Region

Everstone exits India's Servion Global Solutions to EMK Capital

Everstone Capital has sold Indian customer experience management provider Servion Global Solutions to UK private equity investor EMK Capital for an undisclosed sum.

Kedaara targets up to $1.5b for fourth India fund

Kedaara Capital is looking to raise up to USD 1.5bn for its fourth India middle-market fund, having edged past the USD 1bn mark in the previous vintage.

Japan's Sensyn Robotics raises $15m

Japan’s Sensyn Robotics, which develops drones for various industrial inspection applications, has raised JPY 2.25bn (USD 15m) in growth funding from several local banks and VC investors.

Ares raises $2.4b for sixth Asia special situations fund

Ares Management has closed its sixth Asia special situation fund on USD 2.4bn, including a sidecar vehicle, citing strong economic trends in India and Australia.

MassMutual Ventures leads Series A for India's Sugarfit

Sugarfit, an India-based health technology start-up that helps people manage type-two diabetes with a view to reversing the condition, has raised USD 11m in Series A funding.

Reed Smith hires Sidley Austin's Asia fund formation leader

Reed Smith has recruited Han Ming Ho, previously co-head of the Asia investment funds practice at Sidley Austin, as a partner in its global corporate group.

Riverside builds out Australia team

The Riverside Company has added two principals to its Australia investment team as its assets under management (AUM) in the country cross the AUD 1.5bn (USD 965m).

Japanese digital alternatives platform gets pre-Series A

Luca, a Japan-based fundraising platform that aims to give local high net worth investors access to alternatives, has received seed-stage funding from VC investors.

T Capital exits Japan confectionery business

Japanese middle market private equity firm T Capital Partners has agreed to sell its majority stake in Confex Holdings, a wholesale confectionery products business, to Yamae Group Holdings for JPY 16.1bn (USD 107m).

Polaris leads $27m round for Singapore's Engine Biosciences

US healthcare and life sciences growth investor Polaris Partners has led a USD 27m Series A round for Singapore-based cancer medicine developer Engine Biosciences.

Hahn acquires SKC's ceramics business for $267m

Korean private equity firm Hahn & Company is set for its sixth deal in five years involving local conglomerate SK Group, having agreed to carve out a fine ceramics business for KRW 360bn (USD 267m).

Blackstone, Vista buy Australia's Energy Exemplar, Riverside exits

The Blackstone Group and Vista Equity Partners have agreed to acquire Energy Exemplar, an Australia-based simulation software company, setting up a sizeable exit for The Riverside Company.

Japan's Integral agrees strategic exit for fertiliser maker Nitto FC

Japanese GP Integral Corporation has agreed to sell fertiliser maker Nitto FC to Ichinen Holdings, a listed automotive supplier with interests in industrial chemicals, for an undisclosed sum.

Money train: Raising capital out of Asia

Fundraising difficulties at home are prompting some US and European GPs to target Asian capital pools that they previously overlooked. It requires patience and persistence

Deal focus: Affirma generates 8x return with India's TBO

Affirma Capital makes good on a partial exit from Indian travel agent software provider TBO.com as General Atlantic comes in to help rekindle plans for a domestic IPO

Deal focus: Algae-based bio-plastics come to Asia

US-based Algenesis has figured out how to make plastic from algae. Singapore’s Circulate Capital is helping the company bring the technology to Asian manufacturers

LP interview: Australia's QIC

As QIC’s PE programme tilts toward earlier stages, legacy assets have counterbalanced macro turbulence in tech. More direct investment is desired, but funds are still of interest, especially in Europe

Hidden Hill leads $137m round for China's CS Smart

Hidden Hill Capital, a private equity firm backed by warehouse operator turned logistics and infrastructure investment manager GLP, has led a CNY 1bn (USD 137m) Series B round for China-based logistics vehicle manufacturer CS Smart.

Aramaco backs Singapore clean energy certificates player

Aramaco Ventures, a VC unit of Saudi oil giant Aramaco, has led a USD 10m Series A round for Singapore’s Redex, an early mover regionally in renewable energy certificates (RECs).

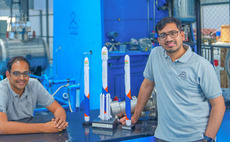

Temasek leads $27.5m round for India space tech player

Temasek Holdings has led a INR 2.25bn (USD 27.5m) pre-Series C round for Indian rocket developer and launch services start-up Skyroot Aerospace.

Indian contract manufacturer Aequs raises $54m

Indian contract manufacturer Aequs has raised INR 4.5bn (USD 54m) in equity funding led by Singapore-based Amansa Capital.

PE-backed Fincare Bank to merge with listed Indian lender

India’s Fincare Small Finance Bank (Fincare SFB), which is backed by the likes of TA Associates, True North, LeapFrog Investments, and Tata Opportunities Fund, has agreed to merge with listed lender Au Small Finance Bank (Au SFB). The combined entity...

Partners Group strengthens Japan private wealth coverage

Partners Group has recruited Tatsuro Aoyama to its private wealth team in Japan with a brief to build out relationships with local distribution partners.