Articles by Justin Niessner

Australia's Square Peg adds partner

Australia-based Square Peg Capital has promoted James Tynan, a principal at the venture capital firm, to partner level. It brings the total number of partners to nine.

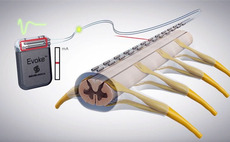

Wellington leads $150m round for Australia's Saluda Medical

Wellington Management has led a USD 150m round for Saluda Medical, an Australian devices company focused on spinal cord stimulation. TPG also came in as a new investor.

India's Paragon raises $86m for Fund II

Indian middle market private equity firm Paragon Partners has closed its second fund on INR 7bn (USD 85.7m). It raised USD 120m in the previous vintage.

Longreach acquires Japan IT company via bolt-on

The Longreach Group has acquired Japanese IT services provider Blueship as a bolt-on for Japan Systems, an existing portfolio company in the space.

MDI leads Series A for Indonesia cloud kitchen

MDI Ventures, the corporate VC arm of state-controlled Telkom Indonesia, has led a USD 13.7m Series A round for local cloud kitchen start-up Legit Group.

Australia cybersecurity start-up raises $20m

Australian cybersecurity start-up Fivecast has closed a USD 20m Series A round led by Ten Eleven Ventures, a US-based specialist in cybersecurity.

JBIC, Mitsui back Singapore's Wellesta

Japan Bank for International Cooperation (JBIC) and Mitsui & Co have invested in Singapore-based Wellesta, a diversified services provider for the regional healthcare industry.

Coller launches $218m renminbi secondaries fund

Coller Capital has launched a renminbi secondaries fund with a target of CNY 1.5bn (USD 218m), confirming it has secured a first close of undisclosed size.

Australia's QIC acquires 50% stake in smart meter business

Queensland Investment Corporation (QIC), an Australian sovereign wealth fund, has agreed to acquire a 50% stake in New Zealand-listed Vector Metering at an enterprise valuation of NZD 2.5bn (USD 1.6bn).

BP, Morgan Stanley back India EV charging station provider

BP Ventures and Morgan Stanley Infrastructure have made a USD 22m equity investment in Magenta Mobility, an Indian electric vehicle (EV) charging station provider.

Deal focus: Hong Kong's Gryfyn issues web3 passport

Gryfyn, the latest project from Hong Kong’s Animoca Brands, has attracted several VC investors, most of which are not existing backers of its parent. The mission is simple: expand the metaverse

Singapore quantum computing start-up secures $18.1m

Singapore’s Horizon Quantum Computing has raised USD 18.1m from a group including Sequoia Capital India and Tencent Holdings.

VCs back Indonesia battery-swapping scooter maker

Ondine Capital, a Southeast Asia-focused VC firm set up by investors from China's CICC Capital and JD.com and Indonesia's MediaTek, has invested in Indonesian battery-swapping scooter maker Swap Energy.

Japan's J-Star names three new partners

Japanese lower middle-market private equity firm J-Star has elevated three longstanding staff to partner, bringing the total number of partners to nine.

Creador completes exit from Malaysia's Mr DIY

Creador has exited its remaining 4.9% equity interest in Malaysia-listed home improvement retailer Mr DIY, generating proceeds of MYR 664m (USD 150.5m).

Japan 'deskless workforce' start-up raises $23m

Japan’s Coral Capital has led a JPY 3bn (USD 23m) Series B round for Kaminashi, a local software start-up targeting an under-digitalised blue-collar segment it calls the “deskless workforce.”

GIC takes co-control of Bain-owned Japan software company

Bain Capital has ceded co-control of Japanese HR software provider Works Human Intelligence (WHI) to GIC in a deal ranked among the Singapore sovereign investor’s largest acquisitions.

Japan's Fiducia hits second close on debut fund

Fiducia, a tech investor set up by the former private markets head of Japan Post Bank, has reached a second close of JPY 3.86bn (USD 29m) following a commitment from SBI Group.

Bessemer leads Series C for New Zealand's Halter

Bessemer Venture Partners has led a NZD 85m (USD 53.3m) Series C round for New Zealand’s Halter, a start-up that makes solar-powered collars for managing cow herds with an app.

Japan's EV Motors raises $27m in extended Series C

Japanese electric vehicle (EV) manufacturer EV Motors has completed an extended Series C round, raising JPY 3.6bn (USD 27.1m) from at least 23 investors.

LG backs US, China autonomous logistics start-up

LG Technology Ventures, the Silicon Valley-based VC arm of Korea’s LG Group, has led a USD 28.8m Series A round for US and China-based logistics automation player Venti Technologies.

India fashion supply chain player Fashinza raises $30m

Indian fashion industry supply chain platform Fashinza has raised USD 30m from Liquidity Group, an Israel and US-based financial technology company and debt investor.

GP profile: Square Peg Capital

Square Peg Capital came of age at the same time as the Australian and Southeast Asian VC ecosystems, straddling the two with a toehold in Israel. The idea was to think big, not get big. It’s doing both

Deal focus: Kredivo cuts through SE Asia growth-stage gloom

Indonesian consumer credit operator Kredivo has punctuated the VC doldrums with an ecosystem-encouraging pre-IPO round. Investors point to low customer acquisition costs as key to the success