Early-stage

Flexibility first: Investing in the future of work

Investment in work-tech has soared as start-ups devise solutions for workforces that are increasingly distributed in terms of location, structure, and practice. Data, and knowing what to do with it, is key

China 3D content platform Xverse raises $120m

Xverse, a Shenzhen-based 3D user-generated content platform has raised USD 120m across a Series A and a Series A extension, led by GL Ventures and Sequoia Capital China, respectively.

Korean metaverse player closes Series A, hits $807m valuation

VA Corporation, a Korean virtual content provider that is positioning itself as a metaverse platform, has achieved a valuation of KRW 1trn (USD 807m) on closing a KRW 100bn Series A round.

Tiger Global leads Series A for New Zealand's ArchiPro

Tiger Global Management has led a NZD 35m (USD 24m) Series A round for New Zealand’s ArchiPro, a platform that connects homeowners with interior design and construction professionals.

Singapore financial crime AI start-up gets $40m

Singapore’s Silent Eight, a compliance and financial crime risk investigation platform, has raised a USD 40m Series B round led by US-based TYH Ventures.

East leads $20m round for Singapore's Mighty Jaxx

Singapore-based toy figurine manufacturer Mighty Jaxx has raised USD 20m in an extended Series A led by East Ventures. Crypto specialist Mirana Ventures also participated.

Tiger Global, Coatue lead Series B for Singapore's AI Rudder

Tiger Global Management and Coatue Management have led a USD 50m Series B round for Singapore-based voice artificial intelligence start-up AI Rudder.

Deal focus: Faux fowl fast-forwards

Next Gen Foods is pushing hard to popularise its meatless chicken brand Tindle in the name of climate action. The largest-ever Series A round in alternative protein is jumpstarting the campaign

China cancer drug developer InxMed raises $50m

InxMed, a China-based biotech company focused on oncology treatments, has raised a USD 50m Series B round led by SDIC China Merchants Investment.

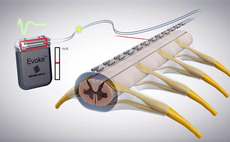

Australia's Saluda Medical raises $125m

US-based healthcare investor Redmile Group has led a USD 125m round for Australia’s Saluda Medical, a devices company focused on spinal cord stimulation.

India edtech player Filo gets $23m Series A

Filos, an India-based instant live-tutoring platform, has raised USD 23m in Series A funding led by US investor Anthos Capital. It is said to be the largest-ever Series A in India’s education technology space.

Headline leads Series B for Australian payments start-up Zeller

Australian payments provider Zeller has closed an AUD 100m (USD 73m) Series B round led by Headline, a US venture capital firm, and supported by domestic superannuation fund Hostplus.

China logistics player Jumeng raises $100m

Fortuna Capital has led a USD 100m investment in Shanghai truck-based logistics platform Jumeng Logistcs, described as the third tranche in a Series B round. IDG Capital also took part.

China VC: Funding puzzles

Late-stage investors are appearing in earlier funding rounds in China, offering premium valuations but potentially leaving start-ups in situations where they have too much too soon

China 5G chip designer Cygnus raises $100m

Chinese 5G chip design company Cygnus Semiconductor has raised USD 100m in Series A funding and an extended pre-Series A round led by Matrix Partners China and Wofo Capital.

Singapore's Volopay gets $29m Series A

Singapore’s Volopay, a B2B financial technology provider specialising in cross-border transactions, has raised USD 29m in Series A funding led by Justin Mateen, co-founder of Tinder.

Deal focus: Affirma sees promise in Asia e-scooters

Affirma Capital has led a USD 93m Series B round for Singapore-based e-scooter provider Beam, citing its ability to internationalise a locally-focused and increasingly popular business model

Pakistan fintech player NayaPay gets $13m seed round

NayaPay, a Pakistan-based financial technology start-up has secured USD 13m in what is claimed to be one of the country’s largest-ever seed rounds.

China cross-border fintech start-up secures $20m

Dowsure, a Shenzhen-based financial technology start-up that has developed credit-checking software that enables banks to lend to small-scale e-commerce vendors, has secured USD 20m in Series B funding.

ZWC, IDG back China social CRM service provider

Wshoto – a Chinese social customer relationship management (SCRM) service provider that focuses on the WeChat ecosystem - has raised a CNY 300m (USD 47m) Series B round across two tranches.

A91, Z3Partners lead Series B for India's Shipsy

A91 Partners and Z3 Partners have led a USD 25m Series B round for India-based Shipsy, an artificial intelligence (AI) platform that helps companies automate logistics.

Deal focus: Tapping a soft spot for Asian VCs

Investment professionals in Asia know on a personal level exactly what education technology provider Cialfo is doing and why the service is a big help. Now they’re taking it to the next level

New Zealand's Soul Machines raises $70m

SoftBank Vision Fund 2 has led a USD 70m round for New Zealand-based Soul Machines, which specialises in creating lifelike digital employees for customer engagement.

Singapore's Next Gen Foods raises $100m Series A

Singapore-based Next Gen Foods, maker of vegetarian chicken brand Tindle, has raised a USD 100m Series A round featuring GGV Capital and Temasek Holdings’ Asia Sustainable Foods Platform.