2.5bn across all strategies, including a recently launched listed equities business.

The growth reflected a rapid ecosystem expansion in Australia but also international expansion. Southeast Asia, in particular, has emerged as a key pillar of the overall strategy and indeed now attracts about half of total capital deployed. In 2020, Piruze Sabuncu – formerly of Stripe, Next Billion Ventures, and Asian Development Bank – was recruited as the Singapore office’s second partner.

It has been a period in which Southeast Asia has proven it can produce global businesses targeting consumer access pain points around financial services, healthcare, and education. Most Australian VC firms have failed to tap this opportunity given the massive tax incentives to stay local. But as start-up markets have contracted in the recent term, the diversification play is coming more into focus.

Beyond broadened access to founders at a time when fewer are venturing into entrepreneurialism, Square Peg has been able to share knowledge, benchmark, and take a thematic approach to investing that would not have been possible as a single-jurisdiction player. It also helps that Australia and Southeast Asia have made significant strides, catching up with Israel.

In Australia, this has involved a crop of early digital winners inspiring institutional investors to return to the asset class combined with improvements in government policy and a seeming shift toward technology in academic circles. In Southeast Asia, leapfrogging technology uptake has begun to highlight massive demographic advantages.

“We’ve got some way to work through this cycle, both from a value and a volume perspective – but in Australia and Southeast Asia, we have much more developed ecosystems,” Holt said.

“The way those ecosystems operate today, they are well and truly significant enough to work through the market cycles we’re seeing. Although we will have more difficulty funding companies than we’ve had in the last several years, these ecosystems will survive and prosper.”

Some of the most recent evidence on this front came last week with a USD 270m Series D round for Indonesian consumer credit platform Kredivo. Square Peg first backed the company in 2018, leading a USD 30m Series B and has re-upped at least three more times. This includes the latest round, the largest sum invested in a privately held Southeast Asian technology company in six months.

Cultural cohesion

Square Peg claims to offer high-touch, high-quality experience for founders and portfolio companies, sharing thematic knowledge, as well as providing support in areas such as talent sourcing. In 2021, the firm engaged Rob Lamb, formerly global head of talent at Uber, to act as head of talent, serving the GP as well as portfolio companies.

“When you put yourself in founders’ shoes, the value of Square Peg is when they ask, ‘Do you understand my business?’” Roy said. “'Can I trust you with this thing that will be the most important thing in my life for the next ten years? Do I want you at the table helping with tough decisions when I’m at my lowest?’ You have to unpack what it takes to be that person.”

One of Roy’s key hires came when the firm was not hiring. Ed Barker, now a senior associate, was an Australia-based consultant at Boston Consulting Group when they met in 2019. After a four-to-five-month process of informal discussions, Barker was moving to Singapore to help build out the new office mid-pandemic.

Barker had just landed at Changi airport when he got a call from Roy requesting that he review two new potential deals. On his second day, he was already on a call with the CFO of one of the businesses, representing Square Peg. That company was Singapore wealth management platform Stashaway, which has raised USD 53m across three rounds from the likes of Sequoia Capital and Eight Roads.

“You have some relatively well-defined guardrails in what to do and not do, but extreme freedom within those guardrails to define how you operate,” Barker said.

“Everyone brings their own identity and how they like doing things. I think that’s super important when you’ve got a globally distributed organisation, where people are operating in quite different market contexts. You need those people to be able to be themselves to get things done.”

There are hybrid investment committee meetings and all-team meetings, with video link across geographies and in-person gatherings for those in the same location – held separately and weekly. This was the norm even before the pandemic.

Once a year, the entire team meets for a week. Once every two years, there is the “Founders Summit,” convening globally disparate portfolio company heads at a single physical event billed as a chance to swap stories and share learnings. This is augmented by other regular social and professional connections aimed at creating a founder community and increasing internal team touchpoints.

“If there’s a great investment in Israel and a great investment in Singapore in the same week, and we need to convene everyone three times that week, I bet we would,” Barker said.

“I have high conviction we would get together if I suddenly messaged everyone on the team right now and said, ‘I’ve got an amazing business. We need to meet the founders in the US tomorrow. Sorry, you’ll have another late night, Australia.’ We would do it because, ultimately, that’s what drives our business.”

Entries and exits

As of end-2022, Square Peg had invested in 69 portfolio companies. At the time, the firm estimated that the USD 1bn it had deployed to date was worth USD 2.6bn as portfolio company valuations have appreciated. It claimed a net IRR of 27.4% and net total value to paid-in (TVPI) 2.1x.

Core areas include fintech, health-tech, future-of-education, and future-of-work. There is a preference for moving quickly, basing decisions primarily on personal connections and establishing trust, while taking significant early-stage stakes in a range of 10% to 15%.

Data has come into the process, not so much for screening masses of potential deals as for boning up on founders and businesses to get the most out of initial conversations. A full-time data engineer, Kai Yi Yong, formerly of Grab, was hired last year to manage this system, creating a proprietary model for relevant company data aggregation.

The data piece appears to be mostly about increasing efficiency rather than reducing risk. Indeed, Holt has suggested the firm is keen to press on with investment during the current period of bearishness, noting that the “pendulum has swung too far in favour of profit versus growth at the moment.”

This viewpoint is supported by evidence that Square Peg’s most adventurous and offbeat bets are gaining traction despite the VC winter. Quantum computer maker Q-Ctrl, and Vow, a company that sells lab-grown meat based on the cells of 22 species, including crocodiles and alpacas, are cases in point. They raised USD 28m in February and USD 49m in November, respectively.

“The key things we look at are team, thematic, and timing. We don’t negotiate on team being sub-standard. That’s a threshold question,” said Leila Lee, head of distribution at Square Peg. “But with companies like Vow and Q-Ctrl, timing was the big question. We’re never going to have a whole portfolio of question marks around timing. But we’re happy to make exceptions.”

No amount of investment bravery can create an exit market, however. In this sense, the general slowdown in technology and VC in recent months has put Square Peg on the back foot.

There have been 11 exits in total to date, including the sales of positions in New Zealand retail technology provider Vend, Australian design platform Canva, and Malaysia-based real estate portal PropertyGuru. Square Peg had returned USD 583m to investors as of end-2022, with the exits generating a gross IRR of 42% and a gross TVPI of 5x. Holt said the “entire team” shares in upside events.

“LPs rightly look at DPI as the key basis on which they should judge GPs, but today is not the time to try to manufacture DPI,” he said. “We have to be patient about what opportunities the exit markets will provide but at the same time very alive to those opportunities as they emerge. There are some positive signs of the IPO markets re-emerging.”

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.