Expansion

China medical device player Hanyu Medical secures $72m

China-based medical devices manufacturer Hanyu Medical has raised a RMB500 million ($72 million) Series D co-led by HighLight Capital, CPE (formerly known as CITIC Private Equity), and Yingke Private Equity.

Singapore's Anchanto raises $12m funding round

Anchanto, a Singapore-headquartered technology provider that helps with e-commerce enablement, raised S$16.6 million ($12 million) in a Series C round.

Chinese CRO player Yaoyanshe raises $86m

Yaoyanshe, a Chinese contract research organization (CRO) for novel drugs, has raised RMB600 million ($86 million) across two rounds in the past eight months.

India clean energy: Shock treatment

The economic fallout from COVID-19 will not spare any sector, but careful planning can ensure private equity firms can take advantage of India’s ambitious energy transition goals

China clean energy: Policy power

China’s aggressive renewable energy development targets are creating opportunities for investors in various points along the supply chain, but inconsistent regulation remains a concern

Chinese chip design company Brite raises $50m

Chinese integrated circuit (IC) design company Brite Semiconductor, has raised a RMB350 million ($50 million) Series D round led by Haitong Securities and sector specialist Sunic Capital.

Huagai leads $43m round for China antibiotics developer

China-focused private equity firm Huagai Capital has a led a RMB300 million ($43 million) Series D round for antibiotics developer MicuRX Pharmaceuticals.

Globis joins $32.6m round for Japan's Photosynth

Globis Capital Partners has joined a JPY3.5 billion ($32.6 million) Series C round for Photosynth, a Japanese internet-of-things (IoT) developer specializing in smart locks for office buildings.

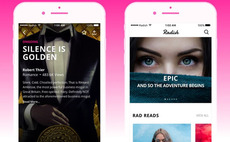

Korea, US-based serialized fiction app gets $63m

SoftBank Ventures Asia and Kakao have led a $63.2 million Series A round for Radish, a Korea and US-based producer and broadcaster of serialized fiction for mobile devices.

Tencent leads $360m round for China fresh produce retailer

Chinese fresh produce retailer Yipin Shengxian has raised a RMB2.5 billion ($360 million) Series C round led by Tencent Holdings and Capital Today. Eastern Bell Venture Capital re-upped.

Chinese EV maker Xpeng raises another $300m

Alibaba Group has led a $300 million round for Chinese electric vehicle (EV) manufacturer Xpeng Motors. It comes barely two weeks after the company closed an extended Series C round of $500 million.

EDBI backs US cybersecurity player's Asia push

EDBI, the investment arm of Singapore’s Economic Development Board, has invested in Vesta, a US-based fraud and payment technology start-up with ambitions to expand into Asia.

JD.com invests $100m in Hong Kong's Li & Fung

Chinese online retailer JD.com is investing $100 million in Hong Kong's Li & Fung, which recently won support from warehouse investor GLP for a privatization.

Deal focus: Fave wins endorsement for ecosystem pivot

Having found online-to-offline services and mobile payments too crowded, Malaysia's Fave turned itself into a digitization guide for small businesses. Collaboration with India's Pine Labs should strengthen its offering

Tata Growth commits $30m to India's Biocon

Tata Capital Growth Fund has invested INR2.25 billion ($30 million) in the biosimilars business of India-listed pharmaceuticals giant Biocon.

BRV Capital invests $110m in Line's Thailand delivery app

Line Man, a parcel-to-food delivery app launched in Thailand by Japan’s Line Corporation, has raised $110 million from BRV Capital, an affiliate of BlueRun Ventures.

GenBridge leads round for Chinese hot pot ingredients supplier

GenBridge Capital has led a $60 million Series C round of funding for Guoquan, a Chinese hot pot ingredients supplier. All the company's existing investors re-upped.

India's Toppr raises $50m from Foundation Holdings

Indian educational technology startup Toppr has raised $50 million (INR3.5 billion) in a Series D funding round led by United Arab Emirates-based investment firm Foundation Holdings.

CDH leads round for China community group buying player

Shihuituan, a China-based community group buying platform also known as Nice Tuan, has raised $80 million in the second tranche of a Series C round led by CDH Investments.

Deal focus: Vedantu adds to war chest as rivals encroach

India's Vedantu has raised $100 million in funding to support its ongoing diversification into non-test preparation services. Other players in the online education space have similar plans

Eurazeo commits $94m in debut Europe-China fund deal

French GP Eurazeo has made its debut investment from a newly launched Europe-China cross-border fund, committing EUR80 million ($94 million) to Dutch medical supplier DORC.

Korean travel app secures $36m funding round

MyRealTrip, a South Korean travel super app that positions itself as a one-stop-shop for bookings, has raised KRW43.2 billion ($36 million) in funding from the likes of Altos Ventures, IMM Investment, and Axiom Asia.

Chinese IT infrastructure player SmartX raises $28m

SmartX, a Chinese enterprise cloud services provider, has closed an extended tranche of its Series B round as well as a Series C round, raising RMB200 million ($28 million) in total.

Korean AI education start-up gets $41m pre-Series D

Korea Development Bank (KDB) and local private equity firms Nvestor, Intervest and IMM Investment have participated in a $41.8 million pre-Series D round for Riiid, a Korean online education platform.