Region

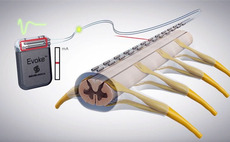

Wellington leads $150m round for Australia's Saluda Medical

Wellington Management has led a USD 150m round for Saluda Medical, an Australian devices company focused on spinal cord stimulation. TPG also came in as a new investor.

Growtheum backs Vietnam's International Dairy Products

Growtheum Capital Partners, a private equity firm established by the former head of GIC’s direct private equity investment group in Southeast Asia, has made a growth capital investment in Vietnam-based International Dairy Products (IDP).

Kotak halts India fund-of-funds

Kotak Investment Advisors (KIAL) has halted fundraising for its latest fund-of-funds, citing the challenging investment environment.

Australia's Milkrun winds down, founder defends business model

The founder of Australian grocery delivery business Milkrun, which announced that it would shutter last week amid challenging market conditions, has defended the start-up’s business model and claimed that its impact on the industry will be long-lasting....

India's Paragon raises $86m for Fund II

Indian middle market private equity firm Paragon Partners has closed its second fund on INR 7bn (USD 85.7m). It raised USD 120m in the previous vintage.

Australia's Crescent closes Fund VII on $670m

Crescent Capital Partners has closed its seventh Australia and New Zealand mid-market fund with AUD 1bn (USD 670m) in commitments.

Japan's Marunouchi Capital hits $303m first close on Fund III

Marunouchi Capital, a Japanese private equity firm controlled by Mitsubishi Corporation, has reached a first close of JPY 40.2bn (USD 303m) on its third fund.

China HR SaaS player Beisen completes $30m HK IPO

Beisen Holding, a China-based human resources software-as-a-service (SaaS) platform backed by the likes of SoftBank Vision Fund 2, Goldman Sachs, Matrix Partners China, and Sequoia Capital China, fell 12% on debut following a HKD 238.9m (USD 30m) Hong...

China automotive parts supplier Bibo raises $29m

Nio Capital and Hangzhou-based Orient Jiafu Asset Management have led a CNY 200m (USD 29m) Series A round for Bibo, a China-based automotive parts supplier.

Longreach acquires Japan IT company via bolt-on

The Longreach Group has acquired Japanese IT services provider Blueship as a bolt-on for Japan Systems, an existing portfolio company in the space.

MDI leads Series A for Indonesia cloud kitchen

MDI Ventures, the corporate VC arm of state-controlled Telkom Indonesia, has led a USD 13.7m Series A round for local cloud kitchen start-up Legit Group.

ResponsAbility sets $450m hard cap for second Asia food fund

Swiss impact investor ResponsAbility has set the hard cap for its second South and Southeast Asia-focused sustainable food fund at USD 450m, having fully deployed Fund I across five investments.

Mistletoe founders to acquire SoftBank Ventures Asia

SoftBank Group has agreed to sell its captive VC unit, SoftBank Ventures Asia (SBVA), to a newly formed entity led by the team behind Japan-headquartered start-up incubation and investment platform Mistletoe.

Australia cybersecurity start-up raises $20m

Australian cybersecurity start-up Fivecast has closed a USD 20m Series A round led by Ten Eleven Ventures, a US-based specialist in cybersecurity.

JBIC, Mitsui back Singapore's Wellesta

Japan Bank for International Cooperation (JBIC) and Mitsui & Co have invested in Singapore-based Wellesta, a diversified services provider for the regional healthcare industry.

Southern leads $31.5m round for fintech player Soft Space

Southern Capital has led a USD 31.5m funding round for Southeast Asia-focused payments technology provider Soft Space.

China hotpot home dining player Guoquan pursues HK listing

Guoquan, a Chinese hotpot ingredients supplier that now positions itself as a one-stop home meal solutions brand, has filed for a Hong Kong IPO.

Lightspeed China hits first close on renminbi fund

Lightspeed China Partners has returned to the renminbi funds space for the first time in seven years, reaching a first close of CNY 800m (USD 116m) on its latest local currency vehicle.

PAG cuts target size of Asia fund by one third

PAG has reduced the target size of its fourth pan-Asian buyout fund to USD 6bn from USD 9bn, according to Mergermarket, AVCJ's sister publication.

Coller launches $218m renminbi secondaries fund

Coller Capital has launched a renminbi secondaries fund with a target of CNY 1.5bn (USD 218m), confirming it has secured a first close of undisclosed size.

Temasek increases holding in India's Manipal Health

Temasek Holdings is set to become the majority shareholder in Indian hospital operator Manipal Health Enterprises, having agreed to acquire an additional 41% stake in the company. The transaction facilitates an exit for TPG Capital, but the PE firm will...

Fund focus: Iron Pillar takes India SaaS to the world

Iron Pillar has secured USD 129m for what it claims is the first India venture-growth fund dedicated to supporting local companies with global software and cloud infrastructure solutions

China chip packaging player SJ Semiconductor raises $340m

Legend Capital, CITIC Securities-controlled Goldstone Investment, and Ince Capital have participated in an extended Series C round of USD 340m for SJ Semiconductor, a China-based chip packaging business.

Australia's QIC acquires 50% stake in smart meter business

Queensland Investment Corporation (QIC), an Australian sovereign wealth fund, has agreed to acquire a 50% stake in New Zealand-listed Vector Metering at an enterprise valuation of NZD 2.5bn (USD 1.6bn).