Investments

US climate VC leads round for Australia lithium player

Lowercarbon Capital, a US-based VC firm specialising in climate, has led a AUD 23m (USD 15.5m) Series A round for Australian lithium production services company Novalith Technologies.

1Q analysis: Barely disguised weakness

Government guidance funds in China and Toshiba Corporation in Japan papered over obvious cracks in Asia private equity fundraising and investment. Nothing could hide the pain around exits

Asia fundraising: To the grindstone

As macro uncertainties add red tape to fundraising processes and oblige some managers to operate on a deal-by-deal basis, the improvisational, survivalist nature of Asian private equity is on display

Deal focus: Bibo puts the smart into chassis

Tsinghua University spinout Bibo has stolen a march on its local rivals in developing a specific electric vehicle component that has a large addressable market and serves as an import substitution play

Deal focus: The SoftBank effect, one step removed

The new owners of SoftBank Ventures Asia are cut from the same cloth – and even come from the same family – as the VC firm’s corporate parent. They aspire to reconfigure Asia’s tech ecosystem

Q&A: Vitalbridge Capital's Jinjian Zhang

Jinjian Zhang, founder of Chinese VC firm Vitalbridge Capital, on addressing domestic turbulence, getting investors to reengage on China, and where he sees opportunities in Southeast Asia

Warburg Pincus set to buy minority stake in Chinese fund house

Warburg Pincus has received regulatory approval to acquire a 23.3% stake in Zhong Ou Asset Management (Zhong Ou AMC), a Chinese mutual fund manager, from Italy's Intesa Sanpaolo Bank.

Nio Capital, Xiaomo back China 4D radar start-up Sinpro

Sinpro, a China-based developer of hardware sensor products, has raised a Series A amounting to several hundred million renminbi led by Nio Capital and Xiaomi.

China's Alebund Pharma gets $145m in debt, equity funding

Alebund Pharmaceuticals has raised close to CNY 200m (USD 29m) in a pre-Series C funding round. Investors include state-owned Yangzhou Guojin Investment and Yangzhou Longchuan Holdings.

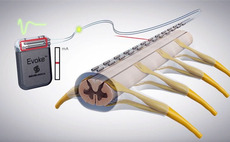

Wellington leads $150m round for Australia's Saluda Medical

Wellington Management has led a USD 150m round for Saluda Medical, an Australian devices company focused on spinal cord stimulation. TPG also came in as a new investor.

Growtheum backs Vietnam's International Dairy Products

Growtheum Capital Partners, a private equity firm established by the former head of GIC’s direct private equity investment group in Southeast Asia, has made a growth capital investment in Vietnam-based International Dairy Products (IDP).

Australia's Milkrun winds down, founder defends business model

The founder of Australian grocery delivery business Milkrun, which announced that it would shutter last week amid challenging market conditions, has defended the start-up’s business model and claimed that its impact on the industry will be long-lasting....

China automotive parts supplier Bibo raises $29m

Nio Capital and Hangzhou-based Orient Jiafu Asset Management have led a CNY 200m (USD 29m) Series A round for Bibo, a China-based automotive parts supplier.

Longreach acquires Japan IT company via bolt-on

The Longreach Group has acquired Japanese IT services provider Blueship as a bolt-on for Japan Systems, an existing portfolio company in the space.

MDI leads Series A for Indonesia cloud kitchen

MDI Ventures, the corporate VC arm of state-controlled Telkom Indonesia, has led a USD 13.7m Series A round for local cloud kitchen start-up Legit Group.

Mistletoe founders to acquire SoftBank Ventures Asia

SoftBank Group has agreed to sell its captive VC unit, SoftBank Ventures Asia (SBVA), to a newly formed entity led by the team behind Japan-headquartered start-up incubation and investment platform Mistletoe.

Australia cybersecurity start-up raises $20m

Australian cybersecurity start-up Fivecast has closed a USD 20m Series A round led by Ten Eleven Ventures, a US-based specialist in cybersecurity.

JBIC, Mitsui back Singapore's Wellesta

Japan Bank for International Cooperation (JBIC) and Mitsui & Co have invested in Singapore-based Wellesta, a diversified services provider for the regional healthcare industry.

Southern leads $31.5m round for fintech player Soft Space

Southern Capital has led a USD 31.5m funding round for Southeast Asia-focused payments technology provider Soft Space.

Temasek increases holding in India's Manipal Health

Temasek Holdings is set to become the majority shareholder in Indian hospital operator Manipal Health Enterprises, having agreed to acquire an additional 41% stake in the company. The transaction facilitates an exit for TPG Capital, but the PE firm will...

China chip packaging player SJ Semiconductor raises $340m

Legend Capital, CITIC Securities-controlled Goldstone Investment, and Ince Capital have participated in an extended Series C round of USD 340m for SJ Semiconductor, a China-based chip packaging business.

Australia's QIC acquires 50% stake in smart meter business

Queensland Investment Corporation (QIC), an Australian sovereign wealth fund, has agreed to acquire a 50% stake in New Zealand-listed Vector Metering at an enterprise valuation of NZD 2.5bn (USD 1.6bn).

Prosus, Accel back India SaaS procurement platform

Prosus Ventures and Accel have led a USD 11m Series A round for Spendflo, an India-founded software-as-a-service (SaaS) procurement management platform now headquartered in the US.

Indian NBFC Avanti Finance raises $24m

Avanti Finance, an Indian technology-led non-banking finance company (NBFC) has received USD 24m in equity funding from Rabo Partnerships and IDH Farmfit Fund, with re-ups from Oikocredit and NRJN Trust.