Investments

NPX invests $43m in Korean digital content provider

The private equity arm of US and Korea-based NPX Capital has invested USD 43m in Korean digital cartoon studio Copin Communications.

CapVest tops BGH's bid for Australia's Virtus Health

CapVest Partners, a UK-headquartered private equity firm that primarily invests in Europe and North America, has entered the race for Australian fertility care business Virtus Health with an AUD 650.1m (USD 469m) offer.

Hong Kong's Animoca Brands raises $359m at $5b valuation

US-based Liberty City Ventures has led a USD 359m round for Hong Kong blockchain media company Animoca Brands at a pre-money valuation of USD 5bn, more than double its valuation in October.

China beauty retailer Harmay raises $200m

Harmay, a China-based omnichannel beauty products retailer, has raised USD 200m across Series C and D rounds.

TPG-owned clinical trials player raises new equity, debt

Novotech, an Asia-based clinical trials specialist controlled by TPG Capital, has secured USD 760m in new equity and debt financing at a post-deal valuation of approximately USD 3bn.

India digital wealth manager secures $75m Series D

Indian personal finance app INDmoney has raised USD 75m in Series D funding from Steadview Capital, Tiger Global Management, and Dragoneer Investment Group.

Asia PE investment hits new high in 2021

A rebound in China-based activity took Asia private equity investment to a record USD 105.3bn in the fourth quarter, ensuring that 2021 represents a new high watermark for the industry.

China's Dishangtie Car Rental raises $200m

Dishangtie Car Rental, a Shenzhen-based electric vehicle (EV) rental service, has raised a USD 200m Series D round across two tranches featuring CICC Capital.

Impact investors commit $60m to India agtech platform

Quona Capital, Lightrock India, and Asia Impact SA have co-led a USD 60m Series C round for Indian agriculture technology platform Arya.

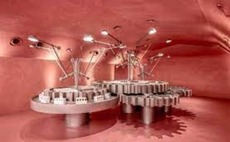

Deal focus: Starfield serves up Series B

The Chinese manufacturer of plant-based protein replacements has secured USD 100m in funding to advance a product portfolio that aspires to diversity and structural sophistication

Q&A: Gulf Capital's Richard Dallas & Shantanu Mukerji

Richard Dallas, a senior managing director at Gulf Capital, and newly appointed Asia head Shantanu Mukerji on using Singapore as a regional hub, cross-border expansion, and why a dedicated regional fund is unlikely

4Q analysis: Record quarter, record year

China rebounds as Asia private equity investment ends 2021 with a bang; bright spots in improving fundraising environment; sponsor-to-sponsor exits thrive while PE-backed IPOs stumble

Deal focus: ACA seeks Asia-Europe sporting synergies

Japan’s ACA Group has acquired a Belgium-based KMSK Deinze as part of a multi-club investment strategy that will – in part – bring Asian players into the middle tiers of European football

China GPs emphasize consumer sector opportunities

Policy volatility in China has prompted many investors to eschew consumer-facing business models in favour of B2B plays like deep-tech, but sector specialists still see opportunity, the Hong Kong Venture Capital & Private Equity Association’s (HKVCA)...

Bain exits Japan hot spring operator to Lone Star

Bain Capital has sold Ooedo Onsen Monogatari Resorts & Hotels, a Japan-based traditional inn and hot spring chain operator it acquired nearly seven years ago, to Lone Star for an undisclosed sum.

Quadria backs Vietnam mother-and-baby chain

Singapore-based healthcare specialist Quadria Capital has invested USD 90m in Con Cung, Vietnam’s largest mother-and-baby retailer.

MBK to buy control of Korea e-commerce solutions provider

MBK Partners has agreed to buy a controlling stake in KoreaCenter, a Korea-based e-commerce services provider, for KRW 491.7bn (USD 429.8m) across several equity and debt transactions.

China 5G chip designer Eigencomm raises $157m

SoftBank Vision Fund II has led a CNY 1bn (USD 157m) Series C for Shanghai-based chipmaker Eigencomm, with participation from new investors Cathay Capital, CoStone Capital, Chobe Capital, and GF Qianhe, a unit of GF Securities.

WestBridge, GSV lead $100m Series E for India's Lead School

WestBridge Capital and GSV Ventures have led a USD 100m Series E round for Indian education technology platform Lead School at a valuation of USD 1.1bn.

Apis invests $50m in Singapore loyalty program start-up

Apis Partners has invested USD 50m in Singapore-based loyalty program management and development services provider Giift.

Indonesia's Pluang doubles Series B to $110m

Indonesian micro-savings and micro-investment app Pluang has raised USD 55m in Series B funding led by Accel. It follows a USD 55m Series B investment led by Square Peg Capital last year.

India early wage access start-up secures $82m

Tiger Global Management has led a USD 82m Series B round for Refyne, an India-based early wage access (EWA) platform. Existing backers QED Investors, RTP Global, Jigsaw VC, Digital Horizon VC, and XYZ Capital also took part, as did partners from DST Global....

PE consortium cuts 51job take-private offer by 28%

A private equity consortium pursuing a take-private of US-listed Chinese online recruitment platform 51job has cut its offer price by 28%, citing deteriorating market conditions, regulatory tightening in China, and the continuing impact of COVID-19.

China plant-based protein player Starfield raises $100m

Primavera Capital Group has led a USD 100m Series B for Starfield, a Chinese producer of plant-based meats.