News

Reed Smith hires Sidley Austin's Asia fund formation leader

Reed Smith has recruited Han Ming Ho, previously co-head of the Asia investment funds practice at Sidley Austin, as a partner in its global corporate group.

Riverside builds out Australia team

The Riverside Company has added two principals to its Australia investment team as its assets under management (AUM) in the country cross the AUD 1.5bn (USD 965m).

Japanese digital alternatives platform gets pre-Series A

Luca, a Japan-based fundraising platform that aims to give local high net worth investors access to alternatives, has received seed-stage funding from VC investors.

T Capital exits Japan confectionery business

Japanese middle market private equity firm T Capital Partners has agreed to sell its majority stake in Confex Holdings, a wholesale confectionery products business, to Yamae Group Holdings for JPY 16.1bn (USD 107m).

Polaris leads $27m round for Singapore's Engine Biosciences

US healthcare and life sciences growth investor Polaris Partners has led a USD 27m Series A round for Singapore-based cancer medicine developer Engine Biosciences.

Hahn acquires SKC's ceramics business for $267m

Korean private equity firm Hahn & Company is set for its sixth deal in five years involving local conglomerate SK Group, having agreed to carve out a fine ceramics business for KRW 360bn (USD 267m).

Blackstone, Vista buy Australia's Energy Exemplar, Riverside exits

The Blackstone Group and Vista Equity Partners have agreed to acquire Energy Exemplar, an Australia-based simulation software company, setting up a sizeable exit for The Riverside Company.

Japan's Integral agrees strategic exit for fertiliser maker Nitto FC

Japanese GP Integral Corporation has agreed to sell fertiliser maker Nitto FC to Ichinen Holdings, a listed automotive supplier with interests in industrial chemicals, for an undisclosed sum.

Hidden Hill leads $137m round for China's CS Smart

Hidden Hill Capital, a private equity firm backed by warehouse operator turned logistics and infrastructure investment manager GLP, has led a CNY 1bn (USD 137m) Series B round for China-based logistics vehicle manufacturer CS Smart.

Aramaco backs Singapore clean energy certificates player

Aramaco Ventures, a VC unit of Saudi oil giant Aramaco, has led a USD 10m Series A round for Singapore’s Redex, an early mover regionally in renewable energy certificates (RECs).

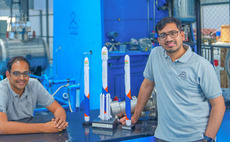

Temasek leads $27.5m round for India space tech player

Temasek Holdings has led a INR 2.25bn (USD 27.5m) pre-Series C round for Indian rocket developer and launch services start-up Skyroot Aerospace.

Indian contract manufacturer Aequs raises $54m

Indian contract manufacturer Aequs has raised INR 4.5bn (USD 54m) in equity funding led by Singapore-based Amansa Capital.

PE-backed Fincare Bank to merge with listed Indian lender

India’s Fincare Small Finance Bank (Fincare SFB), which is backed by the likes of TA Associates, True North, LeapFrog Investments, and Tata Opportunities Fund, has agreed to merge with listed lender Au Small Finance Bank (Au SFB). The combined entity...

Partners Group strengthens Japan private wealth coverage

Partners Group has recruited Tatsuro Aoyama to its private wealth team in Japan with a brief to build out relationships with local distribution partners.

Diageo sells whisky brand to Korean turnaround investor

Global beverage giant Diageo has agreed to sell Windsor, Korea’s best-selling whisky brand, to Pine Tree Investment & Management following the collapse of a transaction involving other Korean private equity firms.

KKR commits $400m to Malaysia's OMS Group

KKR has agreed to invest USD 400m in Malaysian telecoms infrastructure and subsea cable services company OMS Group.

Mandiri, Investible launch climate tech fund

Mandiri Capital, the venture arm of Indonesia’s Bank Mandiri, and Australia-based VC firm Investible have launched a climate technology fund of unspecified size.

PE-backed J&T Express raises $499m in Hong Kong IPO

J&T Global Express, an express delivery business that launched in Indonesia and expanded region-wide, traded flat on debut following a HKD 3.9bn (USD 499m) Hong Kong IPO.

Korea Investment Partners raises $60m SE Asia fund

Korea Investment Partners (KIP) has raised USD 60m for a Southeast Asia venture fund from institutional investors in Korea, Hong Kong, and Singapore.

CVC buys majority stake in Philippines hospital business

CVC Capital Partners has acquired a 63.94% stake in Philippines-based hospital operator The Medical City (TMC) following the completion of a tender offer.

Flourish Ventures secures $350m in new funding

Flourish Ventures, a US-based emerging markets financial technology investor with a strong Asia focus, has secured USD 350m for future deployments from its sole LP, eBay founder Pierre Omidyar.

SparkLabs launches Korea deep tech fund

Early-stage VC investor and accelerator SparkLabs Korea has achieved a first close of USD 15m on a deep tech fund. That target corpus has not been confirmed.

PE-owned Kokusai Electric gains on debut after $720m Japan IPO

KKR-owned Kokusai Electric gained 28% on debut after raising JPY 108.3bn (USD 720m) in Japan’s largest IPO in five years.

Stellantis buys 20% stake in VC-backed Chinese EV maker

LeapMotor, a Chinese electric vehicle (EV) manufacturer that received substantial private funding prior to its Hong Kong IPO in September 2022, has agreed to sell an approximately 20% stake to European automaker Stellantis for HKD 8.5bn (USD 1.1bn).