China edtech: Tangible teachings

Educational hardware remains an emerging investment segment globally. In China, cultural shifts are piquing expectations for a local boom, but success will depend on various cross-market diversifications

The latest investment in Chinese education technology reflects the rising profile of hardware in a software-dominated field. The strategy behind the deal, however, suggests this warmer sentiment comes with an asterisk.

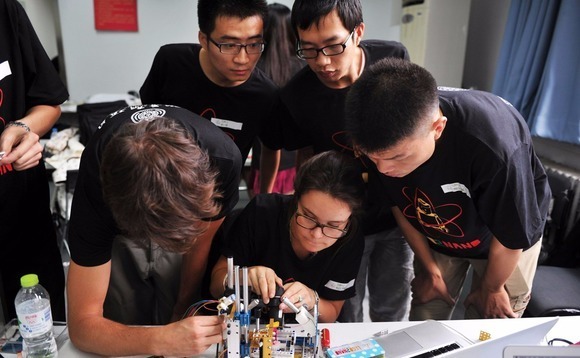

Makeblock – a domestic start-up focused on educational robot construction kits –received a $30 million Series B round led by Shenzhen Capital and Evolution Media China (EMC), an arm of US-based Evolution Media Partners. The prevailing interpretation is that the investment highlights a VC awakening about China's potential to service growing interest in business models based on hardware-related curricula such as science, technology, engineering and mathematics (STEAM).

"In an increasingly complex world, the demand for workers with sophisticated problem-solving skills that students learn by studying STEAM is stronger than ever," says Charles Li, an associate at EMC. "We have been looking at the market for a while, and Makeblock really impresses us with its enthusiastic team, unique product, strong pipeline and global positioning. We believe that Makeblock will keep perfecting the combination of education and entertainment and become the 21st century Lego."

More quantifiably, the company is posting fast revenue growth, driven by sales in some 140 countries. The plan is therefore to further internationalize operations, with the fresh capital aimed at opening new offices in the US, Japan, the Netherlands and possibly Singapore within the year. EMC hasn't formally outlined its value-add contribution yet, but its background in international media suggests it will focus on cross-border marketing.

For industry observers, the implication is clear. Despite anecdotal evidence that STEAM is catching on in China, the country's educational hardware companies will have to be able to flex some global muscle.

Building blocks

The fundamental appeal of educational hardware recalls many of the drivers behind the smart phone phenomenon. As the production costs continue to drop and coding languages become simpler, the world of electronics and programming is opening up to children who might be distracted by educational material without a physical context. At the same time, the emergence of digital-from-birth generations as culturally distinct consumer sets is placing new demands on how connected devices enhance traditional lifestyle routines.

The pros and cons of hardware business models play out in China as they do in other major economies, but with a relatively less inviting cultural backdrop for STEAM education and only a smattering of viable investment targets in related segments. Northern Light Venture Capital, a China-focused firm, has reflected VC appetite in the country by indirectly backing Makeblock via a local angel fund but otherwise steering its education agenda towards online teaching platforms.

"We found STEAM education to be so popular in the US that we tried to find STEAM companies in China, but there have not been a lot of very good candidates," says Lu Lin, an executive director at Northern Light. "In China, most people will still only pay for services like live one-on-one lesson streaming for English and mathematics."

Cracking the educational hardware market in China therefore requires investors to remember that device manufacturers are still software companies at heart. This view has prompted a number of successful combination plays incorporating services and user data that make hardware "smart" over time. For Wonder Workshop, a US and China-based educational robot maker backed by Sinovation Ventures, the dual hardware-software approach has focused on content for subscription. The company raised a $20 million Series B last year to support further expansion in China.

"The gadget should be a Trojan Horse that wraps around something valuable for users on an ongoing basis," explains Angela Bao, senior investment manager at Sinovation. "When considering a hardware investment, we always look deep into how the technology addresses a core pain point for the users and how the start-up weaves non-hardware elements into its go-to-market and expansion strategy."

Hybrid approach

Piggybacking software products on physical learning toys could be a particularly savvy ploy in China because the popularity of professional after-school tutoring is believed to be disproportionally expanding sales potential by blurring the lines between B2B and B2C opportunities. The effect could be further amplified as the country's education methods evolve in step with other social modernizations.

"In terms of general educational hardware adoption, like interactive whiteboards, tablets and connectivity, China is nowhere close to the US," Bao adds. "But we've seen a growing trend among tier-one schools that are opening up for mobile devices and creative products."

Most of these schools are in the affluent cities and provinces of the east coast. Hong Kong is one of the standout markets, with more than 400 of about 1,000 local schools now using STEAM educational hardware.

It also helps to focus on elementary and junior high schools, which often have a more open attitude towards creative learning methods and products since they face less academic pressure. As a result, the hardware companies that got their start in the advanced, US-led hobbyist niche known as the ‘maker' market are now anticipating a more universal social movement by targeting an ever-younger clientele.

"Kids and parents are surrounded by technology and every conversation about what they're going to do in the future leads to more engineering in hardware, robotics and electronics," says Cyril Ebersweiler, founding and managing director at hardware accelerator HAX. "But in China, being a ‘maker' is not cool because it's going back to the blue collar roots of manufacturing and doing things with your hands. It's funny that it's the more progressive parents who understand that we need to go back to the basics of the past if we want to build new things for the future."

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.