Hahn acquires SKC's ceramics business for $267m

Korean private equity firm Hahn & Company is set for its sixth deal in five years involving local conglomerate SK Group, having agreed to carve out a fine ceramics business for KRW 360bn (USD 267m).

The seller, SK Group affiliate SKC, said in a filing that the divestment would allow it to strengthen its balance sheet and facilitate business reorganisation. This is the company's second sale to private equity in the space of three weeks. It offloaded SK Pucore, a manufacturer of polyols used in PET films, to Glenwood Private Equity for KRW 410.3bn.

Hahn & Co's most recent SK deal was also a carve-out from SKC. Last year, the private equity firm paid KRW 1.6trn for SK Future Materials, an industrial materials business best known for producing PET films.

SKC's entire industrials division, which generated KRW 1.13trn in revenue in 2021, was reclassified as a discontinued operation in the company's 2022 financial statements. SKC posted overall revenue of KRW 3.14trn in 2022, most of which came from the chemicals and rechargeable battery divisions.

Industrials was always smaller in terms of operating profit, accounting for just 17% of the KRW 401.5bn reported for 2021. The chemicals share was 82% in 2021 and 63% - out of KRW 220.3bn – in 2022.

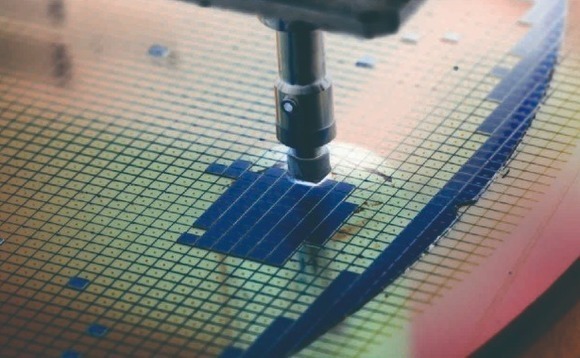

The fine ceramics business produces high-purity quartz and silicon carbide consumable materials used in advanced semiconductor manufacturing. It is a market leader with over 30 years of experience and is an integral part of the global semiconductor industry in Korea, according to a statement.

Hahn & Co's other SK deals include used car retailer SK Encar, renewable energy project developer SK D&D, wet tanker and liquefied natural gas transporter SK Shipping, and the biofuels unit of SK Chemicals.

The private equity firm is currently in the market raising its fourth flagship buyout fund. A first close of USD 1.9bn – against an overall target of USD 3.2bn – came in June. On the investment side, Hahn & Co recently acquired a nearly two-thirds stake in Korea-listed medical laser maker Lutronic through a tender offer for about KRW 629bn.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.