Weekly digest - October 04 2023

|

By the Numbers

AVCJ RESEARCH

VIETNAM'S FAMILIAR FACES

"Whenever you make a new investment, you can do all the checks and due diligence, you can talk to everyone who ever worked there, but you don't really know if the partnership will work," Hans Christian Jacobsen, a managing partner at PENM Partners said earlier this year. "Instead of entering into seven or eight new relationships with each fund, the most valuable thing for us is the knowledge and trust we have built with a company."

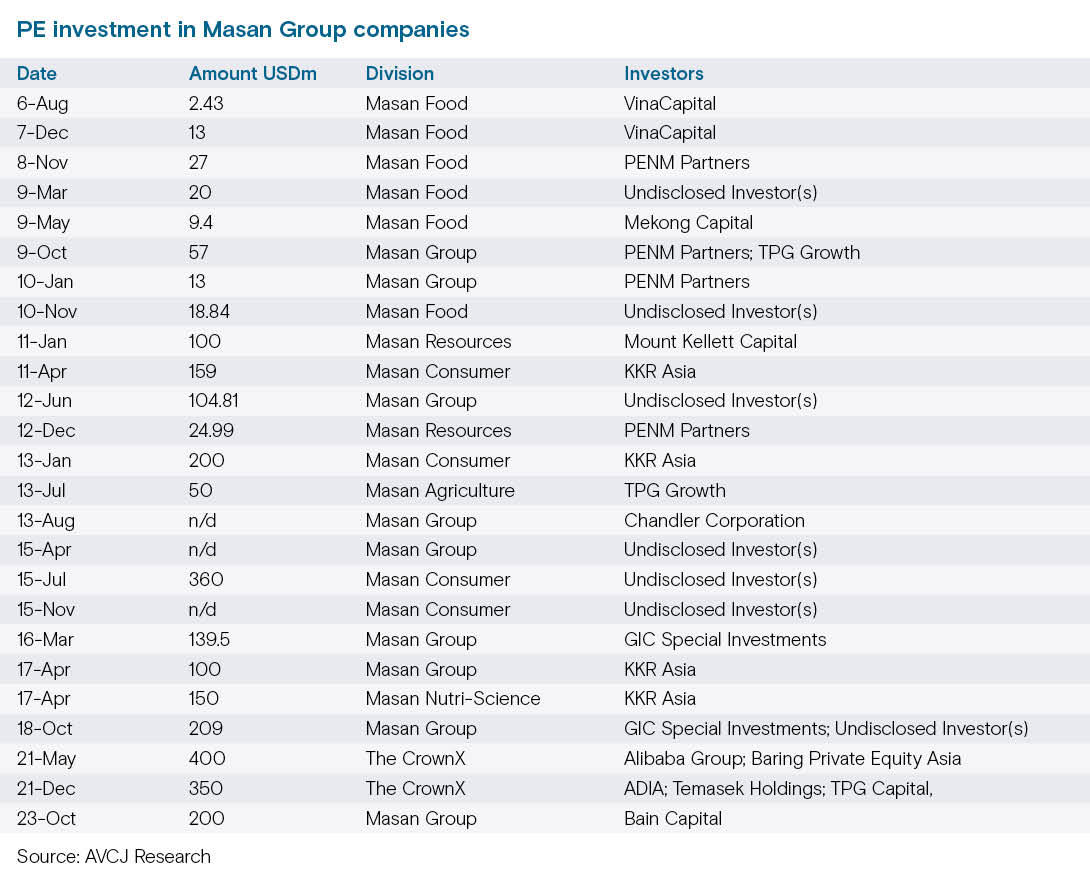

Jacobsen was explaining PENM's affinity for Masan Group, a Vietnamese conglomerate it has backed multiple times. Masan is a consistent theme running through the firm's history: each of the firm's four funds raised to date has invested in at least one Masan subsidiary, and Jacobsen expects to repeat the trick in Fund V. He is not alone in favouring Masan – it might as well be the go-to private equity portfolio company in Vietnam. AVCJ Research has records of investments in 25 companies in the Masan family, from VinaCapital's early dabbling in Masan Food and KKR's sizeable cheques for Masan Consumer Corporation and Masan Nutri-Science through BPEA EQT and TPG Capital support for The CrownX, the product of an ambitious merger between Masan Consumer Holdings and VinCommerce. Bain Capital is the latest addition, making its Vietnam debut with a USD 200m commitment to Masan at group level. The investment was positioned much like The CrownX – an opportunity to participate in the company's transition from a branded products company into an integrated consumer-retail platform. These repeat deals point to the prevailing private equity habit of gravitating towards counterparties of size and repute in Indonesia. The same applies to Southeast Asia and for much the same reason: these markets are still nascent, corporate track records are unproven, stick to what – and who – you know.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.