Articles by Larissa Ku

Tiger Global leads $40m round for India's Loadshare

Tiger Global Management has led a INR 3bn (USD 40m) Series C round for Indian logistics platform LoadShare.

China second-hand luxury goods platform Ponhu raises $45m

Ponhu, a China-based second-hand goods trading platform specialising in the luxury segment, has raised USD 45m in an extended Series C round led by Hedgestone Capital.

Sinovation's AI solutions business completes $151m HK IPO

AInnovation, a China-based artificial intelligence (AI) solutions provider incubated by Sinovation Ventures, traded down on its Hong Kong debut following a HKD 1.18bn (USD 151m)IPO.

CR Capital joins Series E for China's Newlinks

CR Capital Management, an investment arm of China Resources Group, is backing Newlink Group, operator of a platform that helps drivers locate the best value gas stations and charging piles, as part of the company's Series E round.

Vision Fund backs China healthcare robotics player

Fourier Intelligence, a Shanghai-based medical technology start-up that focuses on rehabilitation robots, has raised CNY 400m (USD 63m) in Series D funding led by SoftBank Vision Fund 2.

China raw egg brand Yellow Swan raises $95m - update

Yellow Swan, a China-based edible raw egg producer incubated by Proterra Investment Partners, has raised CNY 600m (USD 95m) across two tranches.

China IPOs: Offshore angst

Private equity exit timelines were thrown into disarray last year when US IPOs abruptly stopped. Regulators have offered some clarity, but investors are unsure when – or if – the magic will return

China medtech start-up SiBionics raises $79m

China-based medical technology start-up SiBionics has raised CNY 500m (USD 79m) in a third tranche of Series C funding co-led by CPE and China Life Investment.

Vision Fund leads $150m round for China e-commerce enabler

Shoplazza, a China-based software-as-a-service (SaaS) provider specialising in cross-border e-commerce, has raised USD 150m in the first tranche of Series C led by SoftBank Vision Fund II.

River Head Capital hits first close on latest reminbi fund

China’s River Head Capital has achieved a first close on its second Innovation Growth Fund, a renminbi-denominated vehicle that has an overall target of CNY 2bn (USD 135m).

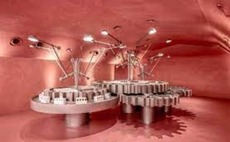

China beauty retailer Harmay raises $200m

Harmay, a China-based omnichannel beauty products retailer, has raised USD 200m across Series C and D rounds.

China's Dishangtie Car Rental raises $200m

Dishangtie Car Rental, a Shenzhen-based electric vehicle (EV) rental service, has raised a USD 200m Series D round across two tranches featuring CICC Capital.

Deal focus: Starfield serves up Series B

The Chinese manufacturer of plant-based protein replacements has secured USD 100m in funding to advance a product portfolio that aspires to diversity and structural sophistication

Q&A: Gulf Capital's Richard Dallas & Shantanu Mukerji

Richard Dallas, a senior managing director at Gulf Capital, and newly appointed Asia head Shantanu Mukerji on using Singapore as a regional hub, cross-border expansion, and why a dedicated regional fund is unlikely

China GPs emphasize consumer sector opportunities

Policy volatility in China has prompted many investors to eschew consumer-facing business models in favour of B2B plays like deep-tech, but sector specialists still see opportunity, the Hong Kong Venture Capital & Private Equity Association’s (HKVCA)...

China 5G chip designer Eigencomm raises $157m

SoftBank Vision Fund II has led a CNY 1bn (USD 157m) Series C for Shanghai-based chipmaker Eigencomm, with participation from new investors Cathay Capital, CoStone Capital, Chobe Capital, and GF Qianhe, a unit of GF Securities.

China plant-based protein player Starfield raises $100m

Primavera Capital Group has led a USD 100m Series B for Starfield, a Chinese producer of plant-based meats.

China sustainability start-up Bluepha raises $235m

Bluepha, a China-based synthetic biology company working on a range of biodegradable plastics, has raised a three-tranche Series B of CNY 1.5bn (USD 235m).

Fund focus: Eastern Bell targets digitalisation

As a supply chain specialist, Eastern Bell Capital claims to have a differentiated take on China industrial digitalisation. It has USD 800m in dry powder to prove this thesis

Sun Hung Kai leads Series B for Singapore digital asset bank

Sygnum, a Singapore and Switzerland-based digital asset bank, has raised a Series B of USD 90m - at a post-money valuation of USD 800m - led by Hong Kong-based investor Sun Hung Kai & Co.

China gene therapy start-up Cure Genetics raises $60m

Advantech Capital has led a USD 60m Series B for Suzhou-based biotech player Cure Genetics. Other investors include Oriza Holdings, Blue Ocean Private Equity, and Qiming Venture Partners.

China's Linear Capital raises $500m

Linear Capital, a China-based, technology-focused investment firm, has raised USD 500m for its fifth US dollar-denominated fund and its second opportunity Fund. It brings the firm’s total assets under management to USD 2bn.

China AI gaming company Parametrix raises $100m

Chinese artificial intelligence (AI) gaming company Parametrix.ai has raised a USD 100m Series B round led by Sequoia Capital China. Existing investors 5Y Capital and Gaorong Capital re-upped.

China CDMO Thousand Oaks raises $240m

Thousand Oaks Biopharmaceuticals, a China-based contract development and manufacturing organization (CDMO), has raised CNY 1.5bn (USD 240m) in funding led by Goldstone Investment - a private equity unit of CITIC Securities - and CDH Investments.