China Merchants Group backs CDMO player Porton Advanced

Three entities under China Merchants Group (CMG) have led a USD 80m Series B round for Porton Advanced Solutions, a local contract development and manufacturing organisation (CDMO) that focuses solely on gene and cell therapy services.

China Merchants Health Care Holdings, a dedicated healthcare investment platform under CMG, China Merchants Capital, and China Merchants Securities Investment were the lead investors. Other commitments came from Fosun Health Capital, a subsidiary of China Fosun Pharmaceutical, Gortune Investment, and SDICTK Trust.

There were also re-ups from CS Capital, HM Capital, Ruilian Investment, and Momentum Venture, as well as Porton Pharma Solutions, an outsourced pharmaceutical services platform and the Shenzhen-listed parent of Porton Advanced.

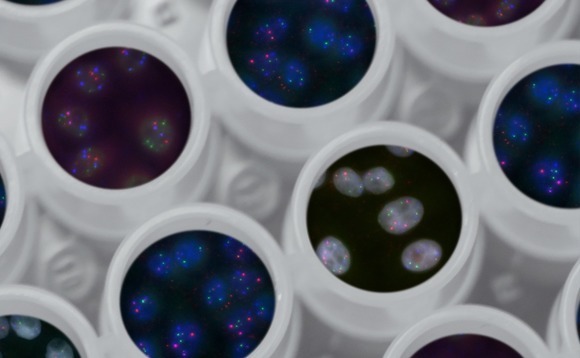

Established in 2018, Porton Advanced specialises in plasmids, cell therapy, gene therapy, oncolytic viruses, nucleic acid therapy, and microbial vectors used for gene therapy. Its services run from cell banking to commercial production, with process development and analytical development, investigator-initiated clinical trials (IIT), investigational new drugs (IND), and clinical trials in between.

The company operates a 40,000-square-foot production facility and has another facility of 160,000 sq ft scheduled to come online in late 2022 or early 2023. The expanded manufacturing footprint will allow Porton Advanced to upgrade its capabilities in adeno-associated viruses (AAV), oncolytic viruses, and mRNA CDMO.

The Series B proceeds have been earmarked for expansion into different markets, with investment in core manufacturing infrastructures and global commercial operations, according to a statement. Various China CROs and CDMOs are looking to realise global ambitions, driven in part by local drug developers launching innovative treatments for worldwide use and running clinical trials overseas.

"We will continue to improve and optimise our internal quality and program management systems, enhance our ability to operate in overseas and domestic markets, and continue to provide the best possible CDMO services to our customers with our open, innovative and reliable platforms, so that best medicine would reach the public sooner," said Yangzhou Wang, CEO of Porton Advanced.

Other recent China CDMO deals include a CNY 500m (USD 74m) Series C for IntellectiveBio. The sharp drop-off in biotech investment in the country this year has prompted some industry participants to highlight the enduring appeal of contract research organisations (CROs) and CDMOs. As long as innovative drug development in China continues to grow, they will benefit.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.