ZhenFund

GSR, BAI lead round for Chinese industrial SaaS provider

GSR Ventures and Bertelsmann Asia Investments (BAI) have led an RMB150 million ($22 million) Series B round for Black Lake Technology, a China-based supplier of data collection, visualization and analysis to factories.

China's Up Fintech trades up after $104m US IPO

Up Fintech, an online brokerage firm focused on global Chinese investors that operates in Asia as Tiger Brokers, gained more than 36% in its first day of trading on NASDAQ after raising $104 million in its IPO.

VC-backed Chinese online brokerage files for US listing

Chinese online brokerage Tiger Brokers, which is backed by smart phone maker Xiaomi and a number of venture capital firms, has filed for an IPO in the US.

GGV leads $108m round for Chinese e-commerce platform

Chinese community e-commerce platform Xiaoqule has raised $108 million in a Series A round of funding led by GGV Capital and Vertex Ventures.

Sequoia China, ZhenFund launch entrepreneur club

Sequoia China Capital and ZhenFund have announced plans to launch a non-profit community dedicated to providing training courses and resources to Chinese entrepreneurs.

Deal focus: XtalPi takes big pharma into the cloud

China and US-based XtalPi has raised $61 million this year from investors impressed its use of quantum physics, computational chemistry, and artificial intelligence to bring greater certainty to drug development

China Life backs AI drug development platform XtalPi

A healthcare fund managed by China Life Insurance has led a $46 million extended Series B investment in XtalPi, a US-based artificial intelligence-enabled healthcare services platform established by Chinese scientists.

Sequoia leads Series B for China's Deep Intelligent Pharma

Deep Intelligent Pharma (DIP) has raised $15 million in a Series B funding from Sequoia Capital China, with the proceeds to be used for accelerating the development of the company’s artificial intelligence (AI) powered drug discovery platform.

SIG leads Series B-plus for China car-sharing platform Togo

Chinese car-sharing platform Togo has received millions of US dollars in an extended Series B funding round led by Susquehanna Asia Investment (SIG), with participation from ZhenFund and Crescent Point. It takes the company’s total funding since inception...

Chinese second-hand goods trading platform raises $65m

Sequoia Capital China has led an extended Series B round worth $65 million for Xiangwushuo, a Chinese online trading platform for second-hand goods. The company, which was founded as recently as 2017, has now raised $110 million in cumulative funding....

Advance.AI raises $50m, targets Southeast Asia expansion

A group of Southeast Asian and Chinese investors has provided a $50 million extended Series B round of funding for Advance.AI, a big data specialist with offices in Beijing, Singapore, Jakarta, and Manila.

China social e-commerce player Red raises $300m

Alibaba Group has led a $300 million Series D round of funding for Red, a social e-commerce site that enables Chinese consumers to buy products from overseas.

GGV leads $15.7m Series B for China's Synyi

Synyi, a Chinese artificial intelligence (AI) start-up that helps hospitals and medical research institutes process and manage data, has received RMB100 million ($15.7 million) in Series B funding led by GGV Capital.

China's Club Factory raises $100m Series C

Club Factory, a China-based e-commerce platform that sells fashion products overseas, has raised $100 million in a Series C round of funding from existing investors IDG Capital Bertelsmann Asia Investment (BAI).

Joy leads $20m round for Chinese e-commerce site

Joy Capital has led a $20 million round of funding for The Good Stuff, an e-commerce start-up that uses online influencers to sell products.

SBCVC leads $30m round for China healthcare AI firm

SBCVC has led a RMB200 million ($30 million) Series B round for 12 Sigma, a China-based biotechnology company that applies artificial intelligence (AI) technology to medical image diagnoses.

Hong Kong AI fintech start-up MioTech gets $7m Series A

Horizons Ventures, a private investment arm of Hong Kong billionaire Li Ka-shing, has led a $7 million Series A round of funding for MioTech, a Hong Kong-based start-up that develops artificial intelligence (AI) software for the financial services sector....

China's 51Job acquires majority stake in VC-backed Lagou

US-listed Chinese recruitment site 51Job has agreed to acquire a 60% stake in industry peer Beijing Lagou Network Technology, which is backed by Qiming Venture Partners and other VC investors, for $119 million.

VCs back China smart vending machine operator

Citybox, a China-based smart vending machine operator, has secured a $15 million Series A round of funding from GGV Capital, Yunqi Partners, Blue Lake Capital and ZhenFund.

China's VIPKid raises $200m Series D

VIPKid, a China-based English-language learning platform backed by VC investors, has completed a $200 million Series D round of funding, in what the company claims is the largest investment in the K-12 education space globally.

Chinese agricultural drone platform secures Series A round

Farm Friend, a Beijing-based agricultural drone services platform, has raised a RMB50 million ($7 million) Series A round led by Gobi Partners.

Hillhouse leads $55m round for China AI developer Yitu

Hillhouse Capital has led a RMB380 million ($55 million) Series C round of funding for Yitu Technology, a Shanghai-based artificial intelligence (AI) technology developer.

China co-working space operators UrWork, New Space merge

UrWork, a Chinese VC-backed co-working office space provider, has agreed to merge with its industry peer New Space. The combined entity will be worth RMB9 billion ($1.3 billion).

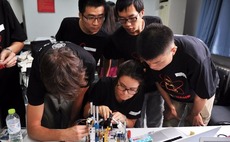

China edtech: Tangible teachings

Educational hardware remains an emerging investment segment globally. In China, cultural shifts are piquing expectations for a local boom, but success will depend on various cross-market diversifications