Weekly digest - October 11 2023

|

By the Numbers

AVCJ RESEARCH

EMPHASIZING INDIA

The INR 163bn (USD 1.99bn) transaction that saw Temasek Holdings become majority shareholder in Indian hospital operator Manipal Health Enterprises. is India's largest-ever healthcare deal. It is also one of six PE investments to surpass USD 1bn in the past two years, sitting alongside large-cap buyouts like Suven Pharmaceuticals and Credila Financial Services and growth equity plays such as PhonePe.

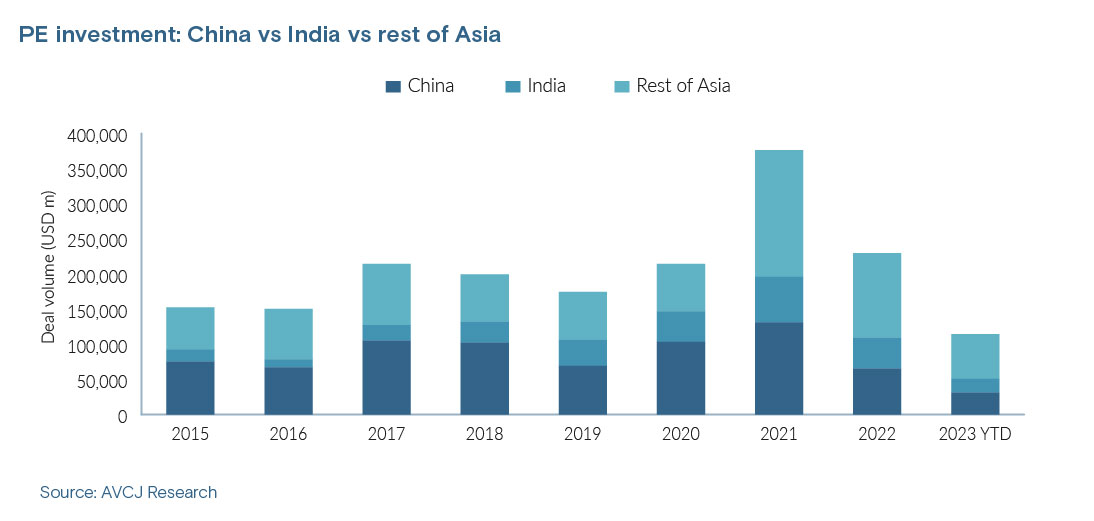

Those six transactions number among 43 in India that have exceeded USD 300m over the same period. China has seen 54 USD 300m-plus deals since the start of 2022, of which 11 exceeded USD 1bn. However, eight of those 11 were renminbi-denominated and in areas increasingly seen as off-limits to foreign investors. In region-wide context, India accounted for 21% of USD 300m-plus deals and 13% of the USD 1bn and up category. This compares to 26% and 23% for China. The situation stands in stark contrast to the 2019-2021 period. China far outpaced India with 38% to 21% in the USD 300m bracket and 36% to 20% for USD 1bn and up. These numbers give context to the broader shift in gravity from China to India. For more than two decades China has led the way, with private equity investment in the country exceeding India by more than 3:1 in some years. Both countries saw record levels of investment in 2021, but China posted USD 131bn to India's USD 64.7bn. In 2022, the gap narrowed to USD 65.3 to USD 43.9bn. The running total for 2023 is USD 30.9bn to USD 19.7bn, but China is supported by those policy-driven renminbi deals. For global and pan-regional managers, the bar for China deals has been raised obscenely high – in terms of building conviction around underwriting and likely exit scenarios as well as risk-return dynamics. Going heavier on India is a logical move. The market also offers growth and increasingly it offers scale – as demonstrated by the relative uptick in larger-cap transactions. KKR already has offices in Beijing, Shanghai, and Hong Kong, which account for three of the firm's nine locations region-wide (excluding stand-alone KKR Capital markets locations). Adding an office in India – it recently established a presence in Gurugram, near New Delhi, complementing an existing base in Mumbai – is an apt reflection of the bigger picture for private equity in Asia.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.