Pakistan's Bazaar gets $70m Series B

Pakistani B2B e-commerce and financial technology platform Bazaar has raised a USD 70m Series B round led by Dragoneer Investment Group and Tiger Global Management.

Existing investors Defy Partners, Wavemaker Partners, Indus Valley Capital, Acrew Capital, B&Y Venture Partners, and Zayn Capital also participated. It comes six months after a USD 30m round led by Defy and Wavemaker that was touted as Pakistan's largest-ever Series A.

It extends a boom in Pakistan's start-up scene that appears to signal a virtuous cycle of local talent gravitating toward entrepreneurship and venture capital increasingly targeting the ecosystem. In the past 12 months, Indus Valley and Gobi Ventures have launched local funds, while 500 Global is establishing a local presence. CDC Group, a Gobi LP, estimates VC funding in the first half of 2021 outstripped the previous five years combined.

Meanwhile, improving sentiment for entrepreneurial culture has been evident in the likes of Airlift, a last-mile delivery app that raised an USD 85m Series B last year. The sum represented 5% of Pakistan's foreign direct investment (FDI) for fiscal 2021. Airlift said technology start-ups alone could contribute more than 10% of FDI in the upcoming years.

Bazaar aims to build an operating system for the domestic USD 170bn traditional retail economy, which is primarily offline and dominated by 5m small to medium-sized businesses. This merchant base lacks access to formal financial services and targets the world's third largest unbanked population amid a massive digital penetration wave. Bazaar seeks to exploit this by aggregating, digitising, and financing the fragmented retail landscape.

The company has expanded to 21 towns and cities in the past two years, covering 30% of Pakistan's population through several fulfillment facilities. It claims to be adding 3-4 new cities and towns every month, putting it on course to establish the country's largest tech-enabled last-mile footprint by the end of the year. The service is said to provide "hundreds of top brands and manufacturers" with real-time analytics and brand performance intelligence.

Bazaar describes its merchant software product, Easy Khata, as bringing a new dimension to B2B e-commerce in emerging markets. The idea is to provide a core system of record for merchants, helping them digitise procurement, inventory management, customer engagement, accounting, and lending. The app has onboarded by 2.4m businesses in 500 cities and towns, recording more than USD 10bn in annualised bookkeeping transaction value.

Bazaar Credit, a recently launched short-term working capital financing product, provides much-needed liquidity to its largely unbanked merchant base. To date, Bazaar has provided thousands of digital loans, claiming 100% repayment and significant uplift in merchant buying volumes. The credit model incorporates data from both Bazaar's marketplace and merchant software products, which is said to provide a differentiated ability to lend to this segment.

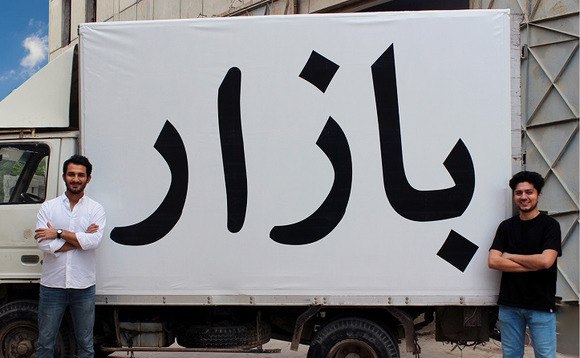

"With significant backing of two of the largest venture growth funds in the world, we believe this will continue to change the narrative on the country and inspire countless more and bigger stories in near future. This is a result of the trust and partnership of our colleagues, suppliers and most importantly our customers – the small merchants who are the backbone of our economy." Bazaar's founders Hamza Jawaid and Saad Jangda said in a statement.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.