Weekly digest - October 25 2023

|

TALKING POINTS

AVCJ AWARDS - VOTING CLOSES ON OCTOBER 30

Have you say on the top firms, fundraises, investments, and exits of the year. For more information, go to https://community.ionanalytics.com/avcj-awards-2023

|

|

By the Numbers

AVCJ RESEARCH

DIVIDING LINES

Will the exemption for passive fund commitments by LPs that appeared in indicative guidelines for the US executive order restricting investment in certain Chinese technology assets be forthcoming? Based on recent communication involving a US Congressional committee that has targeted VC firms with exposure to China, legislators are aware of the potential problems.

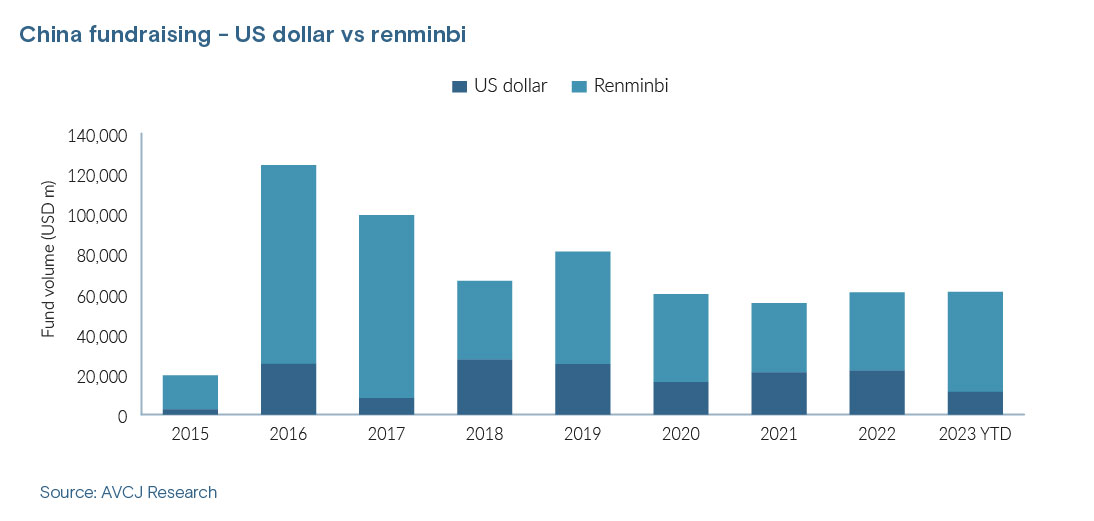

Sequoia Capital is the latest VC firm to receive a letter from the Congressional Select Committee on the Chinese Communist Party asking for details of its investments in semiconductors, quantum computing, and artificial intelligence (AI) in China. But the letter differs from those sent to other firms because it acknowledges Sequoia's plan to separate its US and China operations. The committee noted that rather than staunch flows of US capital into "problematic PRC companies," the separation "may insulate some types of capital flows from regulatory scrutiny they would have otherwise been subject to under the recently released executive order." In short, HongShan – as Sequoia Capital China is now known – will no longer be subject to the screening processes and US legal compliance protocols imposed globally out of Menlo Park, so it can invest wherever it likes. And US LPs can continue to back the firm's funds. The committee suggested that any regulations should cover not only fund-level transactions but also LP commitments to funds. This would choke off US funding venture capital funds by LPs that are not already shunning China managers. (VCs that avoid the designated sensitive technologies would not be impacted, but the impact of heightened compliance requirements and the general negative vibe on China would be far-reaching.) Managers would likely respond by raising more renminbi capital. Commitments to US dollar China funds across all strategies stood at USD 11.2bn by the end of the third quarter, compared to USD 21.8bn for the full 12 months of 2022. Renminbi fundraising, meanwhile, is on course for a bumper year. Nearly USD 50bn has been committed, exceeding the 12-month totals for 2022, 2021, and 2020. The USD 56bn raised in 2019 is within reach. However, most of this capital is not being raised by managers with established US dollar fund businesses who are shifting focus to local currency – or at least, not yet. China accounted for nine of the 15 largest fund closes region-wide in the third quarter. Five of those, including four of the top six, were renminbi vehicles. One of the five was a national level government guidance fund: the CNY 31.5bn (USD 4.3bn) National Research Group Phase II Synergetic Development Fund. Three others were similar provincial-level vehicles.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.