IPO

PE-backed Harbour BioMed raises $221m in Hong Kong IPO

Harbour BioMed, a Chinese drug developer backed by the likes of Advantech Capital, Legend Capital and GIC, raised HK$1.71 billion ($221 million) through a Hong Kong IPO.

Australia IPOs: Window of opportunity

Australian public market investors are famously unforgiving of private equity when IPOs fail to perform. The markets are open for business again, but how long will the golden period last?

PE-owned Burger King India pursues $110m IPO

The Indian franchise of US fast food giant Burger King will launch its IPO this week seeking to raise up to INR8.1 billion ($109.5 million), facilitating a partial exit for majority shareholder Everstone Group.

Advent set for partial exit in Silk Laser's Australia IPO

Silk Laser Clinics, an Australia-based cosmetic treatments business, is looking to raise A$83.4 million ($61.5 million) through a domestic IPO, which will facilitate a partial exit for majority owner Advent Partners.

JD Health targets largest Chinese PE-backed IPO in two years

JD Health, a Chinese online-to-offline healthcare business that raised around $1.9 billion from private investors after it spun out from JD.com, is looking to raise HK$26.9 billion ($3.48 billion) in its Hong Kong IPO.

Warburg Pincus set for another partial exit from ESR

Warburg Pincus has agreed to make another partial exit from ESR, the pan-Asian logistics real estate platform it established in 2011 and took public last year, which will see its stake fall to 4.56%.

Cross-border e-commerce player Wish files for US IPO

Wish, a cross-border e-commerce platform that connects Chinese merchants who primarily sell products through domestic channels like Alibaba Group’s Taobao and Tmall with consumers in the US and Europe, has filed for a US IPO.

PE-backed Antengene trades flat after $359m HK IPO

Antengene, a China-based drug developer that previously raised $238 million across three private funding rounds, closed roughly flat on its first day of trading in Hong Kong following a HK$2.78 billion ($359 million) IPO.

PE-backed Perfect Diary jumps 75% on debut after $616m IPO

Yatsen Holding, the parent company of Chinese cosmetics brand Perfect Diary, gained 75% on its first day of trading on the New York Stock Exchange following a $616.9 million IPO.

Macquarie, Armitage-backed Nuix to list in Australia

Macquarie and Armitage Associates are both set to make partial exits when analytics software provider Nuix completes its Australia IPO.

Warburg Pincus, Advantage honored at AVCJ Awards

Warburg Pincus and Advantage Partners triumphed in the firm of the year categories at the 2020 AVCJ Private Equity & Venture Capital Awards, with The Carlyle Group and Affinity Equity Partners also among the winners with two trophies apiece.

VC-backed Chinese online education business files for US IPO

17 Education & Technology Group, a China-based education service provider that claims to pursue an integrated “in-school plus after-school” model, has filed for a US IPO.

China short video platform Kuaishou files for Hong Kong IPO

Kuaishou, a Chinese video sharing and social networking platform backed by the likes of Tencent Holdings, Sequoia Capital China, Boyu Capital and DST Global, has filed for a Hong Kong IPO.

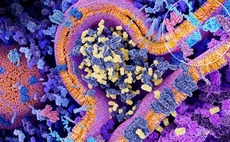

China's JW Therapeutics trades up after $300m Hong Kong IPO

JW Therapeutics, a private equity-backed Chinese drug developer specializing in CAR T-cell therapies that engineer immune cells to fight cancers, has raised HK$2.33 billion ($300 million) through a Hong Kong IPO.

China cosmetics brand Perfect Diary files for US IPO

Yatsen Holding, the parent company of Chinese cosmetics brand Perfect Diary has filed for a US IPO, potentially delivering a liquidity event for the likes of Hillhouse Capital, ZhenFund and Gaorong Capital.

Regulators halt Ant Group's Shanghai, Hong Kong IPO

Private equity-backed Ant Group’s bumper IPO in Hong Kong and Shanghai has been put on hold by Chinese regulators over a potential failure to meet listing qualifications or disclosure requirements.

PE-backed Lufax follows $2.3b US IPO with weak debut

Online lending and wealth management platform Lufax raised $2.36 billion in the largest US IPO by a PE-backed Chinese company so far this year but endured a difficult first day of trading.

Warburg Pincus tips Converge to sustain rapid growth

Philippines-based broadband provider Converge ICT has completed the country’s largest-ever IPO on the back of a tenfold expansion in the past four years as local consumers sign up to highspeed internet services previously unavailable to them.

China's Miniso sees modest trading debut after $608m US IPO

Miniso, a Chinese low-cost retailer backed by Hillhouse Capital and Tencent Holdings, posted a small gain on its US trading debut following a $608 million IPO.

China carpooling player Dida pursues Hong Kong IPO

Dida Chuxing – a Chinese peer-to-peer carpooling business that subsequently expanded into ride-hailing, putting it in direct competition with longstanding market leader Didi Chuxing – has filed for a Hong Kong IPO.

Everest Medicines soars on debut after $451m IPO

Everest Medicines, a Chinese biotech start-up backed by CBC Group, performed strongly in early trading in Hong Kong following a HK$3.5 billion ($451 million) IPO.

PE-backed Chinese fintech player Lufax files for US listing

Lufax, a Chinese online lending and wealth management platform valued at $39.4 billion following its most recent private funding round, has filed for an IPO in the US.

PE-owned Adore Beauty targets $193m Australia IPO

Australia’s Quadrant Private Equity is set to make a first exit from its growth fund with online beauty retailer Adore Beauty announcing plans for a A$269.3 million ($192 million) IPO.

Genor Biopharma raises $372m in Hong Kong IPO

China-based Genor Biopharma, which counts Hillhouse Capital, Temasek Holdings and Qiming Venture Partners among its investors, has raised HK$2.88 billion ($372 million) through a Hong Kong IPO.