News

Coller closes first deal for debut renminbi fund

Coller Capital has completed the first deal from its debut renminbi-denominated secondaries fund, participating in a CNY 315m (USD 46m) GP-led transaction involving healthcare assets held by Chinese VC firm Legend Capital.

US climate VC leads round for Australia lithium player

Lowercarbon Capital, a US-based VC firm specialising in climate, has led a AUD 23m (USD 15.5m) Series A round for Australian lithium production services company Novalith Technologies.

Aquilius closes debut Asia secondaries fund on $400m

Singapore’s Aquilius Investment Partners, an Asia secondaries specialist set up in 2021 by former executives of Partners Group and The Blackstone Group, has closed its debut fund on USD 400m.

Jungle re-hires fundraiser Menka Sajnani as a partner

Menka Sajnani has re-joined Jungle Ventures as a partner responsible for investor relations, three years after departing the Southeast Asia and India-focused GP to head up Asia IR at B Capital Group.

Warburg Pincus set to buy minority stake in Chinese fund house

Warburg Pincus has received regulatory approval to acquire a 23.3% stake in Zhong Ou Asset Management (Zhong Ou AMC), a Chinese mutual fund manager, from Italy's Intesa Sanpaolo Bank.

Collyer seeks $100m for Southeast Asia fund-of-funds

Collyer Capital, a Singapore-based investment firm co-founded by Eric Marchand, formerly of Unigestion and Campbell Lutyens, is looking to raise around USD 100m for a Southeast Asia-focused fund-of-funds.

Australia's Glow hits first close on debut PE fund

Australian private equity firm Glow Capital Partners has reached a first close of AUD 55m (USD 37m) on its debut fund. The target is AUD 300m.

Australia's Square Peg adds partner

Australia-based Square Peg Capital has promoted James Tynan, a principal at the venture capital firm, to partner level. It brings the total number of partners to nine.

Nio Capital, Xiaomo back China 4D radar start-up Sinpro

Sinpro, a China-based developer of hardware sensor products, has raised a Series A amounting to several hundred million renminbi led by Nio Capital and Xiaomi.

China's Alebund Pharma gets $145m in debt, equity funding

Alebund Pharmaceuticals has raised close to CNY 200m (USD 29m) in a pre-Series C funding round. Investors include state-owned Yangzhou Guojin Investment and Yangzhou Longchuan Holdings.

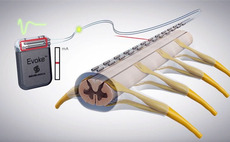

Wellington leads $150m round for Australia's Saluda Medical

Wellington Management has led a USD 150m round for Saluda Medical, an Australian devices company focused on spinal cord stimulation. TPG also came in as a new investor.

Growtheum backs Vietnam's International Dairy Products

Growtheum Capital Partners, a private equity firm established by the former head of GIC’s direct private equity investment group in Southeast Asia, has made a growth capital investment in Vietnam-based International Dairy Products (IDP).

Kotak halts India fund-of-funds

Kotak Investment Advisors (KIAL) has halted fundraising for its latest fund-of-funds, citing the challenging investment environment.

Australia's Milkrun winds down, founder defends business model

The founder of Australian grocery delivery business Milkrun, which announced that it would shutter last week amid challenging market conditions, has defended the start-up’s business model and claimed that its impact on the industry will be long-lasting....

India's Paragon raises $86m for Fund II

Indian middle market private equity firm Paragon Partners has closed its second fund on INR 7bn (USD 85.7m). It raised USD 120m in the previous vintage.

Australia's Crescent closes Fund VII on $670m

Crescent Capital Partners has closed its seventh Australia and New Zealand mid-market fund with AUD 1bn (USD 670m) in commitments.

Japan's Marunouchi Capital hits $303m first close on Fund III

Marunouchi Capital, a Japanese private equity firm controlled by Mitsubishi Corporation, has reached a first close of JPY 40.2bn (USD 303m) on its third fund.

China HR SaaS player Beisen completes $30m HK IPO

Beisen Holding, a China-based human resources software-as-a-service (SaaS) platform backed by the likes of SoftBank Vision Fund 2, Goldman Sachs, Matrix Partners China, and Sequoia Capital China, fell 12% on debut following a HKD 238.9m (USD 30m) Hong...

China automotive parts supplier Bibo raises $29m

Nio Capital and Hangzhou-based Orient Jiafu Asset Management have led a CNY 200m (USD 29m) Series A round for Bibo, a China-based automotive parts supplier.

Longreach acquires Japan IT company via bolt-on

The Longreach Group has acquired Japanese IT services provider Blueship as a bolt-on for Japan Systems, an existing portfolio company in the space.

MDI leads Series A for Indonesia cloud kitchen

MDI Ventures, the corporate VC arm of state-controlled Telkom Indonesia, has led a USD 13.7m Series A round for local cloud kitchen start-up Legit Group.

ResponsAbility sets $450m hard cap for second Asia food fund

Swiss impact investor ResponsAbility has set the hard cap for its second South and Southeast Asia-focused sustainable food fund at USD 450m, having fully deployed Fund I across five investments.

Mistletoe founders to acquire SoftBank Ventures Asia

SoftBank Group has agreed to sell its captive VC unit, SoftBank Ventures Asia (SBVA), to a newly formed entity led by the team behind Japan-headquartered start-up incubation and investment platform Mistletoe.

Australia cybersecurity start-up raises $20m

Australian cybersecurity start-up Fivecast has closed a USD 20m Series A round led by Ten Eleven Ventures, a US-based specialist in cybersecurity.