Articles by Justin Niessner

SEC votes through disclosure reforms for private funds

The US Securities and Exchange Commission (SEC) has adopted new transparency rules for private equity managers requiring increased reporting, special terms disclosure, and annual fund audits.

CLSA exits Japanese uniform rental business Uni-Mate

Japan’s CLSA Capital Partners (CLSA CP) has sold 100% of uniform rental and cleaning business Uni-Mate to local private equity firm Karita & Company (K&C) for an undisclosed sum.

Australia's Airtree leads round for space tech start-up

Australia’s Airtree Ventures has led a AUD 12m (USD 7.7m) Series A round for HEO Robotics, a local space start-up focused on non-Earth imaging.

LP interview: India’s Catamaran

Catamaran brings a global, tech-savvy approach to private equity that sets it apart from most Indian family offices. A strong historical focus on digital inclusion is now extending into manufacturing

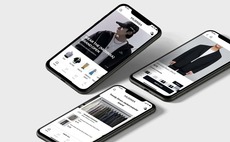

Deal focus: KKR thinks global with Korea’s Musinsa

KKR has made its first tech growth investment in Korea with Musinsa, an online marketplace for a carefully curated selection of streetwear brands with export potential

Horizons leads $50m round for Indonesia EV player IMG

Horizons Ventures, a deep tech investment arm of Hong Kong billionaire Li Ka-Shing, has led a USD 50m Series B round for Indonesian electric vehicle (EV) maker Ilectra Motor Group (IMG).

RRJ invests $300m in Malaysia's Yinson

Hong Kong-based private equity firm RRJ Capital has agreed to invest USD 300m in Malaysia-listed Yinson Holdings, an oil and gas industry supplier aiming to bring cleantech to the local energy sector.

Japan's PowerX raises $32m Series B

PowerX, a Japanese start-up developing a “battery tanker” for shipping stored renewable electricity across oceans, has raised a USD 32m Series B round featuring US-based Translink Capital.

Japan VCs back $100m round for local impact investor Gojo

Japanese impact investor and microfinance institution Gojo & Company has secured a USD 100m Series E from a group of local VC investors including Global Brain and Globis Capital Partners.

TPG, Temasek add $80 to India's Dr Agarwal's

TPG Growth and Temasek Holdings are funding a USD 80m expansion drive for existing investee Dr Agarwal’s Eye Hospital that will see the Indian eyecare chain double its footprint to 300 hospitals.

Japan's Integral files for IPO

Japanese private equity firm Integral Corporation has been approved to go public on the Tokyo Stock Exchange via an IPO that could raise up to JPY 29.3bn (USD 201m).

Mirae Asset acquires majority stake in Australia's Stockspot

Mirae Asset Global Investments has invested about USD 17m in a 53% stake in Stockspot, Australia’s largest robo-advisory.

Singapore's Jungle absorbs healthcare specialist HealthXCapital

Singapore’s Jungle Ventures has ramped up its healthcare investment capacity by combining with local sector specialist HealthXCapital (HXC).

UK VC firm leads $9.4m round for Australia's Pendula

UK-based Octopus Ventures has led a AUD 14.5m (USD 9.4m) round for Australia-based customer retention platform Pendula.

Singapore metaverse player raises $13m seed round

Singapore-based ZTX, which claims to be Asia’s largest metaverse platform, has raised a USD 13m seed round led by US web3 investor Jump Crypto.

China 3D printing player Boston Micro gets $24m Series D

China and US-based microscale 3D printing company Boston Micro Fabrication has raised USD 24m in Series D funding led by Guotai Junan Securities.

IFC to back India's Wellspring Healthcare

The International Finance Corporation (IFC) is set to invest USD 11m in India’s Wellspring Healthcare, which operates 17 primary care clinics in Mumbai and Pune.

Japan's Mixi launches $50m India VC fund

Japanese social media company Mixi has set up a USD 50m corporate venture capital fund targeting Indian start-ups.

AGIC backs Singapore medical device manufacturer

Hong Kong-headquartered AGIC Capital, an Asia-Europe cross-border specialist, has led a growth equity round of undisclosed size for Singapore-based medical devices maker AP Technologies.

Legal action accuses investors of aiding and abetting FTX fraud

Temasek Holdings and SoftBank Group are named in a US class-action lawsuit that claims investors aided and abetted fraud at collapsed crypto exchange FTX.

Singapore commits $111.5m to fintech ecosystem

The Monetary Authority of Singapore (MAS) has committed to invest up to SGD 150m (USD 111.5m) over three years in the local VC and financial technology start-up ecosystem.

Singapore's Quadria secures $200m 'social' credit facility

Singapore-based healthcare specialist Quadria Capital has secured a revolving credit facility of up to USD 200m for investments deemed “social projects.”

Malaysia's Vynn achieves first close on second VC fund

Malaysia-based early-stage investor Vynn Capital has reached a first close of unspecified size on its second fund, with strong support from corporates and family offices in Southeast Asia.

BlackRock, New Zealand launch $1.2b climate fund

BlackRock will manage a climate fund launched alongside the New Zealand government with a target of NZD 2bn (USD 1.2bn). It will focus on renewable energy.