Region

PE-backed GoTo targets $1.1b Indonesia IPO

Indonesia-based ride-hailing service turned super app GoTo, which counts Alibaba Group and SoftBank Vision Fund among its largest external investors, is looking to raise at least IDR 15.2trn (USD 1.1bn) through a domestic IPO.

Lyfe, Qiming lead Series B for China ADC player Medilink

Suzhou Medilink Therapeutics, a Chinese biotech company specializing in antibody-drug conjugates (ADCs) commonly used as targeted therapies for treating cancer, has raised a USD 70m Series B led by Lyfe Capital and Qiming Venture Partners.

India's Licious raises $150m at $1.6bn valuation

India’s Licious, a direct-to-consumer fresh meat and seafood delivery company, has raised a USD 150m round led by Amansa Capital at a valuation of USD 1.6bn.

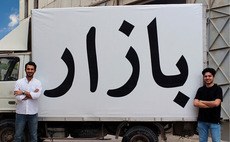

Pakistan's Bazaar gets $70m Series B

Pakistani B2B e-commerce and financial technology platform Bazaar has raised a USD 70m Series B round led by Dragoneer Investment Group and Tiger Global Management.

Deal focus: Mighty Jaxx revels in 'phygital' bridge role

In collectables maker Mighty Jaxx, East Ventures saw not only an effective traditional retail brand, but a company capable of elevating the user experience by straddling the digital and physical worlds

Deal focus: Financial crime pays for Silent Eight

Singapore’s Silent Eight is tackling the toughest cybersecurity subsegment and securing global clients in its early stages. Wavemaker Partners predicts a near-term explosion in growth

Deal focus: Chatbots position for cross-border expansion

Cathay Innovation, an affiliate of Cathay Capital, sees voice recognition services as a key area of B2B growth. Singapore’s AI Rudder is hoped to prove this idea on a global scale

Profile: Foundation Private Equity's Jeremy Foo

Moving from direct investment to secondaries with Foundation Private Equity took Jeremy Foo outside his comfort zone, but past experiences of liquidity crunches have proved instructive

Flexibility first: Investing in the future of work

Investment in work-tech has soared as start-ups devise solutions for workforces that are increasingly distributed in terms of location, structure, and practice. Data, and knowing what to do with it, is key

China 3D content platform Xverse raises $120m

Xverse, a Shenzhen-based 3D user-generated content platform has raised USD 120m across a Series A and a Series A extension, led by GL Ventures and Sequoia Capital China, respectively.

Korean metaverse player closes Series A, hits $807m valuation

VA Corporation, a Korean virtual content provider that is positioning itself as a metaverse platform, has achieved a valuation of KRW 1trn (USD 807m) on closing a KRW 100bn Series A round.

Tiger Global leads Series A for New Zealand's ArchiPro

Tiger Global Management has led a NZD 35m (USD 24m) Series A round for New Zealand’s ArchiPro, a platform that connects homeowners with interior design and construction professionals.

J-Star exits Japan nursing care provider

J-Star has exited dementia-focused nursing care provider Platia to Bain Capital-owned counterpart Nichii Gakkan for an undisclosed sum.

India's Byju's raises $800m at $22b valuation

Indian education platform Byju’s has raised USD 800m at an estimated valuation of USD 22bn, with the company’s founder Byju Raveendran providing USD 400m.

Source Code leads Series B for China's Fair Robotics

Fair Robotics, a China-based collaborative robot developer, has raised a USD 50m Series B round led by Source Code Capital.

Singapore financial crime AI start-up gets $40m

Singapore’s Silent Eight, a compliance and financial crime risk investigation platform, has raised a USD 40m Series B round led by US-based TYH Ventures.

Farallon calls on Toshiba to reconsider PE buyout

Farallon Capital Management, a minority shareholder in Toshiba Corporation, has called on the company to reconsider bringing in a private equity investor amid mounting opposition to a two-way spinoff.

BPEA generates $333m through Coforge partial exit

Baring Private Equity Asia (BPEA) has made another partial exit from Indian IT solutions business Coforge, generating INR 25.6bn (USD 333.5m) in proceeds and reducing its position in the company below 50%.

China's Cloudview reaches $316m first close on renminbi fund

Cloudview Capital, a Chinese GP that previously operated as a joint venture with ICBC International, has completed a first close on its second renminbi-denominated Fund with CNY 2bn (USD 316m) in commitments.

China smart text processing start-up raises $92m

Data Grand, a China-based specialist in text recognition and processing robotics, has raised CNY 580m (USD 92m)in Series C round featuring China Merchants Securities, CITIC Securities, GF Securities, and China Securities.

India fintech player Money View gets $75m Series D

Money View, an India-based financial technology start-up involved in lending, card issuance, and buy now, pay later products (BNPL), has raised US 75m in Series D funding at a valuation of USD 625m.

Nepal's Dolma hits second close on Fund II

Nepal’s Dolma Fund Management has reached a second close of USD 50m on its second impact fund with the addition of the US International Development Finance Corporation (DFC) as an LP.

Warburg Pincus buys majority stake in India's Imperial Auto

Warburg Pincus has acquired Imperial Auto Industries, one of India’s oldest automotive parts manufacturers, for an undisclosed sum.

East leads $20m round for Singapore's Mighty Jaxx

Singapore-based toy figurine manufacturer Mighty Jaxx has raised USD 20m in an extended Series A led by East Ventures. Crypto specialist Mirana Ventures also participated.