Investments

Japan healthcare AI start-up Ubie closes $26m Series C

Japan’s Ubie, a healthcare technology start-up that uses artificial intelligence (AI) for symptom-checking questionnaires, has raised USD 26.2m in Series C funding from local investors.

Singularity Growth leads Series D for India's Servify

India’s Singularity Growth Opportunity Fund, a vehicle associated with former Reliance Capital executive Madhusudan Kela, has led a USD 65m investment in after-sales software provider Servify.

Baidu-backed autonomous truck developer raises $67m

DeepWay, an intelligent driving solutions provider for trucks established by Baidu, has raised a Series A round of CNY 460m (USD 67m) led by Qiming Venture Partners.

Prosperity7 backs China-founded unstructured data specialist Zilliz

Prosperity7 Ventures, a venture capital fund established by Saudi Arabia state oil giant Saudi Aramco, has led a USD 60m Series B extension for China-founded open-source software developer Zilliz.

Keppel buys Singapore waste management player 800 Super

Keppel Corporation has purchased a majority interest in Singapore waste management services business 800 Super Holdings, which was delisted in 2019 through a KKR-backed take-private, at a valuation of SGD 380m (USD 273m).

Korea medical tech start-up raises $20m Series B

Korea’s Airs Medical, a healthcare technology provider active in diagnostics software and robotics, has raised USD 20m in Series B funding from Klim Ventures, Q Capital Partners, and Hanwha Life Insurance.

China luxury goods player Secoo gets private equity bailout

Secoo Holding, a US-listed Chinese luxury goods retailer that has seen its stock price fall by 95% since the start of 2020 and has filed for bankruptcy twice in the past eight months, has received USD 4m in funding.

Australia's PEP buys traffic management business

Pacific Equity Partners (PEP) has acquired a majority stake in Altus Group, which claims to be Australia’s largest provider of traffic management services.

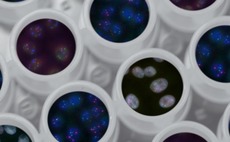

China Merchants Group backs CDMO player Porton Advanced

Three entities under China Merchants Group (CMG) have led a USD 80m Series B round for Porton Advanced Solutions, a local contract development and manufacturing organisation (CDMO) that focuses solely on gene and cell therapy services.

AVCJ Awards 2022 - nominations have closed

Nominations for the 2022 AVCJ Private Equity & Venture Capital Awards have now closed. Many thanks to all those who participated.

India rural fintech player Jai Kisan raises $50m

India’s Jai Kisan, a financial technology start-up focused on digital banking in rural areas, has raised USD 50m in Series B funding from a group including DG Daiwa Ventures and Blume Ventures.

Singapore's TotallyAwesome raises $10m seed round

Singapore’s TotallyAwesome, a digital advertising start-up focused on children’s online safety, has raised a USD 10m seed round featuring US venture debt provider Partner For Growth (PFG).

Tiger Global leads Series B for India savings platform Jar

Tiger Global Management has led a USD 22.6m Series B round for ChangeJar Technologies, operator of India-based savings and investment app Jar, at a valuation of more than USD 300m.

India seaweed biotech start-up raises $18.5m

India’s Sea6 Energy, a company that cultivates and processes seaweed to make a range of bio-engineered products, has completed a USD 18.5m Series B round featuring BASF Venture Capital.

Korea's Kakao abandons plans for mobility unit stake sale

South Korean internet giant Kakao has abandoned plans to partially divest Kakao Mobility, its transportation division.

Korea start-up equity management platform raises $11m

QuotaBook, a South Korea-based equity management platform that helps start-ups organise their cap tables, has received USD 11m in the second tranche of a Series A round.

China carmaker SAIC raises $148m for mobility unit

Chinese carmaker SAIC Motor has raised CNY 1bn (USD 148m) to support the expansion of its mobile services unit, which last year launched a fleet of robotaxis.

OTPP to acquire majority stake in India's Sahyadri Hospitals

Ontario Teachers' Pension Plan (OTPP) has agreed its first control private equity buyout in India, taking a majority stake in Sahyadri Hospitals and setting up a partial exit for Everstone Group.

C2 invests $25m in Eat Just to support China expansion

C2 Capital Partners, a China-based private equity firm that focuses on consumer sector investments, has committed USD 25m to Eat Just, owner of plant-based egg brand Just Egg.

Mobility: Batteries and beyond

The electrification of transportation has created a wealth of opportunities in energy saving and storage. Investors across Asia – led by China – are looking at batteries and other technologies

Energy transition case study: The Arnott's Group

Having acquired Australian snacks producer The Arnott’s Group under its long-dated strategy, KKR hopes to make an enduring impact on sustainable sourcing and energy conservation

Energy transition case study: Towngas Smart Energy

Towngas Smart Energy wants to offer solar and energy management solutions to its existing piped gas customers across China’s industrial parks. Affinity Equity Partners is supporting the rollout

Carlyle backs Japan medical technology player

The Carlyle Group has committed JPY 7bn (USD 52.2m) to CureApp, a Japan-based developer of software for use in the treatment of medical conditions, as part of the company’s Series G round.

China e-commerce SaaS player Dianxiaomi raises $150m

Chinese e-commerce software-as-a-service (SaaS) provider Dianxiaomi has secured a USD 110m Series D round led by SoftBank Vision Fund 2 and Sequoia Capital China.