Weekly digest - September 27 2023

|

TALKING POINTS

AVCJ AWARDS 2023 - NOMINATIONS CLOSE SEPTEMBER 28

The submissions deadline has been extended, giving industry participants until September 28 to put forward the firms, fundraises, investments, and exits they believe worthy of consideration. For more information, go to www.avcjforum.com/awards

|

|

By the Numbers

AVCJ RESEARCH

GOING EX-ASIA

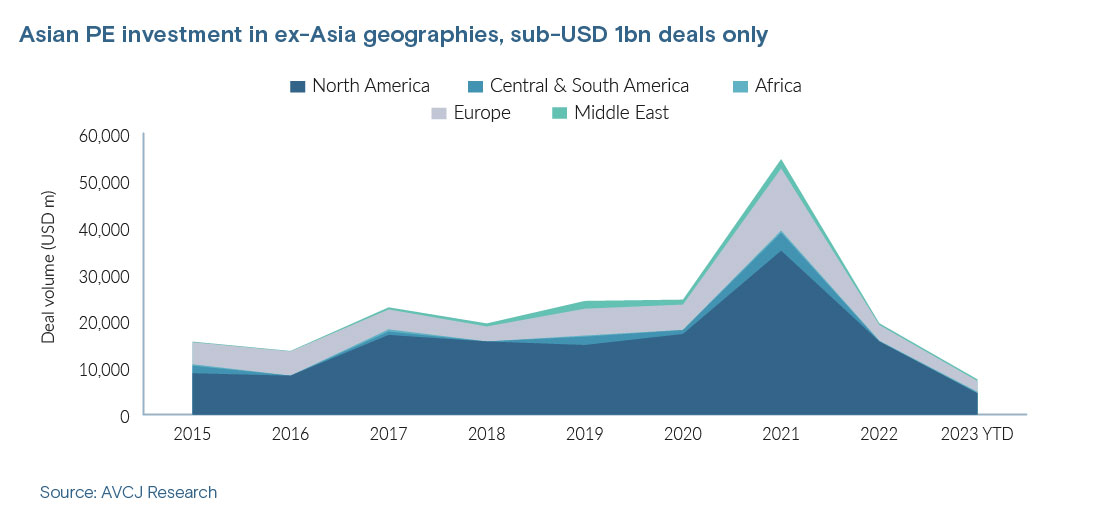

The headline numbers for private investment by Asian financial investors in markets beyond Asia aren't necessarily that informative. They include mega deals – often in the utilities space – pursued by the likes of sovereign wealth funds. Indicative of national strategic priorities, perhaps, but not of the mindsets of independent PE investors.

Restricting the sample size to deals of USD 1bn and below is more helpful. Activity followed a gentle upward trend until 2021, when it spiked to USD 54.4bn. The USD 19.5bn posted in 2022 is in line with the eight-year average (excluding 2021), while USD 7.5bn has been put to work in 2023 to date. The context for these observations is ShawKwei & Partners' recent rediscovery of the US market, more than 30 years after Kyle Shaw, the firm's founder and managing partner, last dabbled there. Three deals have been announced in the past few weeks involving waste-reducing technology provider ZymeFlow, beauty packaging maker CTL Packaging USA, and battery components supplier Group14 Technologies. According to Shaw, US-China decoupling, tariffs, and a desire to reorient supply chains out of China have contrived to make North America and Europe more attractive markets for manufacturing and industrial services. Increased use of robotics is also making ex-Asia factories more competitive on a cost basis. North America consistently attracts the most capital on a geographical basis. The 60% share recorded for deals of USD 1bn and below for 2023 to date is not far removed from the 67% average for the prior eight years. Still, it is worth noting that Asian financial sponsors are also prolific investors in assets located in other parts of Asia, which may offer proximity, familiarity, and the promise of growth. ShawKwei is relatively unusual in its ability to tap into the supply chain diversification trend and follow it across borders. Asia has few dedicated industrial technology investors, while global sponsors – which may dip into this area from time to time – can be restricted because they are investing out of regional funds. A deal involving a US asset would likely have to pass through the US investment committee. Shaw believes these assets, ideally located in North America or Europe, are essential to pushing forward the Southeast Asia story. "Just having Southeast Asia isn't enough, you need to add something to it," he said.

All of the trends featured here were sourced from AVCJ's proprietary database, AVCJ Research, featuring comprehensive information on private equity deals, fundraises and exits.

|

|

For your calendar

UPCOMING EVENTS

|

Latest News

Asian GPs slow implementation of ESG policies - survey

Asia-based private equity firms are assigning more dedicated resources to environment, social, and governance (ESG) programmes, but policy changes have slowed in the past 12 months, in part due to concerns raised internally and by LPs, according to a...

Singapore fintech start-up LXA gets $10m seed round

New Enterprise Associates (NEA) has led a USD 10m seed round for Singapore’s LXA, a financial technology start-up launched by a former Asia senior executive at The Blackstone Group.

India's InCred announces $60m round, claims unicorn status

Indian non-bank lender InCred Financial Services said it has received INR 5bn (USD 60m) at a valuation of at least USD 1bn from unnamed investors including “a global private equity fund.”

Insight leads $50m round for Australia's Roller

Insight Partners has led a USD 50m round for Australia’s Roller, a venue management software provider specializing in family fun parks.