Warburg Pincus buys majority stake in India's Imperial Auto

Warburg Pincus has acquired Imperial Auto Industries, one of India’s oldest automotive parts manufacturers, for an undisclosed sum.

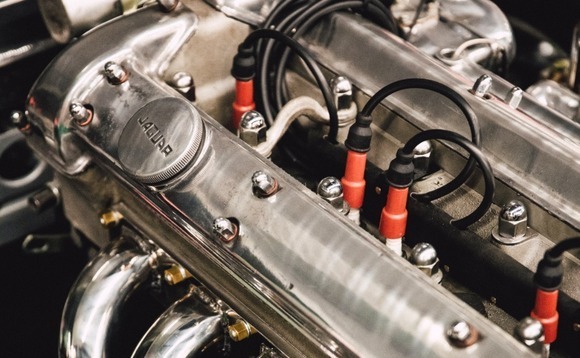

The company claims to be the country's leading supplier of fluid transmission products (FTP) for automobile and off-highway segments. It has a library of more than 25,000 stockkeeping units (SKUs), including rubber hoses, metal and nylon tubes, and hose assemblies, as well as battery cooling products used in electric vehicles (EVs).

Established in 1969 in Faridabad, Imperial Auto now has 20 directly owned manufacturing facilities across India and another seven units as part of joint ventures. The international footprint encompasses Germany and the US. It serves original equipment manufacturers (OEMs) in domestic and overseas markets, generating approximately INR 22bn in annual revenue.

According to a statement, the company is well-positioned to capitalise on a domestic demand revival and to capture export opportunities created by recent disruptions in US and global supply chains. It also expects to tap into the rise of EVs by leveraging its expertise in fluid transmission to develop more products in the battery cooling space.

"This investment will help us fund our future growth plans which include capacity expansion, creation of best-in-class facilities for domestic and export clients and acceleration of EV related product development," said Tarun Lamba, a managing director and CEO of Imperial, who will continue to lead the business under Warburg Pincus.

The private equity firm's previous exposure to the Indian automotive sector includes investments in two tyre manufacturers. It acquired a 70% interest in Alliance Tire Group in 2007 for USD 150m, selling to KKR for around USD 450m six years later. In 2020, Warburg Pincus committed approximately USD 70m to Apollo Tyres.

EY acted as the sole financial advisor to Imperial on the latest transaction.

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.