Legend Capital

China's Leadrive raises $81m Series D

Legend Capital and Oriza FoFs have led a CNY 600m (USD 81m) Series D round for Leadrive, a Shanghai-headquartered manufacturer of semiconductor power modules and motor control units used in electric vehicles (EVs).

China's HC Scientific gets $41m Series B extension

Lake Bleu Capital and Guotai Junan Innovation Investment have led a Series B extension of approximately CNY 300m (USD 41m) for HC Scientific, a manufacturer of DNA sequencing devices used in modern agriculture and healthcare.

PE-backed Gambol Pet trades up after $220m China IPO

Gambol Pet, a Chinese mass-market pet food manufacturer backed by KKR and Legend Capital, has traded strongly since raising CNY 1.6bn (USD 220m) through a domestic IPO.

China's VectorBuilder becomes unicorn, files for Shanghai IPO

China-based gene delivery technology player VectorBuilder has topped up its Series C round - achieving unicorn status in the process - and filed for an IPO on Shanghai’s Star Market.

Legend Capital leads Series A for China CDMO CoJourney

China and US-based contract development and manufacturing organisation (CDMO) CoJourney has raised a Series A of USD 30m led by Legend Capital.

Deal focus: Gitee aspires to be more than China's Github

FutureX Capital got onto Gitee’s shareholder register by suggesting a separation from Baidu. Now, FutureX is backing the company to leverage its status as China’s dominant open-source software player

China's GitHub substitute raises $107m

Gitee, a China-based open-source platform regarded as a domestic substitute for GitHub, has raised an extended Series B of CNY 775m (USD 107m) led by FutureX Capital.

China National Energy Storage raises $143m

Zhongchu Guoneng Technology (ZGT), also known as China National Energy Storage, has raised CNY 1bn (USD 143m) in Series A funding led by a China Development Bank Capital-managed fund and Xinda Kunpeng Equity Investment Management.

CTC Capital leads $72m round for China substrates specialist

Chinese semiconductor industry investor CTC Capital has led a first tranche of Series A funding of more than CNY 500m (USD 72.5m) for AaltoSemi, a local manufacturer of chip packaging substrates.

China energy storage battery maker Rongke raises $145m

Legend Capital has led a CNY 1bn (USD 145m) Series B funding round for China-based energy storage battery developer Rongke Power.

Coller closes first deal for debut renminbi fund

Coller Capital has completed the first deal from its debut renminbi-denominated secondaries fund, participating in a CNY 315m (USD 46m) GP-led transaction involving healthcare assets held by Chinese VC firm Legend Capital.

China chip packaging player SJ Semiconductor raises $340m

Legend Capital, CITIC Securities-controlled Goldstone Investment, and Ince Capital have participated in an extended Series C round of USD 340m for SJ Semiconductor, a China-based chip packaging business.

CCV leads round for China chip designer Cmind-Semi

Cmind-Semi, a China-based wireless communication chip designer, has raised a pre-Series A round led by China Creation Ventures (CCV). Existing investors Walden International Investment and Legend Capital also took part.

China industrial supplies platform ZKH pursues US IPO

ZKH Group, a China-based industrial supplies platform backed by the likes of Eastern Bell Capital, Genesis Capital, Tencent Holdings, and Tiger Global Management, has filed to list in the US.

China's Giant Biogene trades up after $70m Hong Kong IPO

Giant Biogene, a China-based producer of skin treatments that use bioactive ingredients, gained nearly 10% on debut following a HKD 549.4m (USD 70m) Hong Kong IPO.

China's VectorBuilder raises $57m Series C

Guangzhou-based gene delivery company VectorBuilder has raised a CNY 410m (USD 57m) Series C round led by Legend Capital, Sui Kai Equity Investment, and Yuexiu Industrial Fund.

China satellite player Galaxy Space achieves unicorn status

Galaxy Space, a China-based satellite developer, has raised a new funding round led by CCB International at a post-investment valuation of CNY 11bn (USD 1.6bn).

Legend leads $150m Series E for China CRO ClinChoice

US and China-based clinical contract research organization (CRO) company ClinChoice has raised a USD 150m Series E round led by Legend Capital.

Legend axes consumer from latest China TMT fund

Legend Capital has excluded the consumer-facing segment from its latest China technology, media, and telecom (TMT) fund, reflecting a broader sense of uncertainty among local managers regarding the regulatory environment.

Deal focus: Medilink chases global ADC opportunity

The Medilink Therapeutics team spun out from Kelun-Biotech to develop antibody drug conjugates capable of competing with the world’s best. Its USD 70m Series B will support the pursuit of this goal

Lyfe, Qiming lead Series B for China ADC player Medilink

Suzhou Medilink Therapeutics, a Chinese biotech company specializing in antibody-drug conjugates (ADCs) commonly used as targeted therapies for treating cancer, has raised a USD 70m Series B led by Lyfe Capital and Qiming Venture Partners.

Sequoia, Legend back China autonomous driving player Inceptio

Sequoia Capital China and Legend Capital have led a USD 188m Series B extension for Inceptio, a Chinese autonomous driving technology developer that specialises in line-haul trucking.

Legend leads $63m round for China's Hoteam Software

Legend Capital has led a CNY 400m (USD 63m) Series C round for Chinese industrial software supplier Hoteam Software

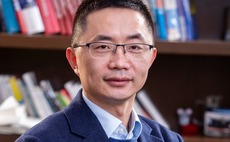

Q&A: Legend Capital's Richard Li

Richard Li, president of Legend Capital, on evolving US-China relations, the logic behind the recent wave of regulation, investing in line with government policy, and why LPs should get used to onshore exits