Weekly digest - August 23 2023

|

By the Numbers

AVCJ RESEARCH

HONING IN ON HEALTHCARE

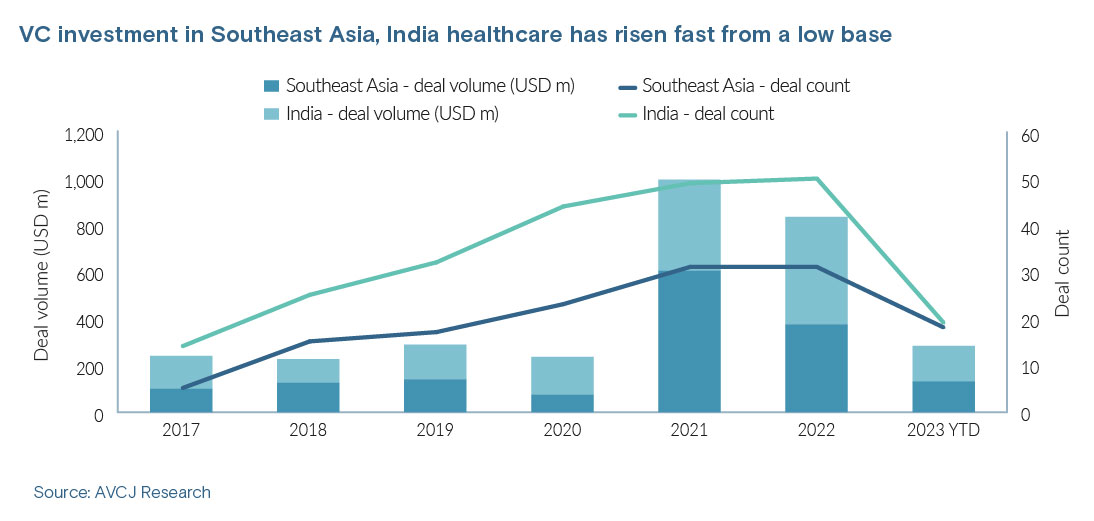

Barely a handful of specialist healthcare GPs operate across Southeast Asia and India, and they tend to focus on mid to late-stage transactions. Nevertheless, early-stage healthcare investment in both markets is going from strength to strength.

In 2021 and 2022, VCs deployed nearly USD 1bn in Southeast Asia healthcare, more than twice the total for the prior four years. Investment in India reached USD 850m, up from USD 550m in 2017-2020. Despite the general slowdown, VC healthcare investment in both markets is on track to surpass pre-pandemic levels. This gives some context to Singapore-based Jungle Ventures absorbing local sector specialist HealthXCapital (HXC). Seemant Jauhari, HXC's managing partner and previously CEO for innovation and research at Apollo Hospitals, will become a partner at Jungle and lead healthcare investments across Southeast Asia and India. Jungle wants to expand coverage of the sector and it is familiar with HXC, having served as an anchor investor in the firm's debut fund in 2018. At the same time, this is an example of consolidation within the investment management space – something that industry participants have flagged as a trend worth watching.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.